When Canberra became the first Australian jurisdiction to legalise cannabis in September it was the bud for many companies to stem out into a fast growing industry.

Throughout the latter half of 2019, many CBD-focused companies took advantage of this legalisation by releasing products and achieving highs that hadn’t been reached before.

Since CBD can be used in a variety of ways whether it be in food, medicinal or just to relieve stress, this will be highly sought after in the upcoming years.

Local companies growing with the changes

One of the companies that grew the most during the year is Elixinol Global (ASX:EXL) which saw an increase of $78,000 revenue in FY18 to $3,614,7000 in FY19.

This can partly be linked to one of its subsidiary’s receiving a manufacturing and supply agreement with U.S. company Pet Releaf, and another receiving a licence to manufacture medicinal cannabis.

Elixinol Global was formed in January 2018 when Colorado-based Elixinol LLC joined forces with Hemp Foods Australia to form a new brand and launch an IPO.

Since listing on the ASX in 2016, Bod Australia’s (ASX:BDA) revenue has increased over 800 per cent from $138,020 in the 2016 financial year to $1,273,391 in FY19. The company has had a busy FY19 with the company collaborating with the University of South Australia, entering the U.K. market, and its share price hitting an all-time high.

Roto-Gro International (ASX:RGI) used 2019 to focus on expanding its products and offerings in many jurisdictions all over the world. The stackable rotary hydroponic garden company eyed off the key markets of Canada, Asia, Europe and North America.

Australia Vs. The World

Unfortunately, Australia is lagging behind the rest of the world.

CBD was legalised in Canada in October 2018, is legal in most U.S. States, and is legal in all European Union countries, except for Slovakia.

The worldwide market for CBD was valued at USD$3,088.51 million in 2018 and is estimated to grow to USD$2,207,162.54 million by 2026.

The market is expected to register a compound annual growth rate (CAGR) of 125.58 per cent from 2019 to 2026.

In 2018, the Americas accounted for the largest CBD market, 74.14 per cent, with a value of USD$2,413.34 million. This was closely followed by Europe with a value of USD$358.19 million.

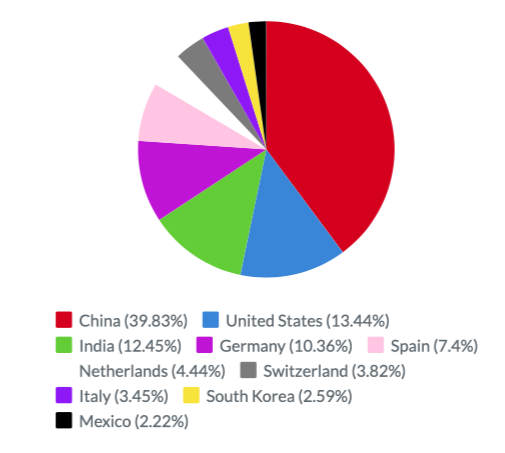

Top exporters of CBD oil include China, the United States, and India.

Where To Now?

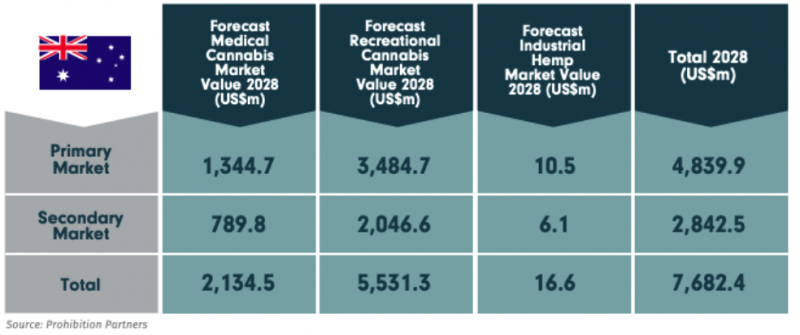

However, the Oceania market is set to quadruple in the next 10 years and with the perfect growing conditions CBD growth in this area is set to flourish.

It is estimated that by 2028 the region will be worth $8.7 billion with $6.2 billion for recreational sales.

But Australia has the potential to be a production powerhouse and leading exporter of cannabis, particularly to the Asia-Pacific region, and is sure to find its feet in the coming years.

Cannabis Jobs Australia estimates that Australia’s legal cannabis market is forecast to grow from $52 million in 2018 to $1.2 billion in 2027 – becoming the fifth largest in the world.

Despite the legalisation of medical marijuana in 2017, data from the Ministry of Health shows that the number of patients being prescribed it is still lagging behind other countries.

Australia is emerging as a leader in the Oceania region and now has more than 15 CBD-specific companies listed on the ASX.

Surely and steadily the CBD market is growing and 2020 is set to be a big year for market growth.

And with companies trying to stay ahead of the curve, don’t be surprised with what comes next in the CBD market.