- Creso Pharma (CPH) has secured up to an additional $17.4 million through a convertible securities agreement with L1 Capital

- Late last year, the company entered into agreements with professional and sophisticated investors to allow it to raise up to $8.2 million

- Under the agreement, Creso can request an initial advance payment of approximately $1.7 million from L1 Capital

- Creso is down 3.23 per cent on the market this afternoon, selling shares at 15¢ apiece

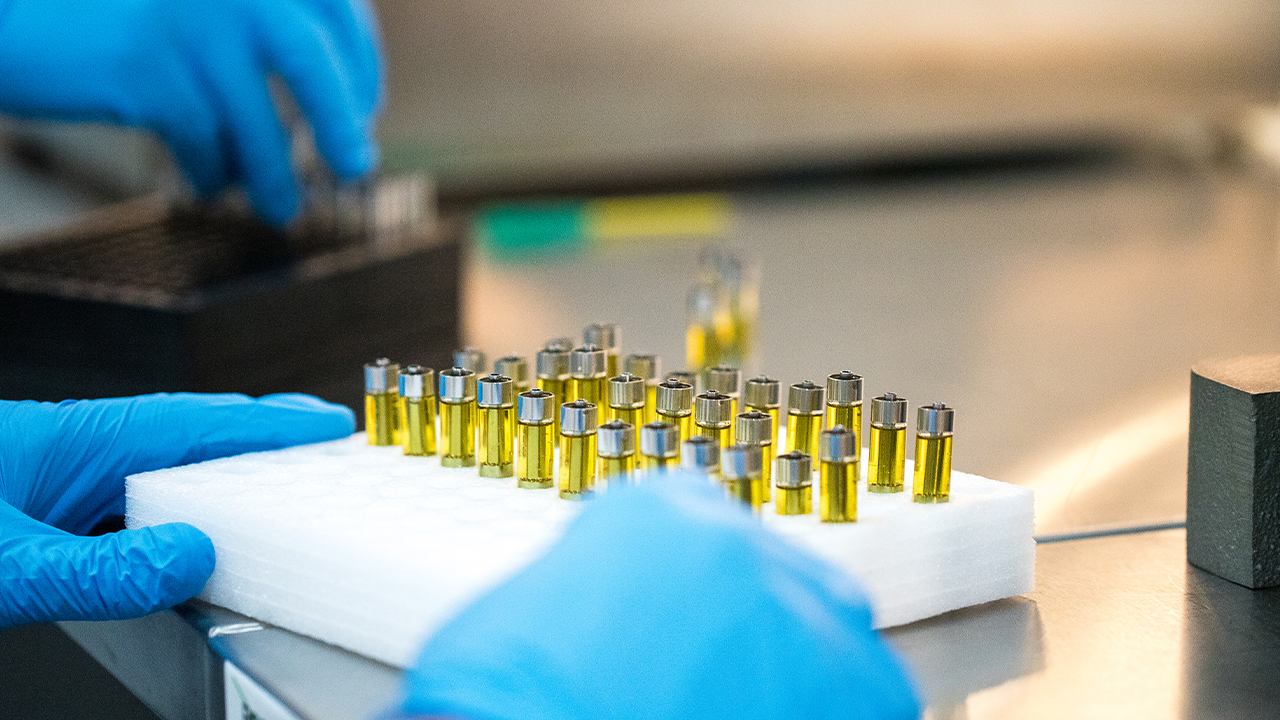

Pharmaceutical cannabis company, Creso Pharma (ASX:CPH) has secured up to an additional $17.4 million through a convertible securities agreement.

Late last year, the company entered into agreements with professional and sophisticated investors to allow it to raise up to $8.2 million. Creso drew down nearly $4 million under the original agreement.

The additional funds will come from L1 Capital Global Opportunities Master Fund.

Under the agreement, Creso can request an initial advance payment of approximately $1.7 million.

Prior to receiving the advance payment, the company must issue L1 Capital nine million shares and pay a fee of 4 per cent of the advance.

The company may then be able to draw down further amounts totalling up to approximately $15 million.

Funds raised by Creso, under the agreement will be used for operations and working capital purposes.

EverBlu Capital acted as lead manager to this debt raising.

Creso was created to bring pharmaceutical expertise to the world of cannabis and deliver quality products to people and animals. It was the first to import medicinal cannabis into Australia.

Recently, the company reached three million sale milestone for Anibidiol, since the products launched in 2017.

Creso is down 3.23 per cent on the market this afternoon, selling shares at 15¢ apiece at 2:48 pm AEDT.