While COVID-19 tears through global economies, companies in the financials sector face a particularly tough challenge.

Stimulus measures designed to support economic activity generally have an inverse effect on banks and insurers. Lowered interest rates mean less revenue for banks, while stimulus packages encourage spending on goods rather than investments.

As such, with the Reserve Bank’s cash rate at an all-time low and extra cash flowing the way of staple products, finance stocks are in a tough spot.

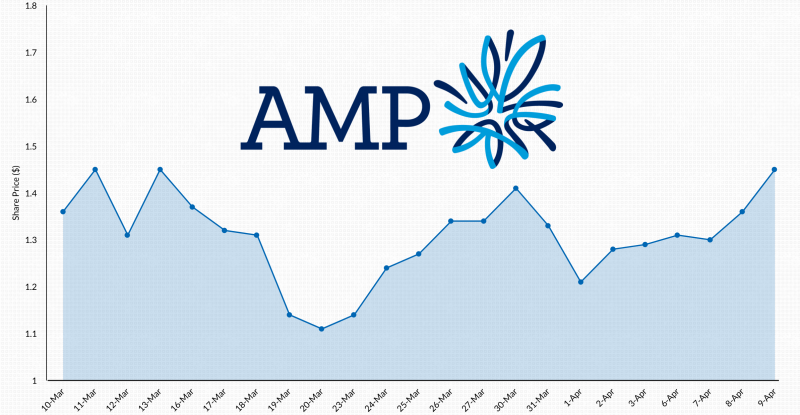

Financial services giant AMP is, of course, no exception. However, the AMP share price has had some particularly nauseating movements over the past month compared to other finance and banking stocks.

Why the volatility?

No stock has been able to escape the mass sell-off brought about by the coronavirus. In AMP’s case, its shares are currently sitting 36.65 per cent lower than they were on February 21, currently worth $1.30 each.

It’s the last month of share price movements that are particularly notworthy, however.

Interestingly, as far as company news goes, AMP has only released one substantial ASX announcement since the March mayhem began.

Outside of some minor board changes and change of directors’ interest notices, AMP’s most substantial announcement came on March 26 when it withdrew its 2020 financial guidance.

At the time, CEO Francesco De Ferrari said despite the downgrade, the company’s balance sheet and liquidity are strong but the economic uncertainty from the coronavirus means forecasts are unreliable.

Yet, the day AMP slashed its guidance, shares gained 8.77 per cent.

March 26 was also the day the U.S. $2 trillion stimulus package was passed by the senate.

On the inverse, AMP shares slumped 14.18 per cent between April 1 and April 3. The company had no substantial news over this period, but the ASX 200 index declined two days in a row for the first time in ten sessions.

So, what does this mean?

AMP not at the wheel

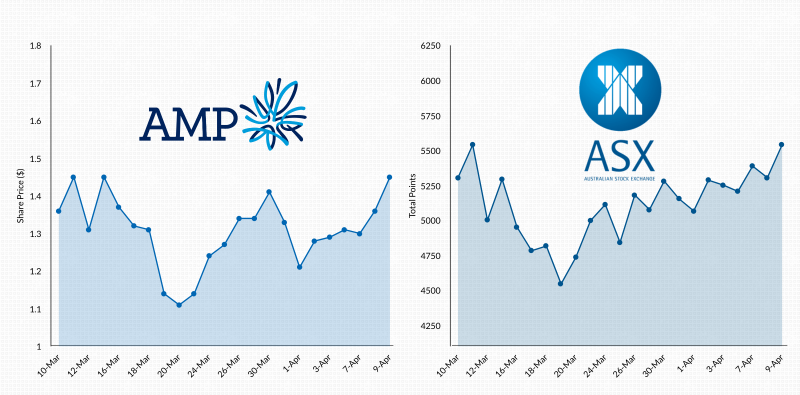

Here’s a comparison of the benchmark index and the earlier AMP chart since March 10:

It would appear the AMP share price is currently out of the company’s control.

The steep movements up and down seem to be an exaggeration of the movements of the wider market.

The green close in the face of the guidance cut shows that at this point in time, investors are less concerned with what AMP is doing and more concerned with what’s happening around it.

With the unprecedented cash rate cuts and stimulus packages popping up around the globe, AMP’s fate sits in the hands of the wider market.

A welcome break?

Nevertheless, the AMP share price has already been on a downward slope since February 2018.

The company reported a $2.5 billion loss over the 2019 financial year in the face of the Hayne Royal Commission and is in the early stages of a three-year mass restructuring of the business.

As such, perhaps the letting go of the reins bodes well for the future of AMP.

In its March 26 announcement, AMP said the sale of its life insurance branch is still on track for the end of June, and business restructuring is still going ahead as planned.

As such, shareholders can bet on the market movements rather than AMP when choosing to buy or sell the company’s shares. This could be an opportunity for some of the more costly restructuring operations to fly under the radar the AMP gets swept up in the current of the ASX.

Of course, such wide movements mean the company is open to a sudden downswing at a moment’s notice. The question, then, remains: how long can AMP ride the ASX wave until it falls back under scrutiny?