- PanTerra Gold (PGI) has been granted approval by the Cuban government for its proposed joint venture to develop La Demanjagua

- The gold and silver deposit is located on the Isle of Youth in Cuba

- The joint venture will be formed between PanTerra Gold Investments (PTGI) and Geo Minera SA (GMSA) and registered under the name Minera La Victoria

- Panterra would hold a 49 per cent interest, while Geo Minera SA would hold a majority stake in the Cuban-registered company

- When the COVID-19 pandemic eases, Minera la Victoria will commence the pre-feasibility study at La Demanjagua

- PanTerra Gold’s share price rose 78.6 per cent following the news and by market close shares were worth five cents each

PanTerra Gold (PGI) has been granted approval by the Cuban government for its proposed joint venture to develop La Demanjagua.

The joint venture will be formed between PanTerra Gold Investments (PTGI) and Geo Minera SA (GMSA) and registered under the name Minera La Victoria (MLV).

PTGI will eventually hold a 49 per cent interest, while a subsidiary of GMSA will hold a majority 51 per cent stake in the Cuban-registered company.

PanTerra expects the Joint Venture Agreement and incorporation of MLV will be completed by the end of June 2020.

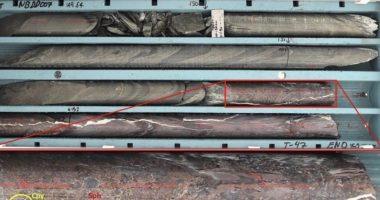

Based on historical metallurgical tests, Panterrra said it expects an open-pit mine at La Demanjugua could produce approximately 60,000 tonnes per annum of concentrate grading around 47 grams per tonne of gold and 380 grams per tonne of silver.

As soon as COVID-19 permits, MLV will commence the pre-feasibility study (PFS) at La Demanjagua. This will consist of a 5000 metres drilling program and is expected to take 10 to 12 months to complete.

PTGI will be responsible for contributing a total of US$6 million (approximately A$3.94 million) for the PFS and a definitive feasibility study which will consist of approximately 20,000 metres of drilling.

Finally, if a subsequent decision to develop is made, PTGI will subscribe for another US$7 million (roughly A$4.6 million) in equity in MLV, thus establishing its 49 per cent stake. Those funds would be spent on infrastructure at the mine.

The PFS will assess comparative returns from two development options for the project. The first option would be to sell the concentrate produced and this option is estimated to have a development cost of approximately US$60 million (approximately A$39.42 million).

Another option is to process the concentrate on-site through an Albion or CIL process plant and produce dore for refining. This option is estimated to cost US$130 million to develop.

PanTerra Gold share price rose 78.6 per cent following the news and by market close shares were worth five cents each.