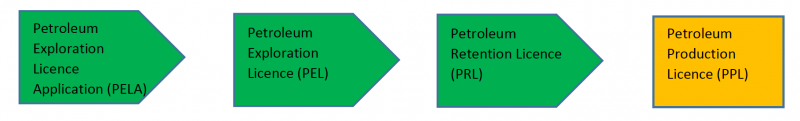

- Leigh Creek Energy (LCK) is a step closer to commercialising its flagship project, after receiving a petroleum retention licence (RL)

- The RL license means the company can sit on the project and wait until prices rebound before it starts production

- LCK said it was well advanced with work that’s required to establish the commercial feasibility of the project to then gain a production license

- Managing Director, Phil Staveley said it was pleasing to be a step closer to production and providing more jobs in these tough economic times

- The project, located 550 kilometres north of Adelaide in South Australia, will produce pipeline quality gas and or nitrogen fertiliser products, when production starts in a few years time

- Despite the news, LCK is down eleven and a half per cent and selling shares for 11.5 cents each.

Emerging energy company, Leigh Creek Energy Limited (LCK), is a step closer to commercialising its flagship project after receiving a petroleum retention licence (RL).

The RL protects the companies interest in the project, which means they can sit on it and wait for prices to rebound before it starts production.

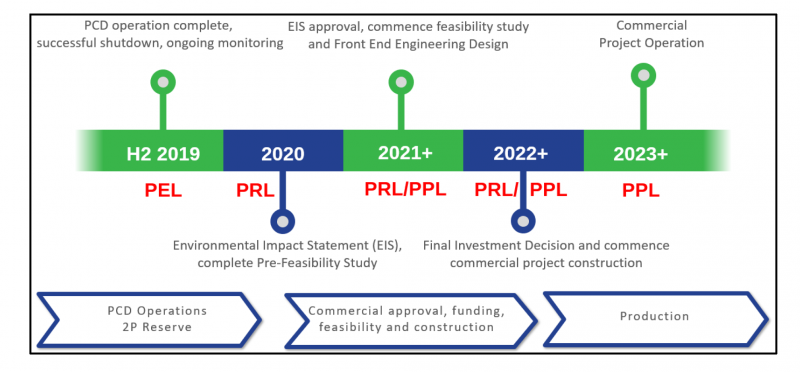

LCK said it was already well advanced with work that’s required to establish the commercial feasibility of the project to then gain a production license.

The project, located five and a half hours north of Adelaide in South Australia, will produce pipeline quality gas and or nitrogen fertiliser products, when production starts in a few years time.

The company is now in the development phase after it conducted the Pre-Commercial Demonstration (PCD) in 2019, which proved up the reserve of 1,153 Petajoules and fulfilled its Statement of Environmental Objectives requirements for the PCD.

“Along with (the) completion of the PCD, we see the granting of the PRL as demonstration of our commitment to the project.”

Managing Director, Phil Staveley

“It is good to see in these tough times that projects that will bring significant employment and revenue to the state are progressing. We look forward to sharing our commercial plans with shareholders as they develop.” Mr Staveley said.

Despite the news, LCK is down eleven and a half per cent and selling shares for 11.5 cents each at 1:30 pm AEST.