- Alligator Energy (AGE) will purchase a 47 million-pound uranium resource in South Australia from Samphire Uranium

- The company will issue 679.6 million shares to purchase Samphire subsidiary, S Uranium (SUPL)

- Samphire has a share capital of over 226 million, meaning every Samphire shareholder will receive three Aligator shares for every Samphire share they hold

- This transaction will more than double Alligators shareholder base

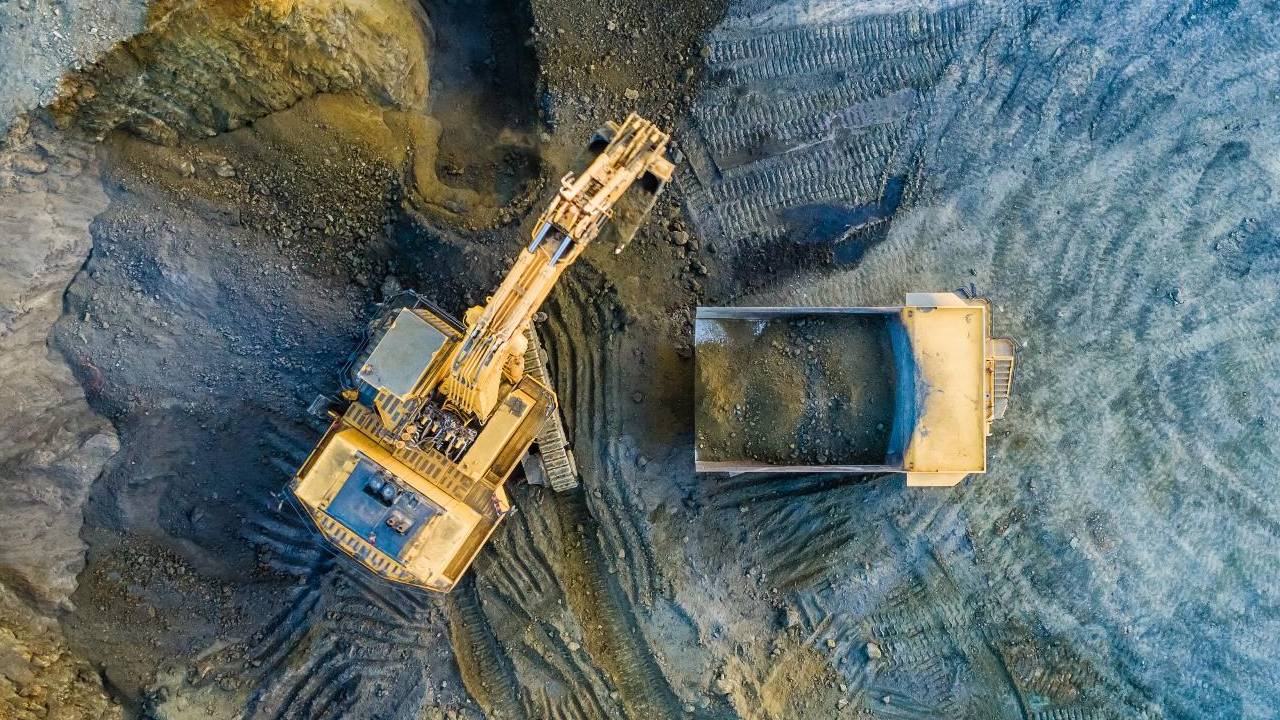

- Uranium is a chemical element that is mainly used for fuel in nuclear power plants

- On the market this morning, Alligator is up 16.7 per cent and is selling shares for 0.7 cents per share

Alligator Energy (AGE) will purchase a 47 million-pound uranium resource in South Australia from Samphire Uranium.

The company will issue 679.6 million shares to purchase Samphire subsidiary, S Uranium (SUPL). Samphire has a share capital of over 226 million, meaning every Samphire shareholder will receive three Aligator shares for every Samphire share they hold.

What does SUPL own?

Blackbush

The Blackbush deposit has an estimated inferred resource of 64.5 million tonnes of mineralisation at a bulk grade of 230 parts per million (ppm). This contains 14,850 tonnes of triuranium octoxide at 100ppm of a triuranium octoxide cut-off grade.

The mineralisation at Blackbush lies at a shallow depth of around 60 metres in permeable sands. This will allow for potential future extraction through either in situ recovery (ISR) or open-pit methods, but this will all depend on the uranium market and price cycle.

Plumbush

Plumbush deposit has an estimated inferred resource of 21.8 million tonnes of mineralisation at a bulk grade of 292ppm. This contains 6300 tonnes of triuranium octoxide at a 100ppm triuranium octoxide cutoff grade.

Through Samphire’s previous owners, UraniumSA undertook high-quality laboratory testwork, which showed high uranium leachability. The company also undertook initial co-development work on the resin extraction processes.

The purchase

This transaction will more than double Alligators shareholder base.

Alligator CEO Greg Hall is pleased with the agreement and will work with Samphire to finalise this purchase.

“Alligator has used the combined experience and capacity of our team and advisors to review the Samphire Project and evaluate the potential … for the future,” he said.

“The work previously undertaken on the resource, exploration targets and met testing has indicated the potential to move a possible project forward at the right time in the uranium price cycle,” Greg added.

“As the recent uranium spot price increase has shown, there is great uncertainty around the required uranium supply growth over the medium to long term, which is expected to ultimately translate through to higher prices on a sustained basis,” Greg explained.

On the market this morning, Alligator is up 16.7 per cent and is selling shares for 0.7 cents per share at 10:31 am AEST.