Gold has been a highly sought after asset in 2020, with the yellow metal rising by more than 15% in the first five months of the year.

Now trading at just below AUD 2,500 per ounce, gold has strongly outperformed most traditional assets including shares, property and term deposits, with this outperformance dating back to early 2000s.

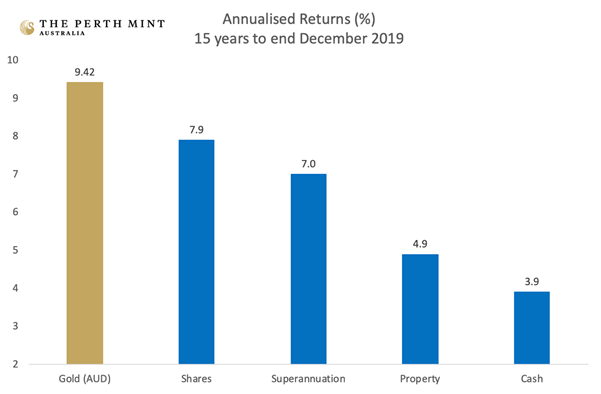

This can be seen in the chart below, which highlights the annualised return on a range of asset classes over the 15 years to end December 1999.

Source: The Perth Mint, Reuters, Chant West

Any Australian that put $10,000 into gold at the end of 2004 would have seen that investment increase to more than $38,000 by the end of 2019.

Unsurprisingly, the strong rise in the price of gold is seeing a wave of new investors, including SMSF trustees, add the metal to their portfolio, with The Perth Mint for example now custodian for more than AUD 5 billion of client metal.

Why is gold rising?

Gold is rising for many reasons, with the recent volatility in share markets caused by COVID-19 the primary driver of demand in 2020. Gold is well recognised as the ultimate safe haven asset, and indeed over the last fifty years has outperformed all other asset classes (like cash and bonds) whenever equity markets sell off.

A second reason is related to interest rates. Whenever real interest rates (which factor inflation into account) are low, gold tends to thrive. Indeed, a study of market data between 1971 and 2019 highlighted that in the years when real interest rates were 2% or lower, the price of gold rose by just over 20% on average.

For most investors that’s a far more attractive proposition than keeping money in a bank account earning nothing, even though gold price returns aren’t guaranteed.

A third and final reason is inflation risk, with gold well recognised as a long-term hedge against inflation. Since COVID-19 started impacting financial markets and the economy, central banks have digitally created trillions of dollars.

The United States Federal Reserve for example has increased their balance sheet by over USD 3 trillion since late February 2020.

For as long as this continues, investors will rightly feel nervous about the potential for higher inflation with gold set to benefit.

How are investors accessing gold?

Investors typically buy gold in one of three ways. These are:

Physical bars and coins

As the traditional method of investing in gold, bars and coins are manufactured in many sizes, from less than 1 ounce (worth AUD 2,500) all the way up to 400 ounces (worth AUD 1 million). Bullion dealers buy and sell these products, with the bars and coins typically stored by the investor at home or in a private vault.

Depository accounts

Like a share trading account but for gold, silver and platinum, investors can open a depository account with a bullion dealer who will trade gold with them (the dealer sells when the investors wants to buy, and vice-versa), with the bullion dealer storing the metal on the investor’s behalf.

Gold exchange traded products (ETPs)

Exchange traded products (ETPs) are accessible via the ASX. As such, investors who already have an account with an online or full-service stockbroker can buy and sell an ETP like a regular share, removing the need to have a separate account with a bullion dealer.

Gold ETPs are designed to track the price of gold, so the performance of these products will move up and down just like the price of a gold bar or coin.

This year, there has been growth seen across all three of these main avenues for gold buying. Demand for gold ETPs has been particularly strong, with products listed on the ASX that offer investors exposure to the price of gold now holding more than AUD 2 billion in investments within them.

This includes Perth Mint Gold (ASX: PMGOLD), which was launched back in 2003. The product tracks the Australian dollar gold price and has risen by more than 9% per annum over the last 15 years.

What’s the outlook for gold?

Going forward, we expect demand for gold to be well supported with prices biased to the upside. There are several reasons for this including the ongoing risk in equity markets, which by many metrics are trading at or near all-time highs, even though the global economy is facing its biggest period of upheaval in 100 years.

A second factor is the ongoing threat from COVID-19. The path forward remains uncertain at best, with the full impact on the global and Australian economy yet to play out.

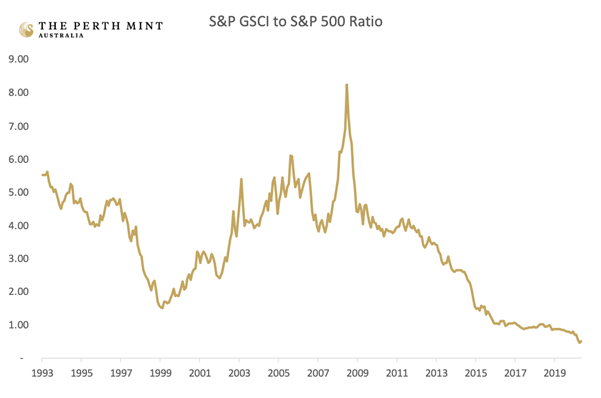

The third factor is the relative pricing between financial assets and commodities. Commodity prices have never been cheaper, with the S&P Goldman Sachs Commodity Index to S&P 500 ratio comfortably below 1 today. The chart below shows this ratio was more than eight when the Global Financial Crisis hit just over 10 years ago.

Source: The Perth Mint, Reuters, au.investing.com

Any investor who remotely believes in mean reversion will look at a chart like this and be encouraged by the potential for commodity prices to outperform in the decade ahead.

A fourth factor is interest rates. In Australia you could earn more than 7% on your money just by leaving it in a bank over a decade ago. Today you are lucky to get 1%, which is less than the rate of inflation. The problem of low interest rates is unlikely to end soon, with current bond market yields implying that interest rates are likely to remain below the rate of inflation for the next two to three decades.

Finally, there is the fact that governments and central banks have committed to providing ongoing monetary and fiscal support to the global economy for the foreseeable future.

Whilst that has undoubted positive outcomes, it does come at a risk of a significant uplift in inflation in years to come.

All of these factors combine to provide a positive outlook for gold demand and gold prices in the years to come, with the yellow metal capable of being a unique and valuable component of any astute investor’s portfolio.

Jordan Eliseo

Manager, Listed Products and Investment Research

The Perth Mint

June 16th 2020

Disclaimer

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.