- Macarthur Minerals (MIO) began trading on the OTCQB Venture Market today, expanding its exposure to over-the-counter (OTC) markets in the U.S.

- The company will begin trading effective immediately under the symbol MMSDF

- The OTCQB is a developmental stage marketplace for international and U.S. companies that enables them to trade with U.S. investors

- To be eligible to trade, companies must undergo annual verifications, pass a minimum bid price test, and be up-to-date in their financial reporting

- Macarthur first announced its intention to re-list on the OTCQB in mid-May, and then cleared the final regulatory hurdle in early August

- Macarthur is currently down 4.55 per cent and shares are trading for 52.5 cents each

Macarthur Minerals (MIO) began trading on the OTCQB Venture Market today, expanding its exposure to over-the-counter (OTC) markets in the U.S.

The company will begin trading effective immediately under the symbol MMSDF.

The OTCQB is a developmental stage marketplace for international and U.S. companies that enables them to trade with U.S. investors.

To be eligible to trade, companies must undergo annual verifications, pass a minimum bid price test, and be up-to-date in their financial reporting.

Macarthur first announced its intention to re-list on the OTCQB in mid-May, and then cleared the final regulatory hurdle in early August.

OTC markets allow companies to trade shares directly between investors rather than through a formal exchange such as the ASX or NYSE.

While they are generally riskier and more prone to manipulation, it is easier to trade between international parties.

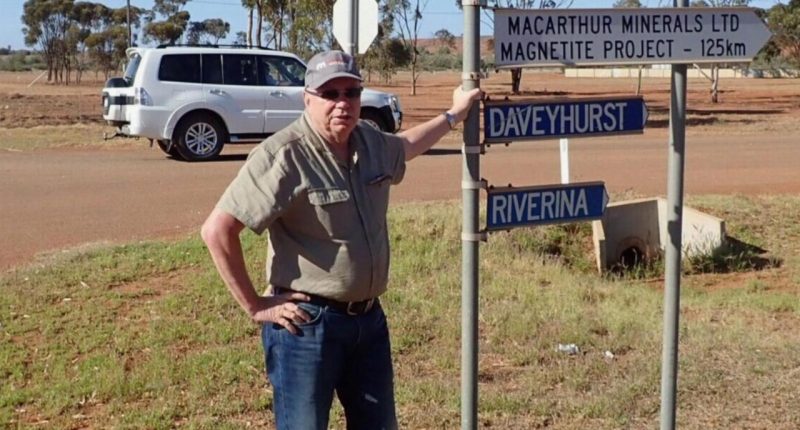

“Macarthur’s re-listing on the OTCQB provides the company with access to an efficient and transparent trading platform within the United States market,” President and Executive Chairman Cameron McCall said.

“This will also give the added opportunity to expand the company’s presence in the United States to reach a broader investor audience and will provide its current and future United States investors with appropriate accessibility and liquidity to invest in the company’s shares,” he added.

Macarthur is down 4.55 per cent and shares are trading for 52.5 cents each at 11:35 am AEST.