- Changes to lending laws, brought in to free up credit and stimulate the Australian economy, are set to trigger a lending boom

- Essentially, the changes simplify the loan application process, meaning there’s less information credit hopefuls are required to hand over when they tap the banks for fresh funds

- Borrowing was on the rise down under even before the lending criteria was relaxed — In July, the Australian Bureau of Statistics (ABS) reported the sharpest-ever monthly spike in home loan lending

- But amid a wave of new applications, deferrals are also on the rise, leading some to question whether the boom is sustainable.

- So, what’s in store if the lending bubble bursts, and how will it impact the ASX-listed credit managers?

Changes to lending laws, brought in to free up credit and stimulate the Australian economy, are set to trigger a lending boom.

The modifications, announced by Federal Treasurer Josh Frydenburg last Friday, will make it easier for Australians to apply for a home or personal loan.

It comes as statistical bodies reported a sharp rise in loan applications over the winter months as COVID-19 restrictions began to ease. But amid a wave of new applications, deferrals are also on the rise, leading some to question whether the boom is sustainable.

So, what’s in store if the lending bubble bursts, and how will it impact the ASX-listed credit managers?

Change is in the air

Last week saw a bevy of changes introduced to the loan application process by the Federal Government in a bid to free up borrowings.

“Credit is the lifeblood of the Australian economy, with billions of dollars in new credit extended to households and businesses in Australia each month,” Treasurer Josh Frydenburg said of the transition.

“Now more than ever, it is critical that unnecessary barriers to accessing credit are removed so that consumers can continue to spend and businesses can invest and create jobs,” he continued.

Essentially, the changes simplify the loan application process, meaning there’s less information credit hopefuls are required to hand over when they tap the banks for fresh funds.

The modifications were largely welcomed by Australia’s big four banks, which argued the system over-complicated the application process.

However, the relaxing of borrowing conditions is poised to further fuel a lending boom, which Financial Counselling Australia CEO Fiona Guthrie told the ABC wasn’t without its caveats.

“As we learnt to our cost during the GFC, weaker lending standards mean people will be loaded up with as much debt as possible. There is significant profit to be made in pushing borrowers to the edge,” she said.

“Removing responsible lending obligations will free banks up to aggressively push credit onto their customers,” the CEO continued.

Borrowing booms

Already, it seems borrowing in Australia is on the rise.

In July, the Australian Bureau of Statistics (ABS) reported the sharpest-ever monthly rise in home loan lending. Over the winter month, the value of new home loan commitments skyrocketed 8.9 per cent.

Additionally, the ABS tabled a rise in personal lending over July. New personal fixed-term loan commitments shot up 6.9 per cent over the month.

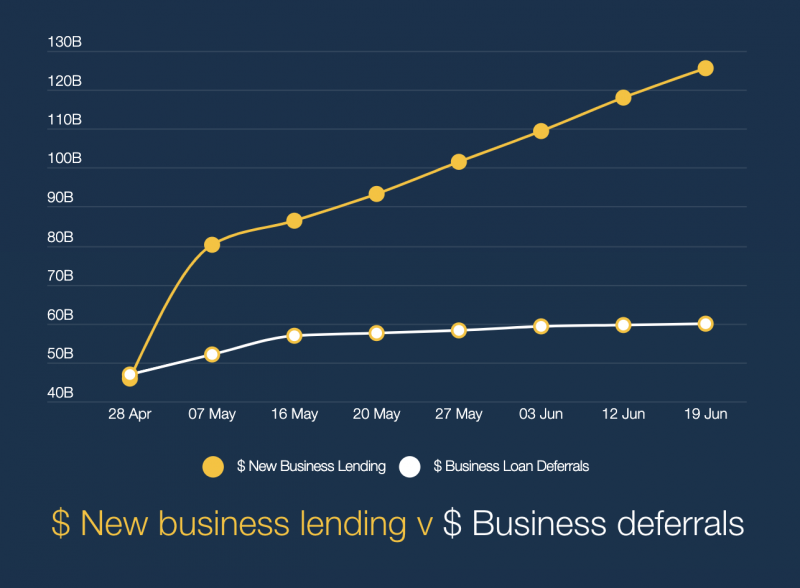

Meanwhile, between mid-May and mid-June, the Australian Banking Association (ABA) revealed that business lending was also on the rise, at an increasingly higher rate when compared to business loan deferrals.

It’s not just business loans which are bing put on hold. Significantly, at the end of May, the Australian Prudential Regulation Authority (APRA) reported 10 per cent of all housing and small business loans — valued at a whopping $266 billion —had been deferred.

While the latest quarter of banking figures are pending, the spike in loans and deferrals points to an avalanche of defaults in the near-term. And while a credit bubble is set to stimulate the economy, it’s also set to leave Australians dealing with the aftermath for years to come.

Bubble bursts

Of course, an increase across home, personal and business lending, encouraged by the relaxation of lending laws, will also lead to a rise in defaults. Coupled with low interest rates and the current recession, it’ll lead to a major Australian credit bust.

Once the lending bubble does burst, the spotlight will be on credit managers. The fallout from the relaxation of lending laws and a wave of debt will challenge managers to work with those in debt and pick up the pieces. So how are ASX-listed credit managers positioned to respond to the impending burst?

Credit Intelligence (ASX:CI1)

Significantly, Hong-Kong based Credit Intelligence (ASX:CI1), while listed on an Australian exchange, has minimal exposure to the Australian lending market — in fact, it made its first Australian acquisition in July.

In its FY20 report, released today, Credit Intelligence tabled $13.6 million in revenue, up 125 per cent on last financial year’s figures.

Even more significantly, CI1 increased its profits nearly fivefold over the period. The debt collector went from just over half a million in profit over FY19 to land $2.54 million in the black at the end of FY20.

Credit Intelligence’s Australian buy, a 60 per cent stake in Sydney-based debt solutions business Chapter Two Holdings, is yet to have a financial impact on the company.

However, as lending booms and the bubble bursts down under, the acquisition positions CI1 to make moves in the Australian market.

Today, Credit shares are trading grey for 2.8 cents.

Credit Corp (ASX:CCP)

ASX-200 lister Credit Corp (ASX:CCP) is another publicly-listed credit manager which recently released its financials.

The billion-dollar stock also held onto a profit over FY20, albeit a much smaller one than recorded in the previous year.

At the end of June, Credit Corp recorded $15.5 million in net profit after tax, down from FY19’s $70.3 million.

Speaking to the results, CCP’s Remuneration and HR Committee Chairman Eric Dodd said the group had focussed on cash generation as COVID impacted its business, setting it up for the future.

“These operational achievements have put the group into a strong position. With $400 million in cash and undrawn credit lines the group can continue to invest and look for opportunity during a period of uncertainty,” Eric stated.

“Pricing and risk settings have been adjusted and the group remains a trusted partner of its banking client base during a period of renewed interest in debt sale and an outlook which suggests rising sale volumes,” he continued.

As lending laws relax, debt booms and deferrals spike, investors will be watching ASX-listed credit managers to see how they perform in the wake of the credit bust.