- Galaxy Resources (GXY) has completed a placement and institutional entitlement offer, raising $124 million

- This forms part of a larger $161 million equity financing package that Galaxy will use to fund lithium projects in Argentina and Canada

- Under the placement, roughly 65 million new shares were issued to institutional investors at $1.70 – representing a 15 per cent discount to Galaxy’s last trading price of $2 on November 24

- Under the institutional entitlement offer, eligible shareholders were able to purchase one new share for every 14 held at the same price as the placement

- To raise the remaining $37 million, Galaxy will be undertaking a retail entitlement offer which is set to open on December 1 and close on December 10

- Galaxy has ended the day 1.26 per cent in the red with shares trading at $1.96

Galaxy Resources (GXY) has completed a placement and institutional entitlement offer, raising $124 million.

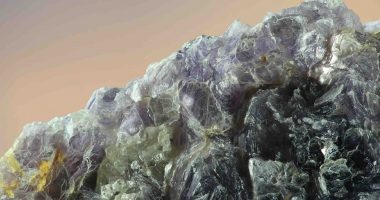

This forms part of a larger $161 million equity financing package that Galaxy will use to fund lithium projects in Argentina and Canada.

Stage one is underway at the company’s Sal de Vida lithium brine project in Argentina, with engineering and design work expected to be completed by Q1 2021.

“Securing these funds is an important milestone for Galaxy as we seek to commit to execute and develop Sal de Vida into a successful, lowest-quartile cost lithium brine operation,” CEO Simon Hay commented.

“The equity finance proceeds will also be used to accelerate James Bay to a construction ready status which Galaxy believes is timely given the project’s high-grade nature and location, position Galaxy to take advantage of the expected growth in electric vehicle demand in Europe and North America,” he added.

Placement

Under the placement, roughly 65 million new shares were issued to institutional investors at $1.70.

This price represents a 15 per cent discount to Galaxy’s last trading price of $2 on November 24, and an 8.1 per cent discount to the 10-day volume weighted average price of $1.85.

Shares are expected to settle on December 3 and begin trading on the ASX on December 4.

Institutional entitlement offer

Under the institutional entitlement offer, eligible shareholders were able to purchase one new share for every 14 held at the same price as the placement.

Shares will also settle on December 3 and begin trading on the ASX on December 4.

Retail entitlement offer

To raise the remaining $37 million, Galaxy will undertake a retail entitlement offer.

Eligible shareholders will be able to subscribe for one new share for every 14 held as at November 27.

It will open on December 1 and close on December 10 unless otherwise extended.

Galaxy has ended the day 1.26 per cent in the red with shares trading at $1.96 in an $800.5 million market cap.