- Pilbara Minerals (PLS) has launched a $121 million entitlement offer as part of a $240 million capital raise to buy Altura Lithium (ALO), a subsidiary of Altura Mining

- ALO’s Pilgangoora Lithium Mine in far north WA has been in care and maintenance mode since the company went into receivership in late October

- With the Altura acquisition, PLS will become the largest ASX-listed pure-play lithium company by enterprise value

- Pilbara Minerals has already raised $119 million through a placement, and will raise the balance of the target through a non-renounceable entitlement offer

- If the full amount is raised, PLS will be able to go ahead with the acquisition without breaking the piggy bank to get it over the line

- Pilbara Minerals is still in a trading halt — shares last traded for 87.5 cents on Friday December 11

Pilbara Minerals (PLS) has launched a $121 million entitlement offer as part of a $240 million capital raise to buy Altura Lithium.

The project

Altura Lithium (ALO) is a wholly-owned subsidiary of Altura Mining (AJM).

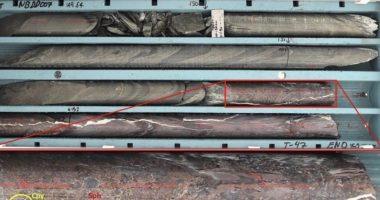

The Altura Project at Pilgangoora in WA’s far north started commercial production in early 2019 and produced 181,263 wet metric tonnes of spodumene concentrate in the year ended June 30, 2020.

The mine has been placed into care and maintenance since the company went into receivership at the end of October.

The acquisition of the project’s resources and infrastructure will provide substantial economies of scale and operational streamlining opportunities as it sits next door to PLS’ Pilgangoora Lithium-Tantalum project.

The combined projects will make Pilbara Minerals the largest ASX-listed pure-play lithium company by enterprise value.

With the signing of the Deed of Company Arrangement (DOCA), PLS has been given the green light to acquire all shares in Altura Lithium.

The capital raise will be used to fund the US$175 million (around A$232 million) acquisition.

The raise

Pilbara Minerals has already raised $119 million through a placement, and is now looking to raise the balance of the $240 million target through a non-renounceable entitlement offer.

Shares in the fully-underwritten one-for-7.6 offer will be offered at 36 cents, the same price as the placement.

PLS expects the raise will cover the entire cost of the acquisition, and the company should maintain its strong balance sheet after the transaction. The company had $96 million cash on hand and a $15 million working capital facility as at June 30, 2020.

Pilbara Minerals Managing Director Ken Brinsden says the raise will afford the company a flexible opportunity to step-up its Pilgangoora operations.

“We are pleased to confirm the successful completion of the placement and

announce the formal launch of the entitlement offer to all eligible shareholders

which represents the final step in acquiring the Altura Project,” Ken said.

“Pilbara Minerals is uniquely placed to realise the full value of benefits that should arise from acquiring the neighbouring Altura Project,” he continued.

“This, when combined with the additional production capacity and uncommitted offtake positions, means we are strongly placed to capitalise on improving lithium market conditions and the expected long-term industry growth trend,” he added.

The institutional portion of the entitlement offer opens today and is expected to close tomorrow.

The retail component will likely open on Friday, December 18.

If the full amount is raised, PLS will be able to go ahead with the acquisition without breaking the piggy bank to get it over the line.

Pilbara Minerals is still in a trading halt — shares last traded for 87.5 cents on Friday December 11.