- Against the backdrop of a shifting North American cannabis sector, Creso Pharma (CPH) finished 2020 with a resilient fourth quarter

- Receipts from customers grew 740 per cent compared to the prior period to $709,000

- However, this figure represents a substantial drop compared to the almost $1.37 million that was generated in the fourth quarter of 2019

- Nevertheless, the company is continuing to expand its footprint across Canada and Latin America

- Creso Pharma is steady at market close with shares trading at 19.5 cents

Against the backdrop of a shifting North American cannabis sector, Creso Pharma (CPH) finished 2020 with a resilient fourth quarter.

For the three months ending December 31, the company collected $709,000 in customer receipts, representing a 740 per cent increase compared to the period before.

While that figure signals a steep growth curve, it’s a substantial drop compared to the almost $1.37 million that was generated in the fourth quarter of 2019.

That said, of the purchase orders received during the quarter only a portion of them were written down as cash receipts. The remainder of these orders are expected to record in the first and second quarters of 2021.

Notably, Creso’s wholly owned subsidiary Mernova Medicinal achieved a number of key milestones during the quarter, backed by strong demand for its products and continued entry to new markets.

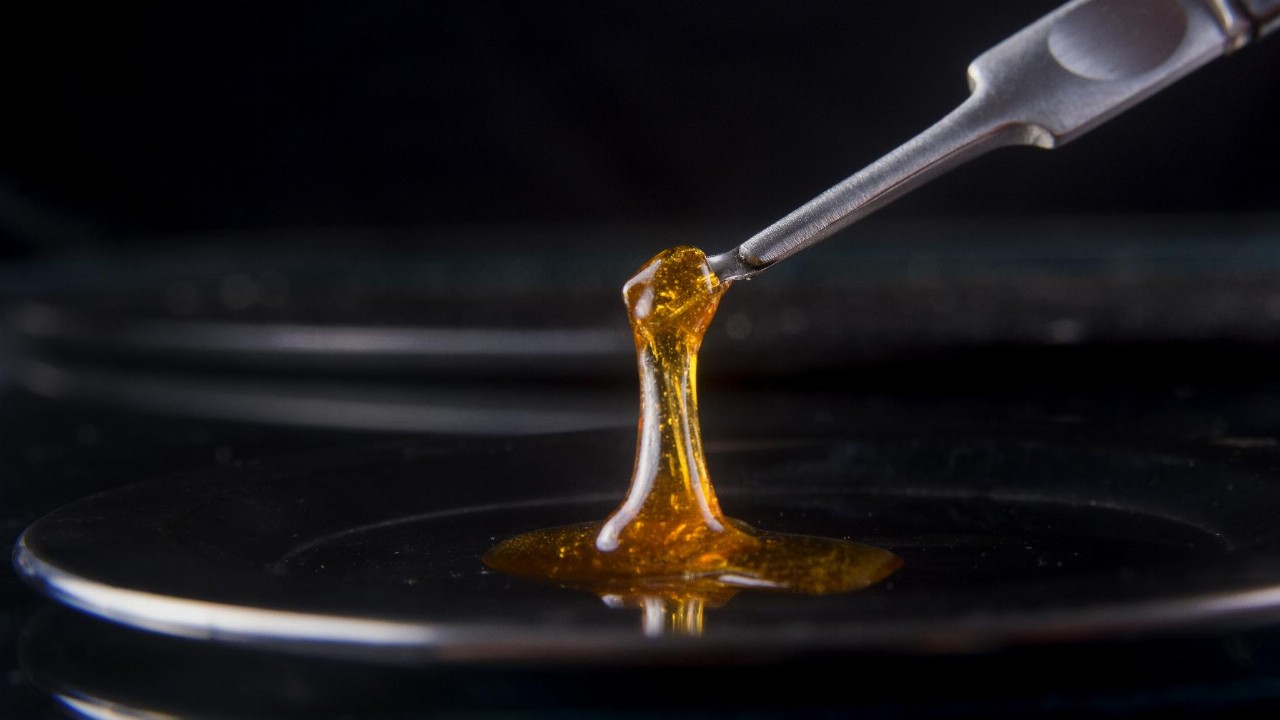

October 2019 saw the legalisation of Cannabis 2.0 products in Canada — edible cannabis, cannabis extracts and topicals.

Following a comprehensive review of the market opportunities available, Mernova made the decision to expand its operations to include hash which, as a result of the legalisation, can be produced and sold in the country.

Crest noted that the Canadian hash market is expected to grow substantially, and Mernova will advance the production of hash products with a view to launching them in the first quarter of this year.

“Strong sales were achieved over the period, stemming from a scale-up of Mernova’s operations and the receipt of a number of new orders,” Non-Executive Chairman Adam Blumenthal said.

“While the uptick in customer receipts is very pleasing, we are now focused on continuing this rapid growth,” he added.

As of December 31, the company had just over $6 million on its balance sheet.

Creso Pharma is steady on the market with shares trading at 19.5 cents at market close.