- Cann Group (CAN) has lowered its revenue guidance for the current financial year due to the COVID-19 pandemic amid plans to purchase Satipharm

- The company has dropped its guidance from $15 million to between $8 million and $10 million

- Cann has seen delays in its regulatory approvals in Australia and Germany due to the pandemic

- Additionally, Cann has also agreed to purchase Satipharm business from Harvest One Cannabis for up to C$4 million (A$4 million)

- Satipharm is a Europe-based business with an exclusive licensed to develop and market the Gelpell delivery system for cannabinoids

- Once the purchase is completed, the acquisition will give Cann immediate entry into Europe’s cannabidiol market

- On the market this morning, Cann is up 1.95 per cent and is trading at 78.5 cents per share

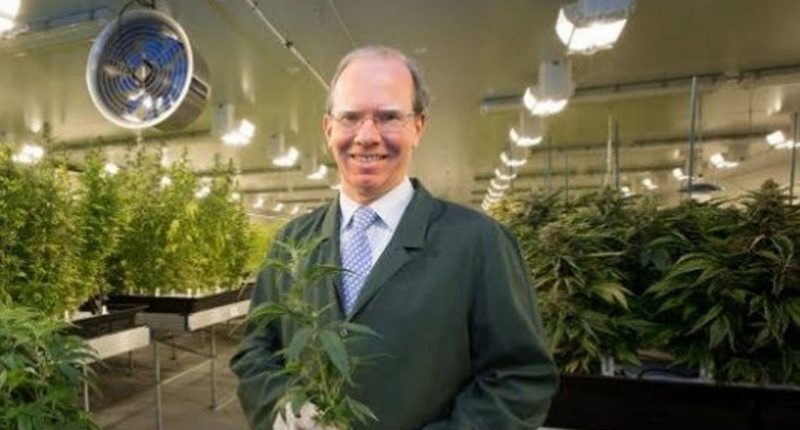

Cann Group (CAN) has lowered its revenue guidance for the current financial year due to the COVID-19 pandemic amid plans to purchase Satipharm.

The company has dropped its guidance from $15 million to between $8 million and $10 million.

The change in revenue follows a review completed over the weekend by the Cann Board in preparation for its half-yearly report, which will be released next week.

Cann says COVID-19 has delayed plans causing the drop in revenue. These delays are for regulatory approvals in Australia and Germany.

Last year, Cann entered a supply agreement with German distribution partner iuvo Therapeutics, receiving an initial purchase order for 19,000 units in December.

The products are currently being manufactured and are expected to be ready for shipment to Germany in late March or early April, depending on the regulatory clearance.

“iuvo has indicated that it is seeing strong demand from its customers and has recently increased the order to approximately 25,000 units, with the additional product having moved into production,” the company said.

Notably, Cann’s revised revenue guidance for the 2021 financial year assumes the iuvo order will be shipped by the end of April, and additional orders will be received and filled from iuvo prior to the end of the period.

Cann’s Australian orders continue to grow, with the company manufacturing and delivering over 5000 bottles in the current quarter.

“While the lengthy regulatory delays are frustrating, we believe this is a timing issue only and the fundamentals of the business have not changed,” CEO Peter Crock said.

“Demand for Cann product continues to build steadily and our commitment to produce quality product to the highest GMP standards ensures the broadest possible market access opportunity,” he added.

Satipharm acquisition

Additionally, Cann has also agreed to purchase Satipharm business from Harvest One Cannabis.

The purchase is an all script deal, worth up to CAD$4 million (around A$4 million).

Satipharm is a Europe-based business that is exclusivity licensed to develop and market the Gelpell delivery system for cannabinoids.

Once the purchase is completed, the acquisition will give Cann immediate entry into Europe’s cannabidiol (CBD) market.

Cann plans to have CBD Gelpell approved for sale in Australia and installing the technology at its new Mildura production facility.

“The technology will allow us to develop more targeted and effective dosage forms of both low dose CBD and differentiated THC prescription formulations of medicinal cannabis,” Peter told the market.

“We believe the Satipharm product offers superior efficacy, delivery and stability qualities compared to other products and we expect these unique features, coupled with its presentation in a more familiar capsule form expected of pharmaceuticals, to generate greater confidence from prescribing doctors,” he added.

On the market this morning, Cann is up 1.95 per cent and is trading at 78.5 cents per share at 11:46 am AEDT.