- PayGroup (PYG) has officially acquired 100 per cent of Integrated Workforce Solutions (IWS)

- The payroll and human capital management business spent $15.3 million buying IWS, which is a cloud-based workforce management platform

- PYG tapped its own investors for $15.7 million, helping to cover the cost of the acquisition

- Explaining the purchase, PYG said IWS would help advance the company’s monetisation opportunities

- Shares in PayGroup are trading down 4 per cent at 48 cents per share

PayGroup (PYG) has completed its acquisition of Integrated Workforce Solutions (IWS).

The payroll and human capital management business spent $15.3 million buying 100 per cent of IWS.

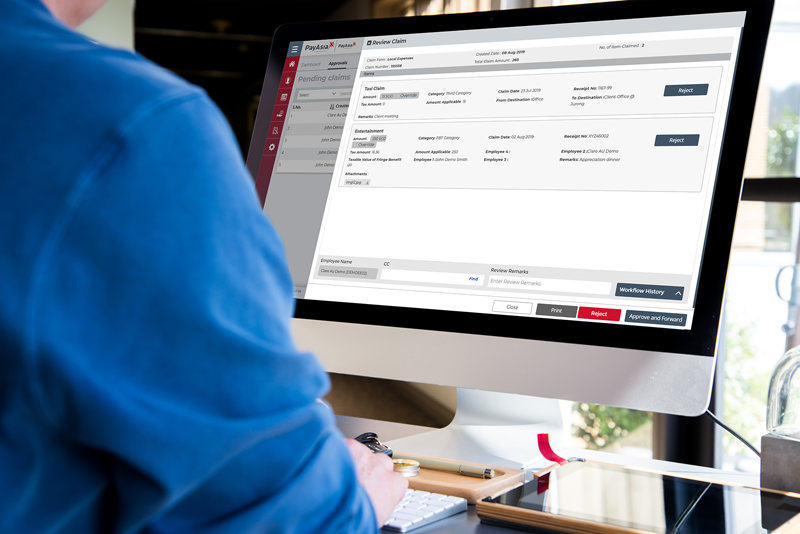

The newly acquired company operates a leading cloud-based workforce management platform for the franchise sector.

It also boasts more than 1000 customers, while its platform “simplifies complex payroll administration” duties.

Explaining the purchase, PYG Managing Director Mark Samlal said it would help advance the company’s monetisation opportunities.

“IWS strengthens PayGroup’s position as a leading provider of mission-critical payroll and scalable HCM solutions, expanding our capabilities, while greatly

increasing monetisation opportunities,” he said.

“PayGroup is well placed to help our Australian and New Zealand franchise networks grow into the APAC region, leveraging our established infrastructure and streamlined solution,” he added.

PYG paid for the acquisition via a capital raise, tapping its own investors and shareholders for $15.7 million.

Shares in PayGroup are trading down 4 per cent at 48 cents per share at 1:27 pm AEST.