- Peak Resources (PEK) has decided to use its £1.8 million (approx. A$2.2 million) option for a long-term lease to develop the Teesside Rare Earth Refinery in the U.K.

- The option covers a 250-year lease through Homes England over a 19-hectare parcel of land within the Wilton International Site

- On the site, Peak intends to construct the refinery which will receive high-grade rare earth concentrate from its planned Ngualla Rare Earth Project in Tanzania

- Construction and development of the refinery are expected to cost around US$160 million (about A$206 million)

- The development of the refinery is central to Peak’s strategy of becoming the second fully integrated producer of neodymium praseodymium oxide outside of China

- On the market this morning, Peak is in the grey and trading at 11.5 cents per share

Peak Resources (PEK) has decided to use its option for a long-term lease to develop the Teesside Refinery in the United Kingdom.

The option covers a 250-year lease from Homes England, a U.K. Government body, over a 19-hectare parcel of land within the Wilton International Site, located near the town of Middlesbrough in the Tees Valley.

Peak will pay an upfront amount of nearly £1.8 million (approx. A$2.2 million) to exercise this option, with annual rent structured as a nominal peppercorn payment.

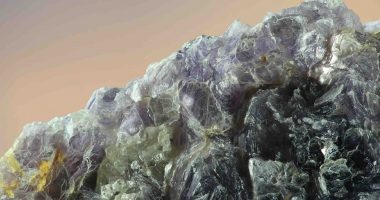

On the site, Peak intends to construct the refinery which will receive high-grade rare earth concentrate from its planned Ngualla Rare Earth Project in Tanzania.

Notably, the construction of Teesside Refinery will occur at the same time as the development of Ngualla.

The development of the refinery is central to Peak’s strategy of becoming the second fully integrated producer of neodymium praseodymium oxide outside of China.

Construction and development of the refinery are expected to cost around US$160 million (about A$206 million).

Managing Director Bardin Davis says this is a significant milestone for Peak.

“With incredibly strong global demand for non-Chinese rare earths, we are ideally placed to supply these critical commodities, which are driving the electrification and decarbonisation revolution,” he said.

“The Teesside location provides a major competitive advantage with its “plug and play” infrastructure, skilled labour force and proximity to potential customers, while its freeport status provides tangible tax and other benefits,” he added.

On the market this morning, Peak is in the grey and trading at 11.5 cents per share at 10:32 am AEST.