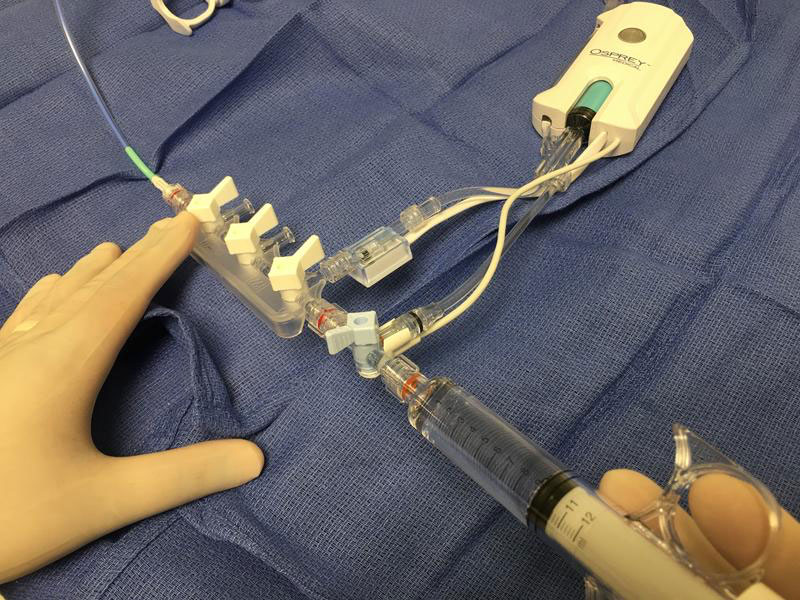

- Heart imaging company Osprey Medical (OSP) will be reducing its workforce across all areas, starting on Friday, May 6

- It comes after the company released its quarterly report on April 29, showing cash available for future was only one quarters worth of funding available

- The company also saw a reduction of units sold outside of the US market – though it doesn’t expect this trend to continue

- Osprey sought a trading halt to evaluate its strategic funding options, including a possible sale of assets

- That was granted on May 3, and trading has not yet resumed. Shares last traded at 20 cents

Heart imaging company Osprey Medical (OSP) has announced it will be reducing its workforce across all areas, starting on Friday, May 6.

It comes after the company announced in its quarterly report on April 29, that it spent US$484,000 (A$681,000) on research and development, but US$1.7 million on staff costs and US$341,000 on administration and corporate costs. All this lead to Osprey spending $2.7 million in operating activities.

The company also announced that estimated cash available for future was only one quarter’s worth of funding available, leaving them with only US$2.61 million worth of available funding.

Osprey also said it was seeking a trading halt to evaluate its strategic funding options, including a possible sale of assets.

During the quarter Osprey also said it was challenged in its Outside the US market, with a reduction of units sold. However, the company believes it wont continue to see this slower trend, as it has already received warehouse order sales for Q2.

Osprey will continue to assess next steps and expects to update the market shortly on further developments.

Osprey has been in a trading halt since May 3. Shares last traded at 20 cents.