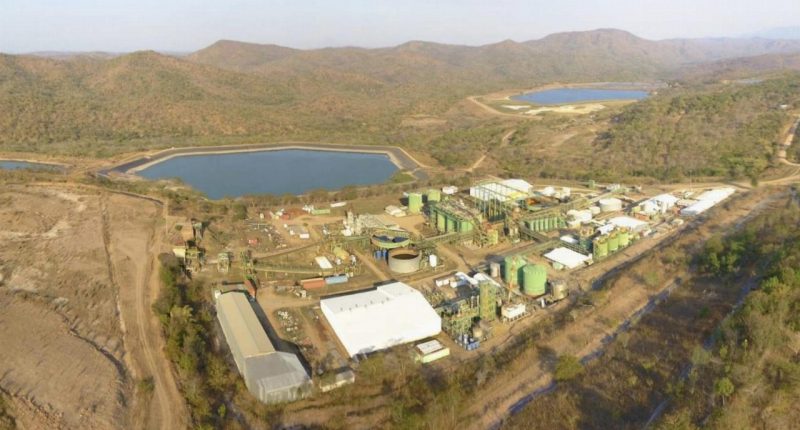

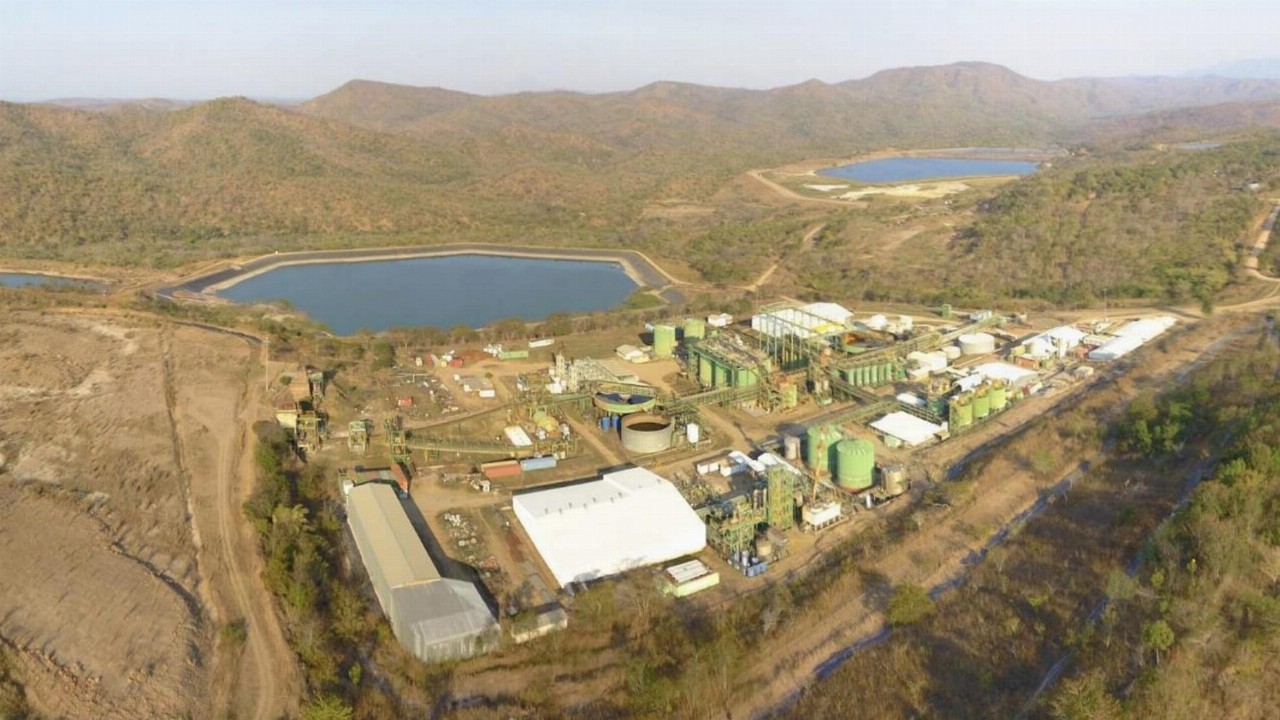

- Lotus Resources (LOT) confirms through a definitive feasibility study (DFS) that its Kayelekera project in Malawi is one of the lowest-capital-cost uranium projects globally

- The study highlights a development timeline for the project of just 15 months, with initial capital costs of US$88 million (A$124 million) and initial capital intensity of US$37 a pound

- Lotus predicts the project will produce an average of 2.4 million pounds of uranium per year for the first seven years of production, with an overall mine life of 10 years

- The company is continuing to work with the Malawian government to secure a mine development agreement that will support project financing

- Shares in Lotus Resources are trading grey at 23 cents per share at 11:00 am AEST

Lotus Resources (LOT) has confirmed through a definitive feasibility study (DFS) that its Kayelekera project in Malawi is one of the lowest-capital-cost uranium projects globally.

The study was underpinned by an ore reserve estimate of 15.9 megatons at 660 parts per million triuranium octoxide for 23 million pounds.

It highlighted a development timeline for the project of just 15 months, with initial capital costs of US$88 million (A$124 million) and initial capital intensity of US$37 a pound.

While this development price tag includes US$35.8 million for a new plant and infrastructure not included in Lotus’ scoping study for the project, the company maintained it still made Kayelekera one of the lowest-cost uranium projects on the planet.

Through the DFS, Lotus predicted the project would produce an average of 2.4 million pounds of uranium per year for the first seven years of production, with an overall mine life of 10 years.

Managing Director Keith Bowes said predicted capital costs for the project were an “excellent achievement” for the company given current global inflationary pressures.

“Having an asset with low technical risk and low restart capital, which can quickly commence production, are key characteristics that investors look for in a mining project,” Mr Bowes said.

“The results of the restart DFS clearly put Kayelekera in this category, and this provides an opportunity for the company to leverage off the strongest fundamentals for the nuclear/uranium industry in many years.”

He added that the company believed it was in the early stages of the uranium market upcycle, meaning it was confident the current price of uranium still had “some way to go” before it peaked.

Lotus will now focus on working with the Malawian government to secure a mine development agreement to support project financing.

Shares in Lotus Resources were trading grey at 23 cents per share at 11:00 am AEST.