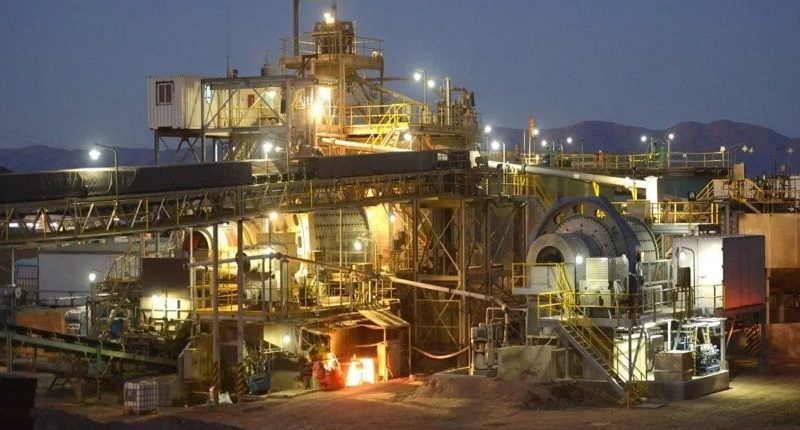

Challenger Gold (ASX:CEL) and Austral Gold (ASX:AGD) have linked forces through a toll agreement that will now see the all-gold production partnership working together at the Casposo Argentina mining facility.

Per the December 30 agreement, Challenger will send materials from its Hualilan project to be processed by Austral subsidiary Casposo at its plant in San Juan, Argentina.

HotCopper understands this deal will run for three years with options for extensions.

The newly-struck San Juan partnership also includes a commitment from Austral’s Casposo regarding its plant; the subsidiary has pledged to “use its best commercial efforts” – directly or through third parties – to secure funding for the refurbishment and commercial startup of the plant by July 31 next year.

To that end, Casposo has already bagged a US$7M loan from Banco San Juan.

This deal has a 24-month term and will see Austral’s subsidiary handed $1.5M immediately.

Austral’s CEO, Stabro Kasaneva, who facilitated much of the deal, said the company was “very pleased” with their side of the deal as refurbishment plans get underway.

Investors seemed very happy with Austral’s side of the bargain, with AGD’s price leaping 15.39% through the morning’s trade. Shares in the Argentina-based mining company are now selling at around three cents each.

Challenger shares didn’t move after Monday’s news – they’re still selling at 4.4 cents – but things should move upwards eventually considering this agreement gives the company access to 300,000 tonnes worth of processing power.

Casposo, based 170 kilometres from Hualilan, historically produces as much as 320,000 ounces of gold and 13.2 million ounces of silver per year of operations.

Challenger actually only requires 150,000 tonnes of annual commitment right now.

Join the discussion. See what HotCopper users are saying about Challenger Gold and Austral Gold and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.