- De.mem has completed a placement of approximately $3 million at $0.20 cents per share

- Additional capital has been raised as the company anticipates new Build-Own-Operate (BOO) contract awards which are integral for its growth strategy

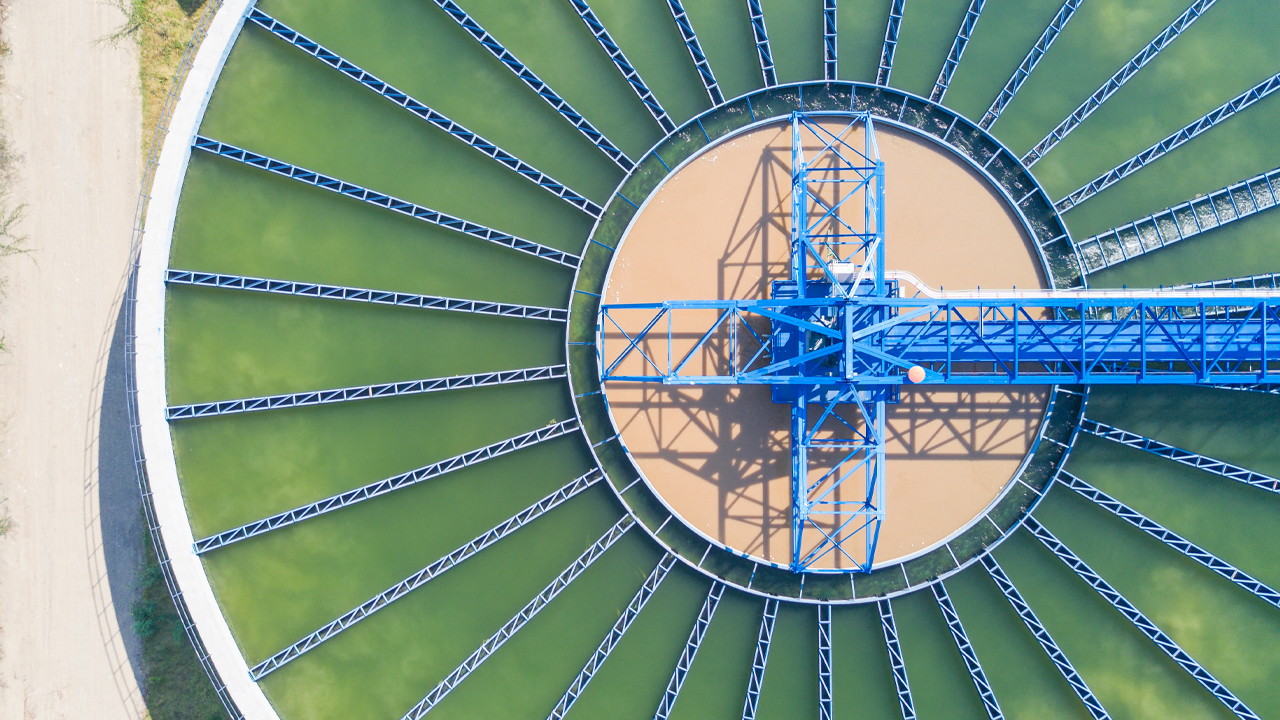

- De.mem is an Australian-Singaporean business that designs and operates water and wastewater treatment systems for some of the world’s largest companies

Water and wastewater treatment company De.mem has completed a placement of approximately $3 million at 20 cents per share.

The company will issue 14.755 million new De.mem shares once the committed capital has all been received.

The additional capital has been raised as the company anticipates new Build-Own-Operate (BOO) contract awards, as well as for general working capital.

Growing BOO revenues is integral to De.mem’s growth strategy. This segment will increase the company’s recurring revenue stream with equipment rentals.

“The investment received from such a high-quality group of investors underlines the attractive investment proposition of De.mem. Each investor is known to be a long-term supporter of high-quality growth businesses,” CEO Andreas Kroell said.

De.mem is an Australian-Singaporean business that designs, builds, owns, and operates water and wastewater treatment systems for some of the world’s largest companies across the mining, electronics, chemical, oil and gas, and food and beverage industries.

Its advanced technologies have been developed by research and development partner, Nanyang Technological University in Singapore.

The technologies include a low-pressure, hollow fibre nanofiltration membrane that uses less electricity and is cheaper to operate than conventional systems. The company and its partner have also developed a new Forward Osmosis membrane deployed in de-watering applications or the concentration of liquids.

“We are focusing on growing our recurring revenues, diversifying our revenues across Australia and internationally, selectively advancing our proprietary product range and expanding into high growth customer verticals such as the food and beverage segment,” Andreas concluded.