- Australia-based resources company, A-Cap Energy (ACB) raises $17.4 million via its heavily oversubscribed renounceable rights issue

- The funds were raised through the issue of more than 267,9 million new fully paid ordinary shares to institutional and professional investors

- To accommodate some of the excess demand, A-Cap has agreed to raise a further $3.25 million via a follow-on placement

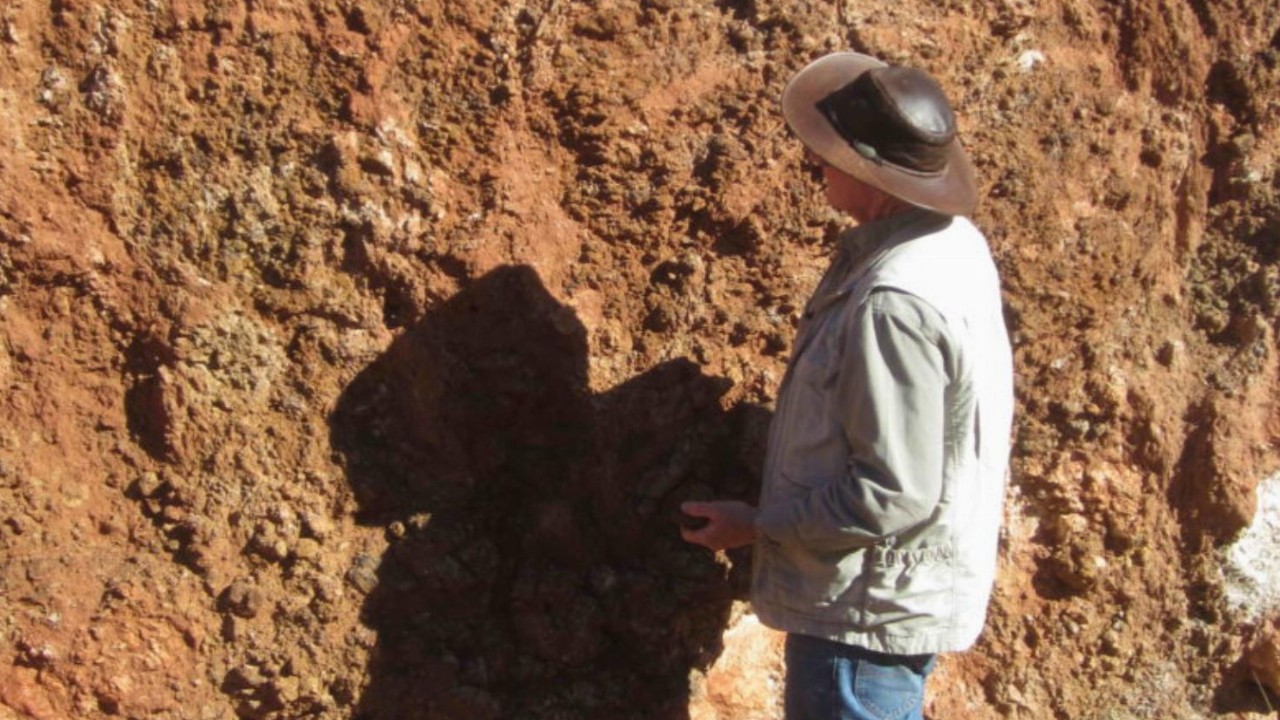

- A-Cap will use the money to repay debt, undertake a pre-feasibility study at the Wilconi Cobalt Project and undertake an optimisation study for the Letlhakane Uranium Project

- Shares in A-Cap are trading four per cent at 12 cents apiece at 2:18 pm AEDT

Australian-based resources company A-Cap Energy (ACB) has raised $17.4 million via its heavily oversubscribed renounceable rights issue.

The $17.4 million was raised through the issue of 267,971,217 new fully paid ordinary shares to institutional and professional investors.

A-Cap’s largest shareholder, Singapore Shenke International, was allocated 20,518,015 shortfall shares while company directors and senior exploration staff took up some entitlements.

The shares are expected to settle on October 26.

To accommodate some of the excess demand, A-Cap has agreed to raise a further $3.25 million via a follow-on placement.

An additional 50 million new shares will be issued under the follow-on placement, priced at 6.5 cents.

Mahe Capital acted as lead manager and underwriter to the rights issue and advised A-Cap on the issue and follow-on placement.

A-Cap will use the money to repay debt, undertake a pre-feasibility study at the Wilconi Cobalt Project and undertake an optimisation study for the Letlhakane Uranium Project.

Shares in A-Cap were trading four per cent at 12 cents apiece at 2:18 pm AEDT.