- Actinogen (ACW) announced it will prioritises its phase two trials in Alzheimer’s disease and depression

- Following results in the company’s recent double-blind XanaMIA Part A trial, Actinogen conducted a reassessment of its priorities and planned expenditures

- From this reassessment, the company will suspend its clinical trial operations for its Fragile X Syndrome trial, and reallocate those resources to Alzheimer’s and MDD, which is expected to be around $12 million

- Actinogen had a cash balance of $19 million at the end of the March 2022 quarter, which will be supplemented by annual rebates from the Australian government

- Actinogen are down 7.41 per cent and trading at 7.5 cents per share

Actinogen (ACW) has made the decision to prioritise its phase two trials in Alzheimer’s disease and depression, following a reassessment.

Following results in the company’s recent double-blind XanaMIA Part A trial, ACW conducted a reassessment of its priorities and planned expenditures.

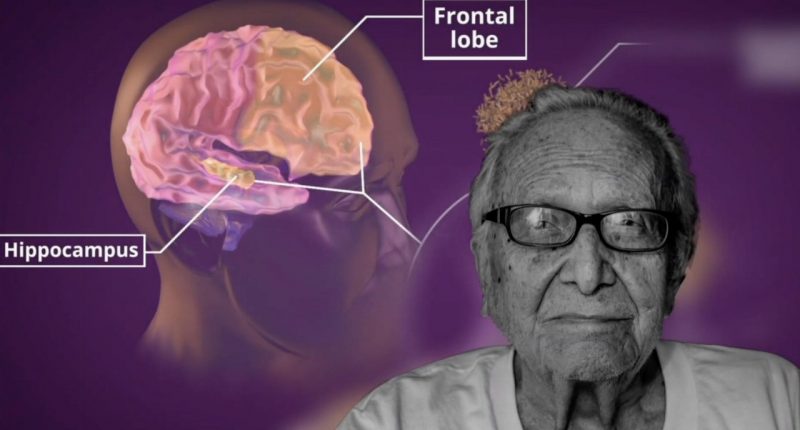

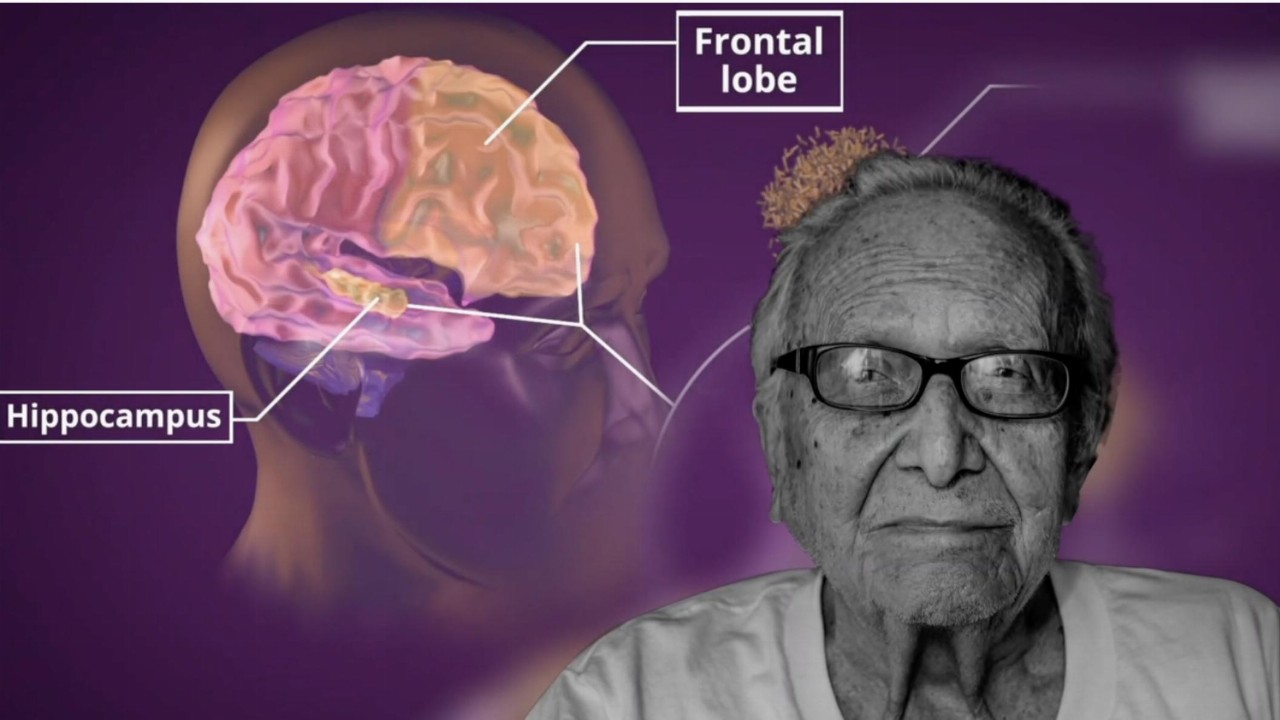

As a result of the reassessment, the company announced it will prioritise its Alzheimer’s Disease (AD) and major depressive disorder (MDD) clinical programs for Xanamem, where cognition is the primary focus.

This will come ahead of the Fragile X Syndrome program where cognition is one of several factors.

Fragile X Syndrome is a genetic condition that causes a range of developmental problems including learning disabilities and cognitive impairment.

CEO and Managing Director Steven Gourlay said results from the Part A trial trigged a review of the company’s priorities for the next two years.

“It makes business and scientific sense to devote resources and capability to our clinical programs focused on cognition, given the XanaMIA data, and expedite the phase 2 trials in Alzheimer’s Disease and Depression,” he said.

“This is clearly now the optimal path to commercialisation of our revolutionary small molecule drug, Xanamem.”

“The strong scientific rationale for our Fragile X program has not changed and we hope to be able to study Xanamem in this disease with the help of strategic partners in industry or academia,” Dr Gourlay added.

As such, the company will suspend its clinical trial operations for its more complex, global XanaFX Fragile X Syndrome trial, and reallocate those resources to AD and MDD. This is forecast to equate to around $12 million.

Actinogen had a cash balance of $19 million at the end of the March 2022 quarter, which will be supplemented by annual rebates from the Australian government under the research and development tax rebate scheme.

The company said it’s now focused on capital-efficient, Australian clinical trial operations for its studies wherever feasible.

Actinogen were down 7.41 per cent and trading at 7.5 cents per share at 11:09 am AEST.