- AGL Energy (AGL) downgrades its FY22 earnings guidance after an outage at its coal-fired power station in Victoria

- The gas and electricity supplier reported a generator fault at Unit 2 of its Loy Yang A Power Station, which isn’t expected to be up and running until August 1

- AGL expects the total financial impact to be about $73 million, leading the ASX 200-lister to slash its EBITDA and profits guidance for the full 2022 financial year

- AGL shares are trading 0.12 per cent lower at $8.67 each

Australian electricity and gas supplier AGL Energy (AGL) has downgraded its earnings guidance for the 2022 financial year.

Previously, the energy stock expected underlying earnings before interest, tax, depreciation and amortisation (EBITDA) for FY22 to be between $1.275 and $1.4 million. This has now been updated to between $1.23 million and $1.3 million.

Additionally, underlying profit after tax for FY22 is now expected to be between $220 and $270 million — significantly lower than the previous guidance range of $260 million to $340 million.

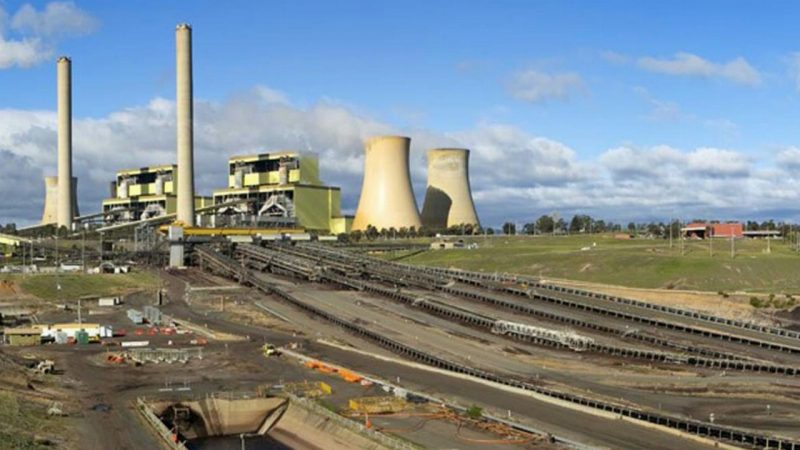

The downgraded guidance follows a review of the expected financial impact of a generator fault at Unit 2 of the Loy Yang A Power Station in Victoria which was announced on Wednesday, April 20.

On April 15, Unit 2 of AGL’s coal-fired thermal power station was taken out of service due to an electrical fault with the generator. Testing then determined that the generator rotor insulation had failed. The unit is not expected to return to service until August 1, 2022.

The estimated total financial impact of this outage is about $73 million pre-tax ($50 million after tax), based on the expected return to service by August 1.

This figure includes the direct trading impacts to date and the estimated portfolio trading impacts over the next three months.

Of the after-tax impairment of $50 million, AGL said it expected to record $41 million during the 2022 financial year and $9 million during the 2023 financial year.

AGL noted the financial impact of the Loy Yang A Unit 2 outage was not recoverable through insurance.

The company is currently reviewing whether any upcoming planned outages in the rest of its generation portfolio can be shifted to help mitigate its shorter energy position in the market.

AGL shares were down 0.12 per cent and trading at $8.67 at 11:55 am AEST.