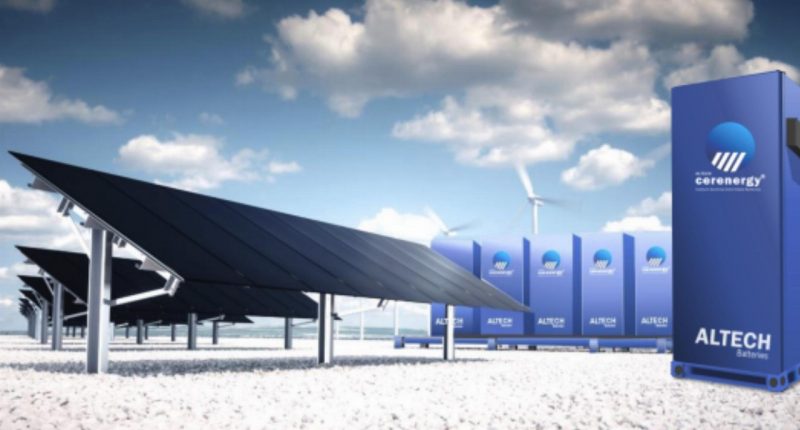

Australian company Altech Batteries (ATC) is commercialising batteries that run on common table salt – that are lithium, cobalt, graphite and copper-free, and that won’t be subject to critical metal price rises and supply chain issues.

Altech has joined forces with German government research and development institute Fraunhofer IKTS to commercialise the CERENERGY Sodium Chloride Solid State (SCSS) Battery, propelling global efforts to transition to a more renewable energy future.

Altech has launched the design of the CERENERGY 1.0 MegaWatt-hour GridPack, and is planning a 100 MWh production facility on its own land in Saxony, Germany.

The CERENERGY Batteries could be a game-changing alternative to lithium-ion batteries, given they’re fire and explosion-proof, they have a lifespan of more than 15 years, and they can withstand extreme cold and desert-hot environments.

The batteries will be capable of storing more energy from renewable energy sources such as wind and solar power.

Altech’s Managing Director Iggy Tan said he was “extremely pleased” with the progress the company was making with its CERENERGY Battery project.

“We have moved very quickly on the opportunity and managed to close the joint venture Agreement with Fraunhofer and incorporated two companies in just two months, with one month being the August holidays in Germany,” Mr Tan said.

“Since that time, we have raced to get the project moving with several workshops, and we have also appointed key engineering companies like Leadec and Arikon.

“I am very pleased with the team we have assembled, and the outstanding progress made thus far.”

In addition to its CERENERGY Batteries, Altech’s Silumina Anodes project increases the lithium-ion battery capacity of electric vehicles (EV) by 30 per cent, using the company’s proprietary high-purity alumina coating technology that incorporates silicon into the graphite anode of EV batteries.

Silicon has ten times the capacity of graphite but swells and cracks, and the industry has been racing to solve the problem. Although, Altech previously announced that it had cracked the silicon code, successfully incorporating silicon into a battery anode.

Altech is now working on a Definitive Feasibility Study (DFS) for its Silumina Anodes coating plant, which aims at supplying the product to the European EV market.

Grid Storage for Green Energy

A battery energy storage system (BESS) is an electrochemical device that charges or collects energy from a grid or power plant so that energy can be used at a later time. It allows the electricity industry to match supply with demand.

“Energy storage – most commonly deployed in the form of battery energy storage solutions – is not just about cutting edge technology and innovative applications,” Mr Tan said.

“At its core, energy storage allows the electricity industry to instantaneously match supply with demand.”

The Clean Energy Council has claimed that transitioning to renewable energy would not only maintain emissions but would bring down household power costs and reduce wholesale power prices. It would lead to a more efficient and competitive energy market.

The Inflation Reduction Act (IRA)

The introduction of the US Inflation Reduction Act (IRA) last August is set to fast-track clean energy initiatives for the future.

It contains US$394 billion (more than A$500 billion) in new spending and tax breaks to support clean energy, reduce healthcare costs and increase tax revenues.

One of the aims of the Act is to jump-start R&D and commercialisation of leading-edge technologies such as carbon capture, carbon storage and clean hydrogen.

Batteries with renewables are expected to see the largest share of funding from the IRA, with other clean electricity sources and transport (which includes EV incentives) also major beneficiaries.

Around $43 billion of the tax credits are aimed at consumers and lowering emissions by making EVs, energy-efficient appliances, rooftop solar panels, geothermal heating and home batteries more affordable.

“The IRA could also be a driver of investment into newer or alternative technologies, which could apply to different types of batteries like flow or sodium-ion, or other types of energy storage advancements in the form of mechanical or thermal storage,” Mr Tan said.

“While some may say the American climate-legislated Inflation Reduction Act threatens Australia’s own clean energy transformation, it actually should reduce energy costs and the carbon emissions that come with battery or solar-plus-storage.

“The IRA incentivises the ability to both reduce costs and carbon emissions with battery storage or solar-plus-storage like never before.

“As the world transitions from a fossil fuel economy to a sustainable energy economy, scale and ramp up of battery storage solutions are required.”

He said Australian companies could play a key role in helping the US achieve its target of reducing emissions by 40 per cent by 2030.

The Future Battery Industries Cooperative Research Centre suggests Australia can tap into the IRA benefits through both raw materials and developing a batteries industry, given one of the aims of the Act is to jump-start research, development and commercialisation of leading-edge technologies, such as battery storage and clean hydrogen.

Mr Tan said Altech’s propositions already align with this strategy.

Australia’s view

According to Australia’s Science and Industry Minister Ed Husic, America’s IRA provides Australia with the potential to leverage its renewable battery opportunities by capitalising on its lithium reserves and other raw materials.

“The revenue and jobs opportunity for the battery industry in Australia has grown exponentially in the past two years,” he said.

Australia’s Government is aware of the need to shore up the country’s supply chains for the clean energy transition.

Resources Minister Madeleine King has vowed to release Australia’s Critical Minerals Strategy later this year, which is also expected to support companies in developing strategic projects.

Earlier this year, ATC re-branded from Altech Chemicals to Altech Batteries, reflecting its new vision to meet a battery storage future as the world transitions to the electrification of energy solutions.