- American Pacific Borates (ABR) has singled out a prospective partner to sell specialty fertiliser produced at its Fort Cady Borate Mine

- Compass Minerals America, a subsidiary of mining monolith Compass Minerals International, could soon be responsible for selling and marketing sulphate of potash from ABR’s flagship asset

- Negotiations are still in their early stages, but both parties have inked a letter of intent that stipulates they’ll work together on a potential contract structure

- The companies will also advance crop trials and studies examining boron-enriched fertilisers, a product outgoing ABR Managing Director Michael Schlumpburger believes could “transform the North American specialty fertiliser market”

- If all goes to plan, American Pacific and Compass Minerals America intend to construct formal agreements in the coming months

- Today’s news helped ABR shares rally 2.97 per cent in early trade, priced at $2.43 per share

American Pacific Borates (ABR) is one step closer to bringing a seller onside to commercialise specialty fertiliser produced at its Fort Cady Borate Mine.

The ASX-lister is progressing talks with Compass Minerals’ U.S. branch, aiming to secure a partner that will market and sell sulphate of potash (SOP) from its flagship asset.

Compass Minerals America is an offshoot from the NYSE-listed Compass Minerals International — a mining stalwart with a US$2 billion (approximately A$ billion) market capitalisation. Compass’s international arm is the largest SOP producer in North America.

As part of their negotiations, both ABR and Compass have inked a letter of intent, stipulating each party will work together to structure the marketing and sales deal.

In addition, the companies will advance crop trials and studies examining boron-enriched fertilisers, a product outgoing ABR Managing Director Michael Schlumpburger believes could “transform the North American specialty fertiliser market”.

“There is a strong alignment between ABR and Compass Minerals relative to our ambitions to supply SOP to the growing North American agricultural market,” ABR Executive Director Anthony Hall commented today.

“Compass Minerals has well-established customer markets and supply

chain, so we think the collaboration on SOP sales is a sensible one.”

“The partnership will allow ABR to focus on its rare Borate business, while also leveraging the combined expertise on the potential to develop new boron enriched specialty fertilisers,” he concluded.

Crucially, the Californian Fort Cady project, wholly owned by ABR and situated in the southeastern desert region of San Bernardino County, is just months away from coming into production.

Phase 1a — the fully funded first stage of American Pacific’s production plan for the mine — is poised to kick off in 2021’s third quarter.

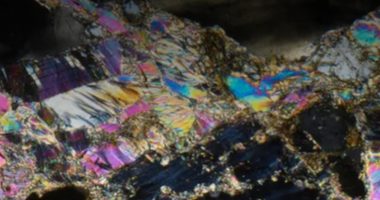

Fort Cady boasts a 120.4-million-tonne mineral resource, thought to contain 13.9 million tonnes of boric acid equivalent. It’s the largest known contained borate occurrence in the world not owned by the two major borate producers: Rio Tinto (RIO) and Eti Maden.

If all goes to plan, American Pacific and Compass Minerals America intend to construct formal agreements in the coming months.

Today’s news helped ABR shares rally 2.97 per cent in early trade, priced at $2.43 per share at 10:41 am AEST.

-1200x645-380x200.jpg)