- American West Metals (ASX:AW1) inks the USA’s only indium deposit

- Indium is a rare earth used in fibre optics and to manufacture modern devices

- The US currently imports 100 per cent of indium it requires

- Some shareholders are hopeful the company will sell the indium asset to fully fund mining of its Storm copper project

- Shares last traded at 12.5 cents

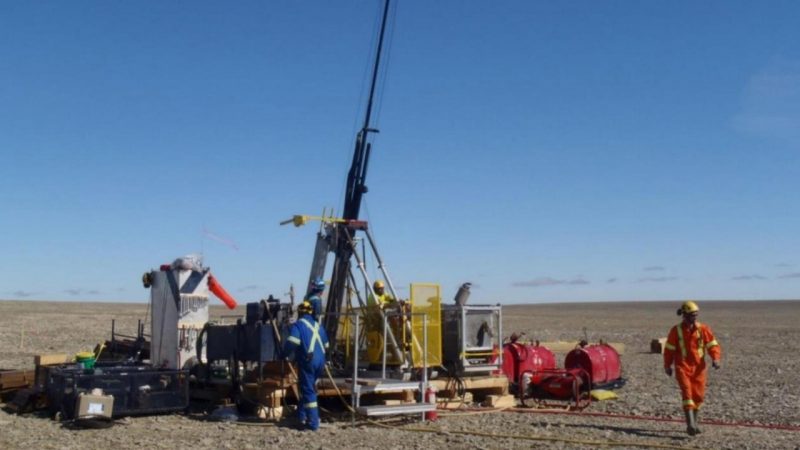

American West Metals (ASX:AW1) – the microcap explorer boasting rights to the minerally rich Storm project acreage – has just added a new high-value metal to its mineral resource.

That high-value metal is indium, a rare earth often used in coasting mobile, laptop and TV screens – as well as roles in fibre optics.

For this reason, indium is something of a backbone to many modern processes – including internet connectivity.

And now American West has the only known indium deposit in the US.

Supply chain potential

Currently, the US imports “1000 per cent of the indium” it needs, which is more often than not taken from the zinc refining process.

Indium tends to coincide with zinc mineralisation underground.

AW1’s indium deposit looks like an inferred MRE read of 33.7 million tonnes at 20 grams per tonne (g/t) of indium.

This, the company described as “one of the largest and highest-grade undeveloped indium deposits globally”.

Sale prospects

Some 119,000 ounces of gold have also been added to the company’s mineral resource estimate. Both the gold and indium relate to the company’s West Desert acreage as opposed to the Storm project.

West Desert is located in Utah, USA. It already boasted 49,000 tonnes of copper and 10 million ounces of silver in its existing JORC.

HotCopper users were, for one, largely happy with the news today. More than one user mused whether a sale of the indium asset could allow for fully funded mining of the Storm copper project.

Management comment

One possible issue to note is that AW1’s new indium resource is within a relatively low-confidence ranking, classed as an inferred resource.

“Indium and gold were omitted in the maiden MRE for West Desert due to data gaps in the historical drilling, but further studies allow us to now add these two highly valuable metals as inferred resources,” AW1 chief Dave O’Neill said.

“The updated MRE adds a world-class indium resource to the existing large volumes of zinc, copper and silver that were defined within the maiden resource announced in February this year.”

That zinc is key to the indium in the first place, and AW1 will need to find a way to deal with it – indium doesn’t form on is own underground.

China has long produced indium on its own as a byproduct of refining zinc ore.

Shares last traded at 12.5 cents.