- Arafura Resources (ARU) has received a $200 million financing proposal from an Australian Government agency

- The cash injection, available over a 15-year term would help the ASX-lister develop its shovel-ready rare earths play in the Northern Territory

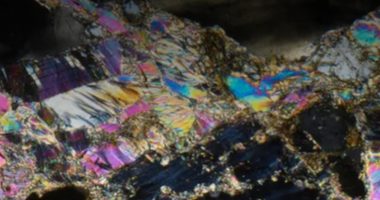

- Arafura’s Nolans project is described as one of the world richest and largest neodymium praseodymium oxide assets

- While the government funding isn’t guaranteed, ARU hopes to secure a final investment decision by 2022’s second half

- ARU shares last traded at 16 cents on May 6

Minerals explorer Arafura Resources (ARU) could receive a multi-million-dollar cash injection from the Australian Government to develop its shovel-ready rare earths play.

The ASX-lister, headquartered in WA, is currently exploring what it describes as a world-class neodymium praseodymium oxide (NdPr) project in the Northern Territory.

Arafura wholly owns the Nolans Rare Earth Project, situated just 135 kilometres from Alice Springs, and claims the asset is one of the world’s richest and largest NdPr deposits.

Now, that project has garnered government interest; Australia’s federal export credit agency, Export Finance Australia (EFA), has inked a non-binding letter of support that proposes a funding package for the Nolans project.

Essentially, EFA is willing to provide a senior debt facility with up to $200 million in available funding. The facility will run over 15 years and is, of course, subject to a wide range of conditions.

More broadly, Arafura says the package will cornerstone a broader banking debt facility — something the company is progressing with a bevy of commercial banks and export credit agencies outside Australia.

So it can progress towards a final investment decision (FID), the minerals explorer has tapped Macquarie Bank to refine its debt financing strategy and engage with prospective lenders.

Since changing tack and setting the Nolans project on a more conventional front-end engineering and design model, Arafura has set its sights on securing an FID by 2022’s second half.

To date, there have been no firm financing commitments for the NdPr play, but Arafura Managing Director Gavin Lockyer believes the EFA proposal is a step in the right direction.

“Arafura is delighted to be working with EFA and Macquarie to secure a senior debt funding package that can greatly assist in financing the Nolans Project,” he stated.

“Following the COVID-19 pandemic, we have seen increasing focus on governments globally to support the development of diversified critical raw material supply chains and provide auditable and sustainable supply chains for NdPr oxide. We are hoping to secure binding senior debt terms in line with the target final investment decision date, subject to market conditions.”

ARU shares last traded at 16 cents on May 6.

-1200x645-380x200.jpg)