It’s a good time to be a miner with a potential large-scale supply of critical minerals right now.

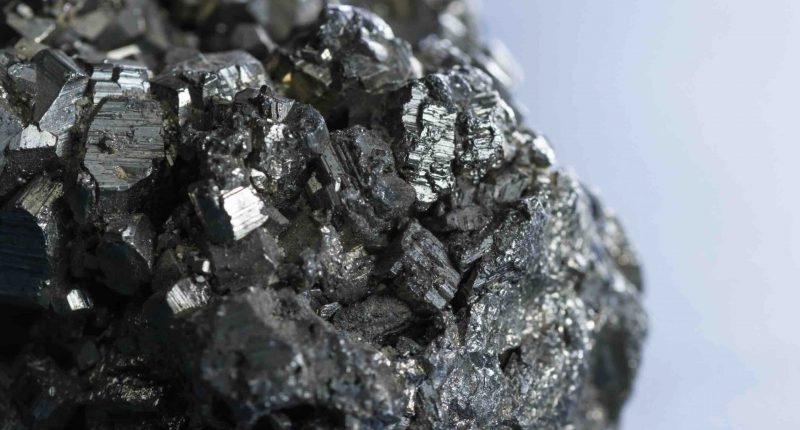

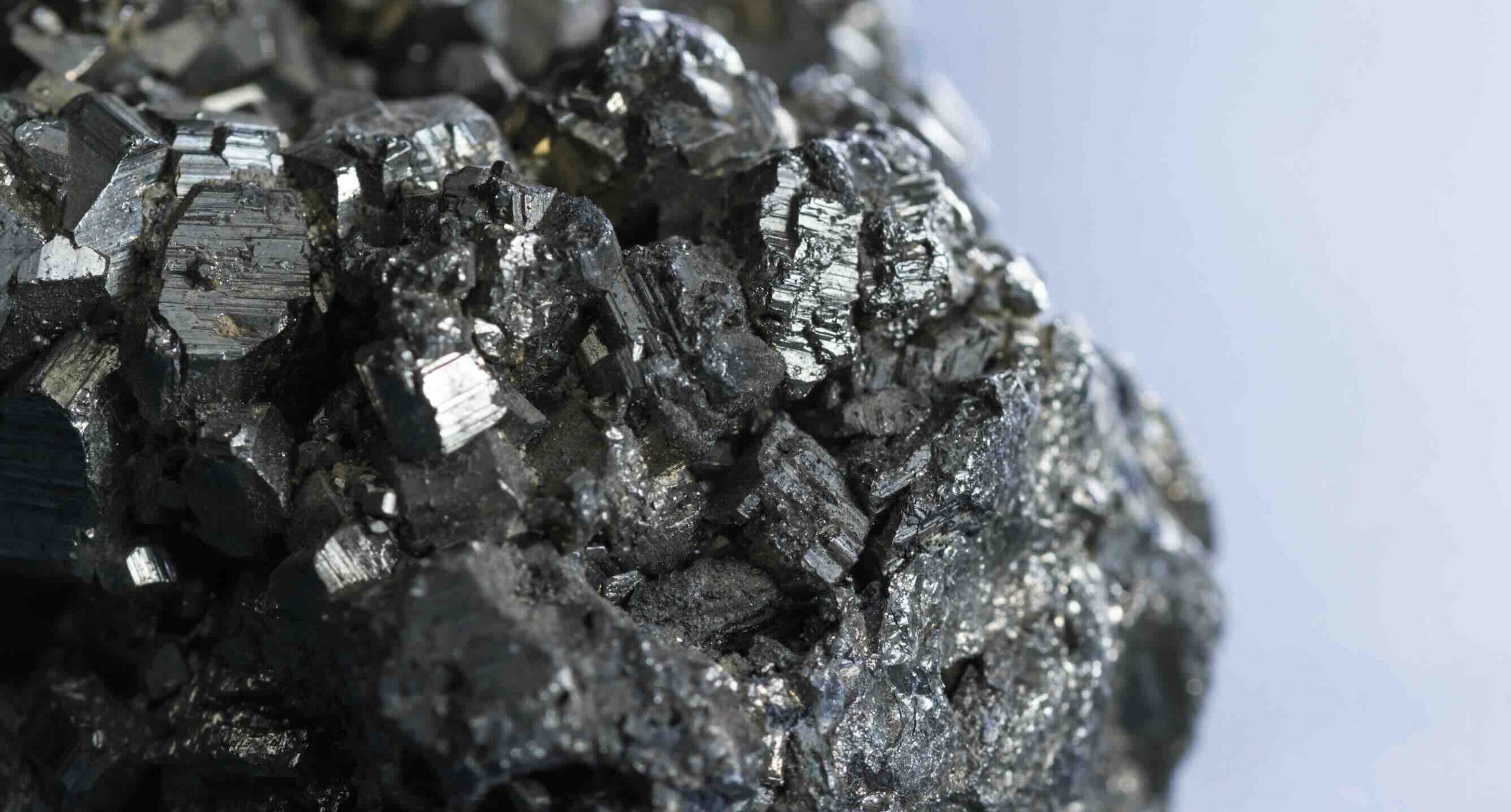

The latest winner of Australian governments’ interest in securing domestic supply chains for minerals needed in batteries, chips, and weaponry, is International Graphite (ASX:IG6).

(Fun fact: graphite is used in missile warheads.)

Of course, the Cook government don’t want IG6 to make missiles. Not yet, anyway – and the funding they’re giving wouldn’t be enough for that, at $6.5M.

Notably, the news hadn’t done much to excite the market – shares were flat at 14.5cps at 11.30am AEDT on Monday.

This isn’t that much compared to Renascor’s triple digit figure awarded recently, nor is it anywhere close to the nearly-billion-dollars given to Arafura by Canberra (handily, backed by Gina Rinehart.)

Lynas recently saw its funding doubled by Biden over in the states.

But today’s funding decision to International Graphite, while not really enough to cause a stir (it’s literally only enough to fly to a few conferences for a few years,) does demonstrate a growing trend in Australia.

That trend?: We’re trying to get pretty serious about this whole “not relying on China so much” thing. I’m steering very clear of making any comment on what I think about that.

WA’s former coal mining town of Collie – a real-life-scale exhibit of “what-do-we-do-with-this-place-now” type thinking – is to house IG6’s downstream graphite plant.

An ongoing plan to not let Collie die, older than COVID-borne geopolitical supply chain issues, also informed part of Monday’s decision.

The processing of graphite takes biblical amounts of sulphuric acid and is on the whole quite dirty – a chief reason why the world prefers China to do it. (China, in turn, just do it all in Mongolia, and let them deal with the deserts of waste.)

Regardless, the lack of market excitement could prove to be a missed opportunity.

IG6 reports this will be the first “purpose-built graphite processing facility and will increase the nation’s sovereign supply.”

Commercial-scale micronising applications will be introduced, and this is what a graphite plant needs to truly make it in the market.

For graphite to be used in batteries it needs to be incredibly fine such that it can be turned into a foil which then becomes an anode/cathode element within a battery. Those elements ultimately let electrons “flow” through the batteries.

All in order, the company is gearing up to produce 4,000 tonnes per annum. Not enough to compete with China – whatsoever – but still a good start.

IG6 last traded at 14.5cps.