- Australian housing values have surpassed their previous 2017 record after rising by 0.9 per cent over the first month of 2021

- Across the nation, average home values are above pre-COVID-19 levels by 1 per cent and above their September 2017 peak by 0.7 per cent

- This growth is largely driven by regional housing, which rose at twice the pace of capital city markets

- This is the continuation of a trend that began in the early days of the coronavirus pandemic as people leave capital cities for outer fringe houses and the virus keeps potential immigrants out of the country

- Another emerging trend is that houses are strongly outperforming units, with house values up 3.5 per cent over the past six months and unit values virtually unchanged

- Darwin saw the highest increase in overall housing prices over January, up 2.4 per cent, while Perth and Hobart were next in line and both up 1.6 per cent

Australian housing values have surpassed their previous 2017 record after rising by 0.9 per cent over the first month of 2021.

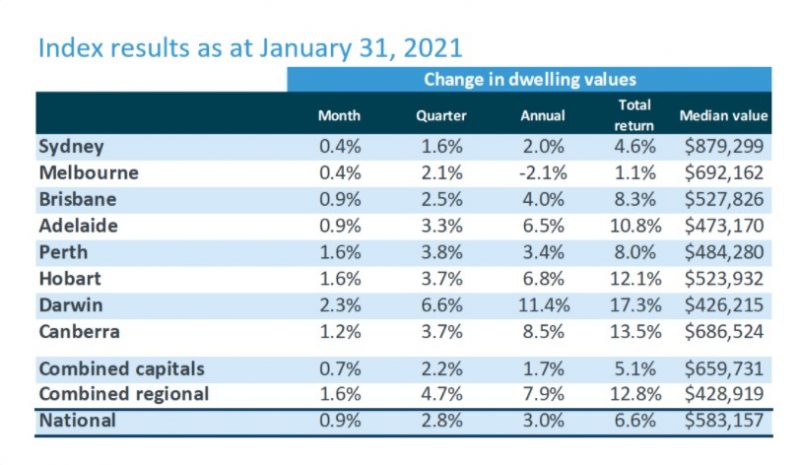

The latest data from CoreLogic shows average Aussie home values are now above their pre-COVID-19 levels by 1 per cent, with the housing index now 0.7 per cent above its September 2017 peak.

Regional homes taking charge

The data suggests that the price rise is largely driven by regional homes. Regional housing values rose at twice the pace of capital city markets, continuing a trend that began in the early days of the coronavirus pandemic.

CoreLogic said its combined regionals index was up 1.6 per cent over the month of January, while its combined capital cities index was just 0.7 per cent higher.

This trend is particularly pertinent across some of our larger states, with home values across regional Victoria and regional New South Wales up 1.6 per cent and 1.5 per cent, respectively, over January — more than tripling the 0.4 per cent growth seen across Melbourne and Sydney.

CoreLogic research director Tim Lawless said these housing value movements are caused by a combination of people leaving capital city areas and a lack of immigration as international borders around the world stay shut.

“Internal migration data shows more people are leaving Sydney and Melbourne for regional areas, resulting in a transition of activity from the metro regions to the outer fringe and regional markets,” Tim said.

“This demographic trend is further compounded by the demand shock of stalled overseas migration,” he added.

“As Melbourne and Sydney historically receive the vast majority of overseas migrants, these metro areas have been the hardest hit by this demand shock.”

He explained that better housing affordability in regional areas, lower density housing options, and the chance for a lifestyle upgrade could also be contributing to this trend — particularly with the global shift to remote working in light of COVID-19 restrictions.

Since the start of COVID-19 woes in March 2020, regional homes have appreciated 6.5 per cent in value across the nation, while capital city homes have fallen 0.2 per cent overall.

Darwin has seen the highest average increase in housing prices with a 2.3 per cent rise over January. Perth and Hobart each increased by 1.6 per cent, with Canberra’s housing prices increasing by 1.2 per cent.

Houses outperforming units

CoreLogic’s report said another broad trend becoming increasingly evident is that houses are, in general, increasing in value far more than units.

In fact, though house values have increased by 3.5 per cent over the past six months, unit values have gone virtually unchanged.

Moreover, every single capital city has recorded a stronger price increase in houses than units over the past three months.

“Demand for units has diminished through COVID-19 amidst record low levels of investor participation and changing living preferences,” Tim explained.

“At the same time, supply levels are heightened in some precincts. While demand and supply remain imbalanced, we are likely to see units continue to underperform relative to detached housing markets,” he said.