- In the face of recent stock shortages, Bubs Australia (ASX:BUB) is making waves in the US infant formula market with strong growth and surging consumer demand

- Bubs Australia hit a record weekly revenue exceeding $770,000 in November 2023

- The company expanded its footprint in the US with products now available in more than 5900 stores across the country

- As of November 30, Bubs Australia has $30.1 million in reserves, with an additional $9.8 million of unused headroom on its bank facilities

- BUB shares last traded at 12.5 cents

In the face of recent stock shortages, Bubs Australia (ASX:BUB) is making waves in the US infant formula market, boasting strong growth and surging consumer demand.

Driving growth despite challenges

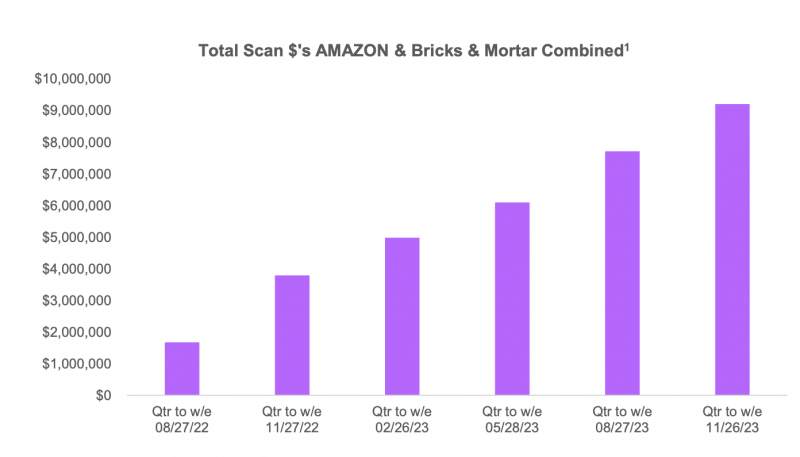

Bubs Australia hit a record weekly revenue exceeding $770,000 in November 2023, despite facing supply chain interruptions and inventory shortages over the past six weeks.

The demand for the company’s products and brands continues to grow, with BUB achieving the status of the number one infant formula goat milk provider in the US.

“The American Academy of Pediatrics (AAP) expanded their infant formula recommendations recently to include goat milk-based products for the first time which is a game changer,” BUB CEO and Managing Director Reg Weine said.

Bubs has sold more than 330,000 tins this financial year-to-date by the end of November 2023, compared to 400,000 in the entire full 2023 year.

Not only has the company secured its position as a market leader for infant formula, but it’s also expanded its footprint in the US with products now available in more than 5900 stores across the country.

Operational adjustments and outlook

In response to escalating demand, Bubs Australia has proactively extended its manufacturing capabilities.

Mr Weine revealed that a second shift at the Deloraine facility is in the works and is expected to be fully operational by mid-January 2024.

Despite recent challenges, Bubs forecasts a robust full-year net revenue of at least $48 million for FY24, reflecting a 100 per cent increase compared to FY23.

“Despite the supply chain interruptions and inventory shortages in the US over the past six weeks, the demand for our products and brands continues to grow,” he said.

“Once we are back in a full stock position, we expect our growth rate will increase further.”

Financial strength and future growth

As of November 30, 2023, Bubs Australia boasts a healthy cash position, holding $30.1 million in reserves, with an additional $9.8 million of unused headroom on its bank facilities.

This financial strength positions the company for further expansion and market dominance, as it continues to respond well to market dynamics that are propelling it to the forefront of the U.S. infant formula market.

BUB shares last traded at 12.5 cents.