Investors were expecting an injection of Chinese government stimulus to be announced at Tuesday’s National People’s Congress (NPC) in Beijing, but they didn’t get their wish, sending regional stock markets – particularly the Hang Seng – into a slide.

The Hong Kong bourse fell 2.6 percent by afternoon trade after Premier Li Qiang announced there would be no significant government stimulus to boost the Chinese economy, which has been experiencing turmoil due to property sector crisis, local government debt, and deflation.

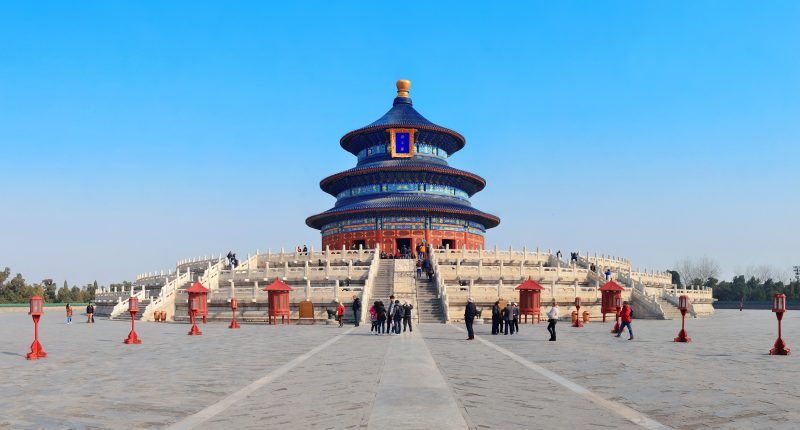

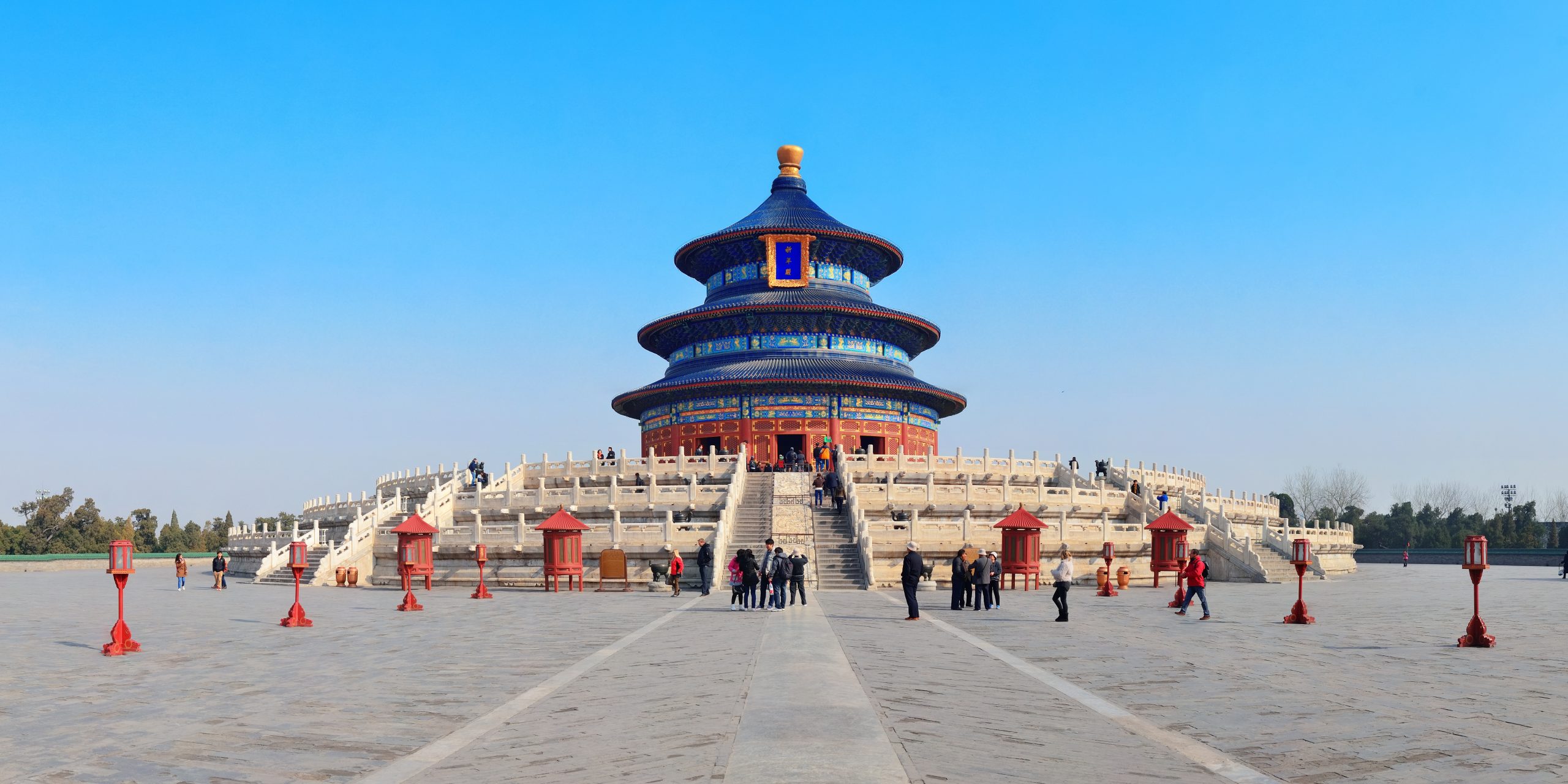

Premier Li delivered this news as part of the Government Work Report at the NPC, which this week is running concurrently with another key economic policy meeting, the Chinese People’s Political Consultative Conference (CPPCC).

The NPC and CPPCC are collectively known as the ‘Two Sessions’ and are crucial events for investors seeking clues as to where the Chinese government will be putting its economic focus.

Another crucial announcement from the Premier was targeted growth for the Chinese economy in 2024, which was set at an optimistic 5 percent, the same figure as last year.

Ambitious target largely expected

This matched Chinese economists’ expectations, although international economists had expected a slightly weaker growth figure of either 4.5 or 4.6 percent, citing the aforementioned economic headwinds, which have caused significant short positions and weakened investor sentiments.

Saxo Chief China Strategist Redmond Wong noted some divergence between the Hang Seng sell-off and the mainland A-share market, which remained relatively stable after the announcement.

“In contrast to the Hong Kong market, the mainland A-share benchmark indices displayed a more resilient performance following the delivery of the Government Work Report on Tuesday,” Mr Wong said.

However, he added that the “Government Work Report and the outcome of the first day of the NPC meeting aligned with general expectations, offering no significant positive surprises.”

Other announcements from the Work Report included a predicted fiscal budget deficit of 3 percent of GDP for 2024, and an increase in 1.1 trillion yuan bond issuances (this being the first such sale since 2020), which is set to provide extra funding to strengthen infrastructure investments.

China watching AI thematic

Mr Wong said the Report had yielded some indications of China’s economic commitment to industries like advanced manufacturing, artificial intelligence, green energy, and quantum computing, adding that more detail on this would become clear throughout the week.

“The emphasis on high-quality development, as highlighted by President Xi Jinping, underscores China’s commitment to industrial policies fostering technological advancement and innovation,” he said.

“Investors eagerly await insights into these policies during the upcoming press conference, where key officials will address questions and provide details on China’s industrial strategies, plans, and financial system reforms.

“Of particular interest is the assessment of the regulatory environment of China’s equity market by the new CSRC Chief, Wu Qing, adding a layer of significance to the unfolding events in China’s economic landscape.”

On Tuesday, China announced a 10 percent increase to its annual budget for science and technology, which rose by 10 percent to an unprecedented 370.8 billion yuan ($51.6 billion).