The conventional landscape of equities, a longstanding cornerstone of investment portfolios, is witnessing a notable shift.

Diversifying beyond the confines of the equities market is emerging as a strategy that could unlock significant advantages for novice and seasoned investors.

Alternative investments, including bonds and yields, funds, real estate, and cryptocurrencies are becoming more and more popular.

According to data compiled by global alternative asset researcher Preqin, assets under management in the alternative assets industry are projected to surge to $23.3 trillion by 2027.

This projection reflects an 80 per cent increase from the $13.3 trillion reported in 2021.

Australian companies are actively navigating this evolution. Income Asset Management (ASX:IAM), for instance, leverages its expertise in corporate bonds, cash markets, and fund management to provide high-level investors and professional investment managers with opportunities in the space.

Another player is cryptocurrency asset manager DigitalX (ASX:DCC), Raiz Invest (ASX:RZI), a micro-cap company with asset portfolios in ESG, bitcoin, real estate, and uniquely formed assets from a range of available ETFs.

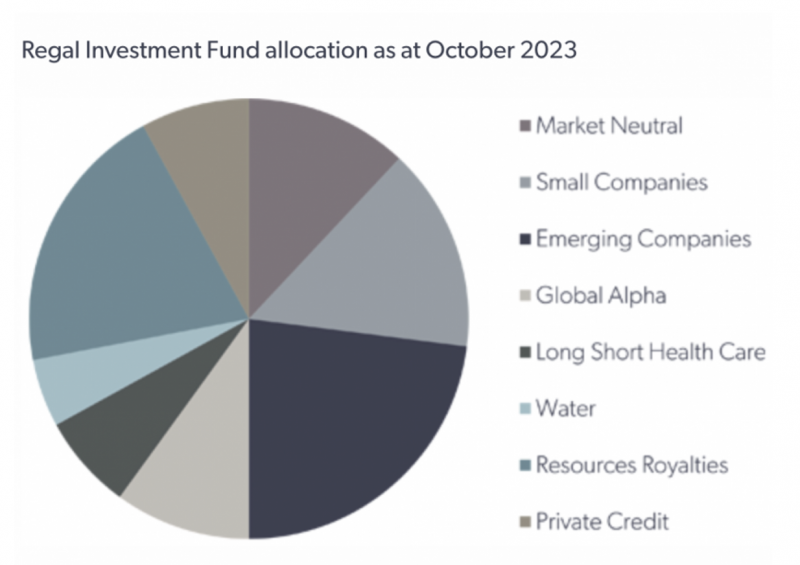

As for Regal Investment Fund (ASX:RF1), it listed on the ASX in 2019 and offers a portfolio of diversified assets in healthcare, small and emerging companies, water, private equity, and more.

Investing in funds

When venturing into the realm of fund investments, individuals frequently face a choice between mutual funds and managed funds – two investment avenues that provide access to diverse portfolios managed by professionals.

Despite the inherent risks associated with mutual and managed funds, their diversified nature often serves to mitigate risks attached to individual stocks or bonds. Investors stand to gain when the value of bundled securities within the fund experiences an increase.

Mutual funds

A mutual fund functions as a collective pool of investors’ money, strategically invested across a variety of companies.

The fund can take on either an actively managed approach, where a fund manager selects securities intending to outperform the market, or a passively managed approach, as observed in index funds that track major stock market indices like the Dow Jones Industrial Average or the S&P 500, in the case of Wall Street.

Investors realise profits from mutual funds when the value of the securities they invest in, such as stocks and bonds, appreciates.

These funds are accessible directly through managing firms and discount brokerages, typically requiring a minimum investment and an annual fee.

Managed funds

In contrast to mutual funds, managed funds consolidate the capital of individual investors, enabling a fund manager to invest across various asset classes, including shares, bonds, property, and infrastructure assets.

Managed funds provide investors with a streamlined and diversified approach to investing. Through a single transaction, investors gain exposure to a spectrum of underlying investments, effectively diversifying their portfolios across different asset classes and market sectors.

Upon investing in a managed fund, investors are issued shares that signify their ownership stake in the fund. Regular payments, termed dividends, or distributions are received based on the fund’s profits or income generated from underlying investments.

Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) operate similarly to mutual funds by assembling a portfolio of investments that mirrors a specific market index.

The key distinction lies in their accessibility and trading mechanism.

Unlike mutual funds, which are acquired through fund companies, ETFs are bought and sold on stock markets.

Their prices exhibit fluctuations throughout the trading day, akin to stocks, departing from the fixed net asset value associated with mutual funds.

Generating profits with ETFs involves capitalising on the collective returns generated by their diverse investments, making them a recommended option for new investors seeking to mitigate risks associated with individual stocks.

Choosing an ETF linked to a broad index, such as bitcoin or real estate, further aids in risk reduction.

Similar to mutual funds, profits from ETFs can be realised by selling them as their value appreciates over time.

The Regal investment fund

Source: The Regal Investment Fund

The Regal Investment Fund (ASX:RF1) provides investors with direct access to Regal Partners’ (ASX:RPL) extensive investment expertise, boasting a 19-year track record in managing alternative investment strategies.

Unlike traditional funds, the Regal Investment Fund offers a unique blend of experience, covering various roles in financial markets, including healthcare, water, sales, research, long-side and hedge fund investing, as well as investment banking and capital markets.

In November, the fund’s net asset value (NAV) increased by 1.2 per cent to $2.99.

Since June 2019, the fund has delivered an annualised return of 17.8 per cent, after fees, for its investors.

The company maintains regular communication with its fund holders through a newsletter, providing insights into the market’s dynamics based on analysis.

In November, the global financial landscape experienced a significant boost in risk assets.

This boost was driven by a growing consensus overseas that the US Federal Reserve’s cycle of raising interest rates is nearing its conclusion.

Notably, US 10-year bond yields recorded their most substantial monthly decline since 1985, dropping by 73 basis points.

The Aussie market analysis

In the Australian market for November, RF1 reported that the ASX200 rose by 4.5 per cent, with smaller companies outperforming their larger counterparts, as indicated by the seven per cent increase in the ASX Small Ordinaries index.

Key contributors to the fund’s performance were strategic investments, including a long position in luxury fashion brand, Cettire (ASX:CTT) up 21 per cent, driven by a robust rebound in its share price compared to other luxury retail peers.

Other successful contributors were investment manager, HUB24 (ASX:HUB) up 11 per cent, gold producer Pantoro (ASX:PNR) up 66 per cent, and US-bitcoin miner Iris Energy up 60 per cent.

Real estate investments

REITs

Real estate investments can be found on the ASX, listed as real estate investment trusts (REITs), encompassing both commercial and residential buildings, and extending to non-listed properties.

REITs offer exposure to various property assets, including office towers, shopping malls, industrial buildings, hotels, and cinemas.

Similar to managed funds, they are pooled investments overseen by professional managers.

Some ASX-listed REITs that have performed well in 2023 include Centuria Capital Group (ASX:CNI), Goodman Group (ASX:GMG), Scentre Group (ASX:SCG), Stockland (ASX:SGP) and Mirvac Group (ASX:MGR).

Other types of property investment

Investors seeking income through property ownership can choose between commercial buildings or residential properties that can be leased to families or businesses.

In this model, investors charge regular rent, generating a profit over time. This consistent revenue stream enhances the attractiveness of real estate investments.

Unlike the intangible nature of stocks and bonds, real estate investments offer tangible assets. Investors can physically utilise, manage, and enhance these properties through restoration and renovation.

This characteristic sets real estate apart, providing investors with a hands-on approach to their investments and the potential for added value through strategic improvements.

Cryptocurrency

Cryptocurrency, often referred to as crypto, is a form of digital currency, exemplified through popular currencies like Bitcoin.

As a virtual currency, akin to cash, crypto offers purchasing power and serves as an avenue for investment with the potential for financial returns.

However, it’s essential to note that cryptocurrency is one of the most volatile asset classes, characterised by significant price swings. While cryptocurrency investment presents opportunities, it comes with risks and It’s crucial to be cautious, as the regulatory landscape is evolving, and scams may arise.

Cryptocurrencies operate on a decentralised system, meaning they are not governed or regulated by a central authority, unlike traditional currencies.

These digital currencies are created utilising blockchain technology, which is a secure and transparent system that records the value and transactions of each virtual coin.

Just this week, the crypto sector was flooded with excitement following the US Securities and Exchange Commission’s (SEC) approval of several spot bitcoin ETFs.

The crucial milestone includes the approval of Grayscale’s initial Bitcoin ETF application the crypto asset manager took the SEC to court over and has passed several other applications from NYSE-listed BlackRock, and other private companies including, Ark Invest, 21Shares, Fidelity and Bitewise.

Apollo Crypto Founder and CEO Henrick Andersson said it was a watershed moment for both Bitcoin and crypto.

“It is a game changer for wealth advisors, institutions and retirement funds, now they for the first time have a vehicle that they can easily allocate into,” he said.

Raiz Invest

Raiz Invest (ASX:RZI) is Australia’s leading micro-investing app, pioneering a concept where customer transactions are rounded up to invest the excess change in real estate, crypto, and ETFs.

This innovative approach has garnered attention from many beginner investors, earning the company multiple awards.

Operating in Australia and Southeast Asia, Raiz’s app offers diversified portfolios comprising low-cost ETFs, bitcoin, Australian residential properties, and ASX-listed equities.

Since its launch in 2016, the app has garnered more than 3.5 million sign-ups and boasts in excess of 674,000 monthly users.

Raiz 2023 performance

Raiz Managing Director and CEO Brendan Malone told The Market Herald that when it comes to real estate investing, several factors contributing to property prices in our current economic climate have continued to defy gravity.

“Property is a generational store of wealth and when transferred from generation to generation, there is typically little to no tax. Meaning this market isn’t fully rational and subject to usual transaction costs,” he said.

“The real estate portfolio was new this year and we have been very happy with the inflows associated with this.”

Mr Malone also touched on the solid run crypto had this year and the impending spike in bitcoin ETFs in 2024, as well as the company’s new and diversified option to create an individual and unique ETF from a bundle of available assets.

“What we have been really happy with is the use, switch and new customers signing up to our new PLUS portfolio which gives customers the ability to create their portfolios with 23 ETFs, 50 recognisable Australian stocks, the real estate options and Bitcoin… We have a month-on-month increase in FUM and user numbers trying this for themselves.”

As of November 30 2023, Raiz had A$1.19 billion in funds under management (FUM), and it continues to enhance its platform with 20 new products and features to date, with more soon to come.

Raiz currently offers 23 ASX-quoted ETFs, aiming to provide customers with low-cost and simplified diversification.

Government and corporate bonds

When delving into bond investments, investors essentially assume the role of lenders, extending financial support to specific entities, be it an ASX-listed company or a government entity.

In return, as lenders, investors receive consistent interest payments throughout the bond’s specified period, with a fixed interest rate upon purchase.

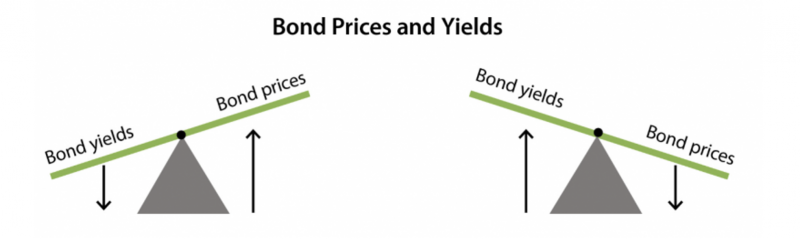

The total return on the bond at the end of this period is referred to as its yield.

According to the Reserve Bank of Australia (RBA), bonds are an appealing investment, offering low risk for potentially high returns through fixed interest rates over a designated period.

However, the landscape becomes more intricate when considering the constant fluctuation of interest rates in financial markets.

For instance, a decline in interest rates results in newly issued bonds offering lower interest payments.

This makes existing bonds, issued before the rate drop, more attractive to investors due to their higher interest payments.

Consequently, the value of existing bonds rises, but their increased price makes them more expensive for new investors.

This surge in price causes the bond’s yield to decrease as the expected return for new investors becomes lower.

In the financial realm, corporations issue corporate bonds, local governments release municipal bonds, and on a broader scale, the U.S. Treasury issues Treasury bonds, notes, and bills—all of which are enticing options for investors seeking fixed-income securities.

While bonds generally yield lower returns compared to stocks, they come with a significantly lower level of risk.

However, no investment is entirely without risk; there is a potential for financial challenges for companies issuing bonds, and in the case of government bonds, a risk of default.

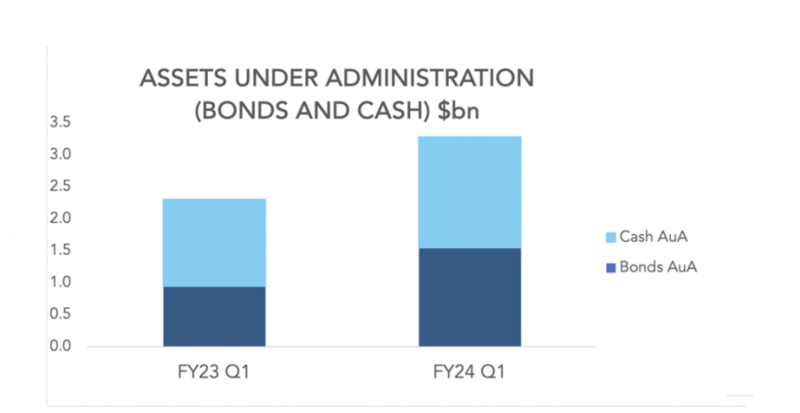

Income Asset Management

Income Asset Management (ASX:IAM) is an asset manager providing investment opportunities in capital markets, cash markets, and funds tailored for high-level investors and professional investment managers.

Aspiring to establish itself as a leading player in Australian capital markets, IAM focuses on delivering innovative, client-focused solutions that encompass direct investment services such as bonds and asset management, along with offerings in deposits, loans, and treasury management services.

The company extends its services across retail, wholesale, and institutional channels, leveraging more than 14 years of specialised industry-focused expertise.

IAM manages assets exceeding $3 billion and has positioned itself as a key player in the financial landscape.

“Our transactional flow is rapidly exceeding that of two known competitors who have

been in the market for much longer than IAM has been,” IAM CEO Jon Lechte said.

“Based upon current mandates we expect to double our new-issue revenue in FY24 from FY23, the temporarily delayed closure of transactions in Q1 is not relevant to this expectation.

“Our funds Management division is adding investors to our Global Credit Opportunities Fund and are key participants in our drive for managed account business, particularly with Netwealth clients.”

The positives of an alternative investment

The unpredictable nature of the market, influenced by global economic factors, underscores the significance of alternative investments.

Emphasising a crucial theme—diversification—alternative investments become an invaluable strategy for risk mitigation in the realm of investing.

These avenues offer a wealth of diversification, making them particularly appealing, especially for novice investors.

Acting as a hedge against inflation, certain alternative investments provide a means to preserve wealth over extended periods.

While these investments may be less liquid than stocks, their unique nature often yields more substantial long-term rewards, making them a compelling choice for those with a strategic, forward-looking investment approach.