New housing data from the Australian Bureau of Statistics saw dwellings approvals drop in September after an 8.1 per cent increase in August.

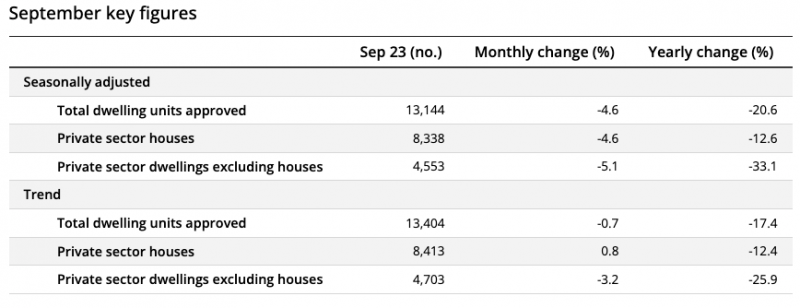

Total dwellings approved fell 4.6 per cent to 13,144, and private sector houses also fell 4.6 per cent to 8338.

“Approvals for private sector dwellings excluding houses fell by 5.1 per cent, following a 10.1 per cent rise in August,” ABS Head of Construction Statistics Daniel Rossi said.

“Approvals for private sector houses dropped 4.6 per cent, following a 7.2 per cent bounce last month.”

The value of freshly built residential buildings fell to 3.6 per cent at a value of $5.83 billion, followed by a 7.2 per cent decrease in the value of non-residential buildings.

The value of buildings can be attributed to a growing demand for using greener materials within the construction industry, which is increasing the value of buildings while decreasing the value of non-sustainable structures at the same time.

All employee households recorded the largest annual rise in living costs, with a nine per cent increase, down from a peak of 9.6 per cent in the June 2023 quarter.

“Higher global oil prices for automotive fuel and increased insurance premiums across house, home contents and motor vehicles contributed to greater living costs for all household types,” ABS Head of Prices Statistics Michelle Marquardt said.

By State and Territory

The ABS had a mixed report for September, with a fall of 11 per cent recorded in Western Australia for all total dwellings. This was followed by a 10.5 per cent drop in New South Wales and an 8.9 per cent decrease in Victoria.

Meanwhile, Queensland saw significant growth at a rate of 34.6 per cent, while Tasmania surged 18.3 per cent, and South Australia jumped 5.1 per cent.

Approvals for the private sector, however, saw Western Australia lose 12.7 per cent, 9 per cent lost in Victoria, and a 2.6 per cent fall in South Australia. The only two private sectors to see increases were NSW with a 1.1 per cent growth and a slight 0.7 rise for Queensland.

Household cost increases

Living costs for all employee households rose 2 per cent during the 2023 September quarter and are double the June quarter.

“Increases in living costs in the September 2023 quarter ranged from 0.5 per cent to 2.0 per cent depending on the expenditure patterns of the different household types,” ABS head of prices statistics Michelle Marquardt said.

“Employee households recorded the largest increase in living costs of all household types with a rate almost twice that of the Consumer Price Index (CPI), which rose 1.2 per cent.”

Living Cost Indexes include mortgage interest charges rather than the cost of building new dwellings, and during the quarter employee households were largely impacted by rising mortgage interest charges.

“Mortgage interest charges rose 9.3 per cent following a 9.8 per cent rise in the June 2023 quarter,” Ms Marquardt said.

“While the Reserve Bank of Australia has not increased the cash rate since July 2023, previous interest rate increases and the rollover of some expired fixed-rate to higher-rate variable mortgages resulted in another strong rise this quarter.”