- Equatorial Resources (EQX) has seen shares spike after appointing John Welborn as Managing Director and CEO

- John is an experienced executive within the mining sector and previously led ASX-listed Resolute Mining (RSG) for five years

- As Equatorial’s new Managing Director and CEO, John will receive $300,000 a year, along with superannuation and potential incentive bonuses

- John will subscribe for 1.5 million new shares at 30 cents each, investing $450,000 into the company

- Equatorial Resources closed 18.75 per cent higher for 38 cents per share

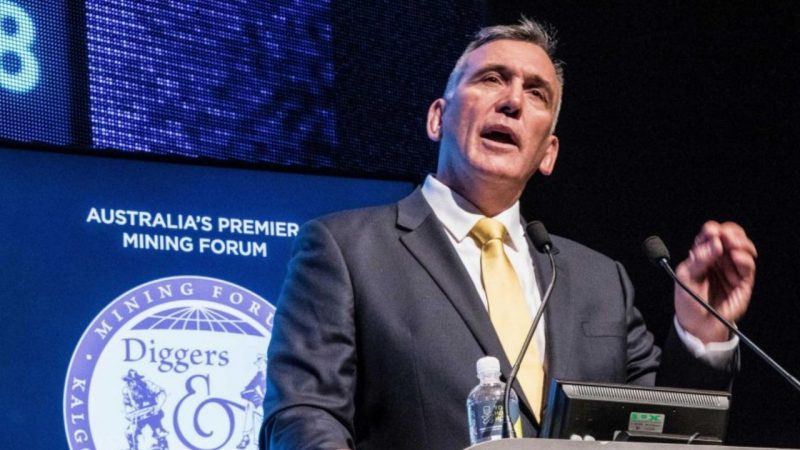

Equatorial Resources (EQX) has seen shares spike after appointing John Welborn as Managing Director and CEO.

The company’s new leader is an experienced senior executive within the mining sector, as well as a former investment banker.

He has been a Director of Equatorial since August of this year, and has already proven his capabilities in the months since. John was responsible for a successful period of change, during which the company acquired and began exploration of its iron ore assets in West Africa, and divested its investment in African Iron.

Prior to joining Equatorial, John was the Managing Director and CEO of fellow ASX-listed company, Resolute Mining (RSG). He stepped down from these positions in October, after successfully leading the company for five years.

During his tenure at Resolute, John saw the company’s market cap grow from under $200 million to over $1 billion, with its share price increasing by over 300 per cent.

As Equatorial’s new Managing Director and CEO, John will receive remuneration consisting of a fixed annual salary, short-term incentives, and long-term incentives. His annual salary will be $300,000, plus compulsory superannuation.

John will be eligible for potential short-term incentive bonuses, based on the successful completion of specific key performance indicators. Subject to certain approvals, he will be granted long-term incentive securities consisting of incentive options and performance rights.

John has demonstrated his commitment to his new positions by investing financially in Equatorial. Subject to certain approvals, he will subscribe for 1.5 million new company shares at $0.30 each, investing $450,000 into the business.

The market has responded positively to the announcement of John’s appointment to these leadership roles.

Equatorial Resources closed 18.75 per cent higher for 38 cents per share.