All sensible investors ask themselves the fundamental question of ‘what does the future hold?” when positioning their investment portfolios today. Taking a long-term perspective on portfolio construction is simply not straightforward for professional money managers. Long-term investment ideas need to be constructed with due consideration given to short-term performance (1-year). However, short-term investing requires almost impeccable ability to pick the right side of geopolitical events, monetary policies (e.g. liquidity, duration), election results (e.g. U.S. elections) and unexpected exogenous market shocks (such as the Coronavirus). Whilst we do not discard the importance of these drivers, it is timely to remind ourselves the importance of long-term investing. Invariably, good and structurally sound business models will prevail through all market conditions.

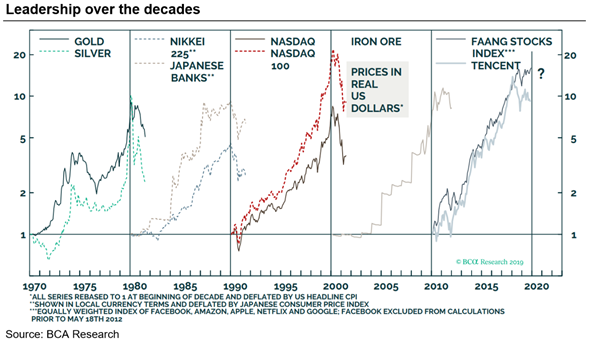

Investors who positioned their portfolios to the major themes in the past decades have done exceptionally well. Profitable investment themes over the past decades include the gold & silver trade in 1970s, Nikkei 225 & Japanese banks in 1980s, Nasdaq 100 in 1990s, iron ore in 2000s and the FAANG stocks in 2010s. Put another way, if you had invested in one of these themes at the start of the decade, did nothing during the period and came back at the end, you would have done very well. If you feel that you have missed out on capturing the full benefits of these past trends in your investment portfolio(s) then the good news is that there are a myriad of new themes and opportunities emerging that will drive the next decade of investment returns. The key though is, to capture the latest emerging trends investors must be unwilling to be distracted by markets suffering from myopia and hypersensitivity to the news of the day.

Rethinking your approach to the technology sector

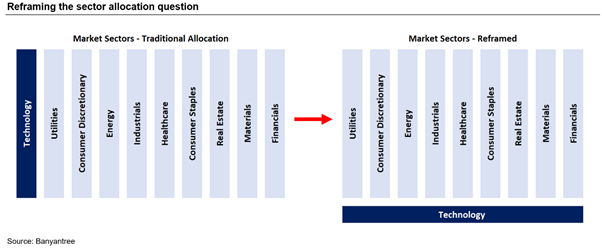

Traditionally, most investors and certainly fund managers have viewed technology as a separate category of companies. They view the market comprising of individuals sectors such as financials, materials, real estate, consumer staples etc and amongst these there is usually a mention of the Information Technology sector, which constitutes ~3% of the S&P/ASX200 Australian index and ~24% of the S&P 500 index in the U.S. This is a very limited and vertical view by which to capture technology trends. Investors need to view technology as a horizontal application of capability by companies in ‘all’ sectors integrated into the business strategy to create overall value for end customers. The influence of technology is currently centre stage for businesses in all sectors. Technology is bringing businesses closer to their customers. Innovation in technology is allowing businesses to be more nimble and flexible to the individualised preferences of their customers while delivering the products and services at unprecedented speeds and convenience. Investors need to see technology as the key enabler for businesses to transform themselves from the traditional way of operating to the new and cutting edge. Investors need to seek out companies who are executing the right set of technology enablers appropriate for their business needs while ensuring they have enough flex and openness in their approach to continue ingesting the evolving innovations in technology.

Looking at technology through the prism of sector allocation (being overweight or underweight) could limit investors from achieving attractive returns over the coming decade(s). In the case of fund managers, arguing against holding technology stocks based solely on traditional valuation metrics could mean their respective strategy significantly lags market returns. We are not making a case for a portfolio consisting of just technology stocks. There are many companies utilising technological innovation in their respective industries not only to gain a competitive advantage, but also to drive earnings higher. Dominos Pizza (ASX: DMP) is an example. It’s classified as a Consumer Discretionary stock (according to ASX GICS classification guidelines), however technology is a key driver of their financial productivity. Similarly, the current investment thesis in Nine Entertainment (ASX: NEC) should be centred around what is NEC’s subscription video on demand (SVOD) service Stan and digital assets are worth. Not its cyclical businesses such as free-to-air (FTA) TV. Hence, investors do not have to compromise on the benefit of diversification across industries and opportunities to play the technology thematic.

Banyantree Investment Group is an investment management firm based in Sydney, who manage client funds across Australian and Global equities and Multi-Asset mandates. For more information please contact [email protected]