Amid reports of an 18 per cent surge in gold investment to 4741 tonnes in 2022, the price of gold has dropped below $1900 per ounce, marking its lowest point since March 2023.

Central banks view gold as an inflation hedge, as gold often increases in value while the purchasing power of the dollar declines. This trend is catching on among individual consumers, particularly in countries like China and the United States, the globe’s two biggest economies.

Research from City Index revealed that Australia is the second-largest gold producer globally and it has maintained stable gold reserves at 79.85 tonnes over the last decade.

The Reserve Bank of Australia’s perspective on gold as a safe-haven commodity differs from some European nations actively increasing their own reserves. Following the sale of two-thirds of the RBA’s gold holdings in 1997, Australia has refrained from boosting its reserves.

Australia’s gold reserves are stable

As highlighted in the RBA’s Financial Stability Review released today, Australia’s “strong” financial system amid challenging macroeconomic conditions has reduced the need for gold as a hedge against volatility, leading the Reserve Bank of Australia to refrain from bolstering its reserves.

While some countries are actively boosting their reserves, this may not necessarily indicate a robust economy. In fact, it can signify a different scenario altogether.

“Unlike its international peers, Australia has reduced its gold acquisitions in recent years,” City Index Head of Market Research Matt Weller said.

“This shift can be attributed, in part, to the country’s traditionally stable economic climate, which has reduced the need for gold as a hedge against economic volatility.

“The RBA’s approach to gold reserves reflects a carefully considered evaluation of its economic context, marked by economic stability and a relatively insulated position on the global stage.”

Hungary’s near 3000pc increase in gold holdings

Hungary has witnessed an increase of 2967 per cent in its gold reserves, reaching an all-time high of 94.49 tonnes in 2021, the largest purchase by a sovereign nation since Poland in 2019.

This rise is part of Hungary’s strategy to diversify its reserves and reduce reliance on the US dollar.

This surge, the largest in Europe, has allowed Hungary to hold 89 per cent more gold than its neighbouring country, the Czech Republic (11.96 tonnes).

Hungary’s substantial gold holdings proved beneficial during the global crises of the 2020s, and the subsequent upsurge in the international gold price post-2020 further elevated their gold reserves.

“Hungary’s significant increase in gold holdings in the last decade is likely an attempt to diversify its foreign reserves, a move that is consistent with its broader strategic goals,” Mr Weller said.

“This trend is part of a larger global shift in which countries are increasingly looking to reduce their reliance on the US dollar, and we expect this trend to continue as geopolitical tensions persist.”

Poland’s gold reserves surpass the Czech Republic

Poland has experienced the second-largest increase in gold reserves in Europe, growing by more than 120 per cent to 228.67 tonnes over the past decade.

This surge, which is 94 per cent more than Czechia’s reserves, aligns with Poland’s goal to reduce dependence on the US dollar.

In 2021, Governor Adam Glapinski announced Poland’s intention to acquire an additional 100 tonnes of gold in the coming years as part of an effort to reduce this dependence.

Ireland’s gold holdings growth

Ireland’s gold reserves have increased by 100.67 per cent in the last decade, reaching 12.04 tonnes.

The most significant surge occurred in the final quarter of 2021 when the Central Bank of Ireland purchased 3.52 tonnes of gold, bringing its total reserves to 9.52 tonnes.

This expansion is part of the central bank’s long-term investment strategy aimed at diversifying its assets and bolstering its balance sheet resilience.

As of 2022, Australia held more than 500 per cent more gold reserves than Ireland.

A global perspective on reserves and current economic strategies

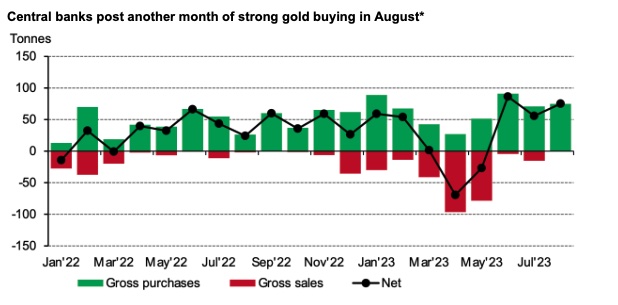

In August, central banks collectively increased their gold reserves for the third consecutive month. According to data from the World Gold Council, 77 tonnes of gold has been added to global official reserves increasing July’s acquisitions by 38 per cent.

Over the last three months, the combined net buying has totalled 219 tonnes, significantly outweighing the combined net sales from April and May, which accrued 96 tonnes.

As geopolitical tensions persist, this trend of diversifying reserves and reducing reliance on the US dollar is likely to continue, impacting gold markets worldwide.