- New data from the Australian Competition and Consumer Commission (ACCC) has revealed a 55 per cent increase in identity theft over the COVID-19 pandemic

- Scamwatch, an ACCC organisation, received 24,000 reports of stolen personal information this year so far

- This has resulted in $22 million being lost to scammers who also stole personal information

- Overall, $91 million has been stolen across all types of scams

- The increased time at home and online as a result of COVID-19 has caused the spike in scam victims

- Those aged between 25 and 34 made more identity theft reports than any other age group

- The ACCC urged Australians to stay vigilant by never clicking on links from unexpected emails and never feeling pressured to give out personal information online

New data from the Australian Competition and Consumer Commission (ACCC) has revealed a 55 per cent increase in identity theft over the COVID-19 pandemic.

This year, the consumer watchdog’s Scamwatch website received 24,000 reports of stolen personal information, compared to the 15,500 reports over the same time period last year.

This identity theft has resulted in $22 million being lost to scammers who also stole personal information over this time period. Interestingly, it’s not the older generation falling victim to the whims of a long-lost Nigerian prince, either; those aged between 25 and 34 made more identity theft reports than any other age group.

Across all scams, $91 million has been stolen so far.

Why the increase?

It seems the increase in time spent at home and on the internet as a result of the COVID-19 pandemic has played a role in the higher number of scams.

ACCC Deputy Chair Delia Rickard said the increased use of technology has given scammers more opportunities to try to steal our valuable personal information.

“During the COVID-19 pandemic, with more people working and socialising online, we have unfortunately seen a sharp increase in scammers seeking personal information,” Delia explained.

She said as well as bank details and financial information, scammers often go after passports, drivers licences, utility bills, and other personal documents so that they can impersonate others.

As far as COVID-19-related scams go, Scamwatch has received 3600 scam reports that directly mention the coronavirus.

Scammers have been using the pandemic as a way to catch people off-guard, often by pretending to have a connection to the victim or to a genuine trusted organisation. So far, just under $2.4 million has been stolen directly from COVID-19-related scams.

Of course, this is less than five per cent of the total $91 million lost to scammers, meaning it’s the increased opportunity from the virus rather than fear of the virus itself that’s getting the swindlers a foot in the door.

What to look out for

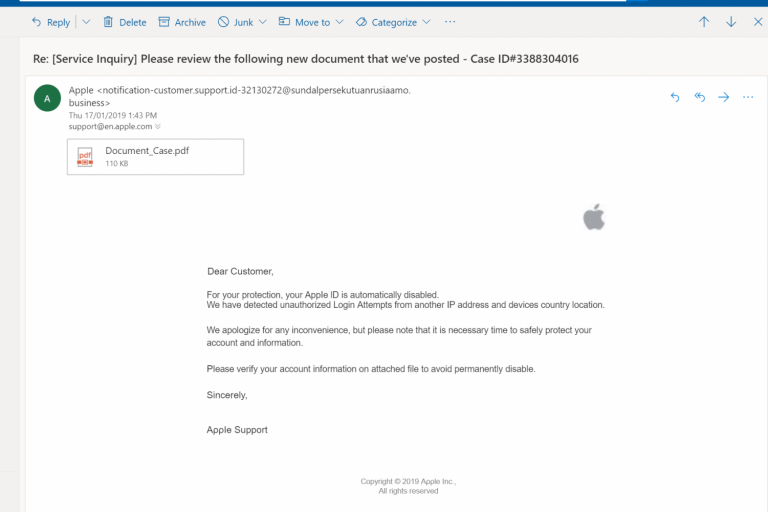

The most common form of online scams are ‘phishing’ scams, which are up 44 per cent compared to last year.

Generally, phishing scams are sent through emails or text messages posing as government departments or tech companies, like the ATO, Telstra (TLS), or Western Power.

The fake message prompts you for your login details to these services, and as you type in your username and password, you’re giving these details to the scammer.

Scammers can then use this information to access your personal accounts and do with it what they please.

“Scam victims who have lost personal information are vulnerable to further scams, fraud or identity theft,” Delia said.

Luckily, these fake messages are generally fairly easy to spot.

While some emails are more-carefully crafted, most are riddled with spelling errors and vague details. Importantly, a real company will almost always use your name in email correspondence, while phishing emails often refer to you as ‘customer’ or ‘user’.

As such, on top of strong anti-virus measures and decent tech support, the best way to avoid falling victim to scams in the era of COVID-19 is to simply keep your guard up.

The ACCC advised to never click on links from unexpected emails, even if they seem to be from a legitimate source, and to never feel pressured to give personal information to someone via email, no matter who they claim to be.