The lithium rally is firmly over, and supply is likely to outpace demand for years to come.

Lithium juniors lucky enough to boast polymetal resources are pivoting where they can to things like copper and uranium; and long gone is the Pilbara Minerals (ASX:PLS) madness that defined 2022.

We’ll get back to the Pilbara shortly. I can sum up this article for the time-poor, however.

If you missed out on the Azure sale – Raiden Resources (ASX:RDN) could be the next contender.

But let’s turn back to lithium markets. The market is done for, right? The answer is complicated, but can be explained succinctly: just wait for the next upswing.

How do we know prices will rise again?

Due to the diverse human behaviours of millions of unique actors that comprise markets, it’s basically impossible for lithium prices not to have another upswing. Lithium will reign again – and we can say that confidently.

The answer to why can be explained by the Pork Cycle. (I’ve written about this phenomenon before.)

While it may seem strange to equate pork with lithium, it really isn’t strange at all. The same psychological forces are at play (and the pig analogy is easier to understand.)

The exact same process drives commodity prices.

- A demand for pork emerges, and so one or two farmers begin raising pigs. While pig supply is limited, prices are high – at this point of the cycle, pork is a rare good. Only those with money can afford it and so it becomes a status symbol – and seductive investment.

- More farmers realise the value potential and also begin raising pigs. As more and more piggeries come ‘online,’ the pork prices start to decrease as supply becomes more voluminous.

- At some point, demand and supply equalise; or supply may outstrip demand. Pork may become a commodity, or consumers may get bored of pork. In the example of lithium, it’s become a commodity. Suddenly, nobody is making as much money raising and selling pigs.

- In turn, farmers turn away from raising pigs and go back to more valuable crops or livestock.

- As a result, the pork supply begins to decline.

- After a number of years, there are fewer farmers raising pigs, and so pork goes back to being a high-priced item.

- The cycle resumes again.

We’re currently at the mid-way stage of this cycle in lithium markets, where supply has outstripped demand.

The ramifications of that are maybe best exemplified in looking at the shorts market.

Pilbara Minerals remains the most heavily shorted stock on the ASX, purely because investors expect lithium prices to fall further.

Of course, the cycle will eventually take us back to a point where demand outpaces supply and lithium prices rise again. The general consensus is this will happen in 2028 – a view held by market-leading advisory Benchmark Minerals Intelligence (BMI.)

And come 2028, the Western Australian Pilbara region will become globally significant once again. After all, Australia is the world’s largest lithium exporter – followed by Chile, which is where this story now takes us.

Riches are waiting in the Pilbara – and miners are preparing now

Chile nationalised its lithium industry in 2023, and its state-owned lithium company Sociedad Quimica y Minera de Chile (SQM) has been on an acquisition spree since.

One region firmly on its radar is WA’s Pilbara region.

Earlier this year, one of the biggest ever landmark deals in the Australian lithium sector finally cleared, when SQM’s Australian operations bought out former market darling Azure Minerals for $1.7B.

SQM wanted the company’s Pilbara-based Andover project. We’ll get back to that shortly.

In January of 2023, SQM acquired a 19.99% stake in Azure, officially becoming the largest shareholder. It paid $700M in cash and also acquired 16.38M shares. Part of that deal saw it commit to offtaking at least 25% of Azure’s ore once production commences, expected in 2030.

The Chilean lithium giant – itself the world’s 2nd largest exporter of the battery metal – already had the WA-based Mt. Holland project on its books, flush with a lithium hydroxide manufacturing plant.

The buyout of Azure Minerals gave SQM the Andover project, from which ore will feed the hydroxide plant.

Notably, it wasn’t only Chileans who spotted the value in Andover. None other than Australia’s richest woman, Gina Rinehart, swooped in on Azure in late 2023 (after the SQM buyout was already announced.)

Through her company Hancock, she picked up an 18% stake that officially made her a member of the cast. What was a $900M deal then became a $1.7B deal as Hancock joined forces with SQM to sweeten the deal – thereby exposing Hancock to the future action at Andover.

While the strategic decisions of the rich are always interesting, it’s worth noting this glosses over an important point: the world-class geology at Andover and surrounding regions.

It’s not just Azure exposed to potential windfalls

Less widely reported at the time is that SQM wasn’t only interested in Azure when it moved in on Andover assets. It struck another deal in late 2023, too.

The Chilean company paid microcap Novo Resources (ASX:NVO) $10M for the right to take a stake in five tenements that company has nearby Azure’s Andover project in the Pilbara region.

Worth considering, then, is what could happen to Raiden Resources (ASX:RDN) – another company also placed relatively nearby.

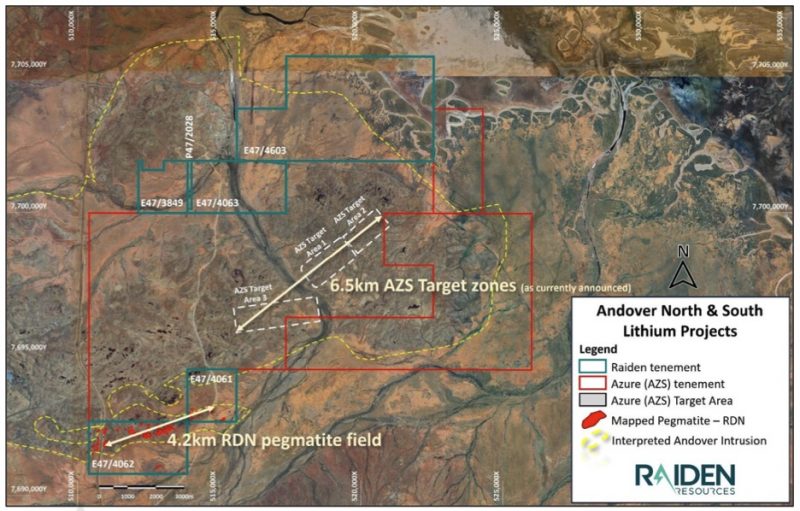

Raiden’s status as a nearology play is one way of putting it. Another way of putting it is that the company is literally right nextdoor. Let satellite imagery speak for itself:

In late May, Raiden inked its final heritage compliance duties, and the drills are practically on their way to site.

The company’s geotechs have their eyes on pegmatite targets across its Andover South tenements – pegmatites being the same type of rock that drove Pilbara Minerals to market fame.

Raiden also boasts tenements to the immediate north of Azure’s former acreage, sharing a border.

What may come from Raiden’s drilling results remains to be seen. But with known lithium-bearing host rocks spotted on-site, SQM and Gina Rinehart gearing up for the next market upswing literally next door, and the prospect of looming interest rate cuts spelling good things for the minerals sector – the stock is a very interesting one to watch.

The market, by all means, has already figured that out – as at 1.30pm AEST, the stock is up +700% over the last year.