- The International Monetary Fund (IMF) flags the need for global crypto regulation as the digital assets further solidify their place in the investment economy

- According to an IMF report, crypto assets are beginning to move more in sync with traditional investments like stocks

- The means crypto may be losing its perceived risk diversification benefits as it is more widely adopted by both retail and professional investors around the world

- What’s more, the IMF says the growing interconnectedness of crypto and equity markets permits the “transmission of shocks that can destabilise financial markets”

- As such, the fund has pushed for a global regulatory framework in order to guide national regulation and supervision of the crypto market

Crypto assets are solidifying their place in the investment economy as greater adoption among both retail and professional investors sees crypto move more in sync with stocks, according to the International Monetary Fund (IMF).

A Tuesday report from the IMF highlighted the explosive growth of the crypto market over the past half-decade, with the market value of crypto assets rising from US$620 billion (A$859 billion) in November 2017 to almost US$3 trillion (A$4.15 trillion) in November 2021.

Of course, volatility has been a defining characteristic of cryptocurrencies, with the combined value of the market sitting at around US$2 trillion (A$2.77 trillion) this week — a far cry below the November 2021 record, but still more-than-double its value in 2017.

Alongside its major growth, the crypto market is also beginning to show a greater correlation with traditional investments.

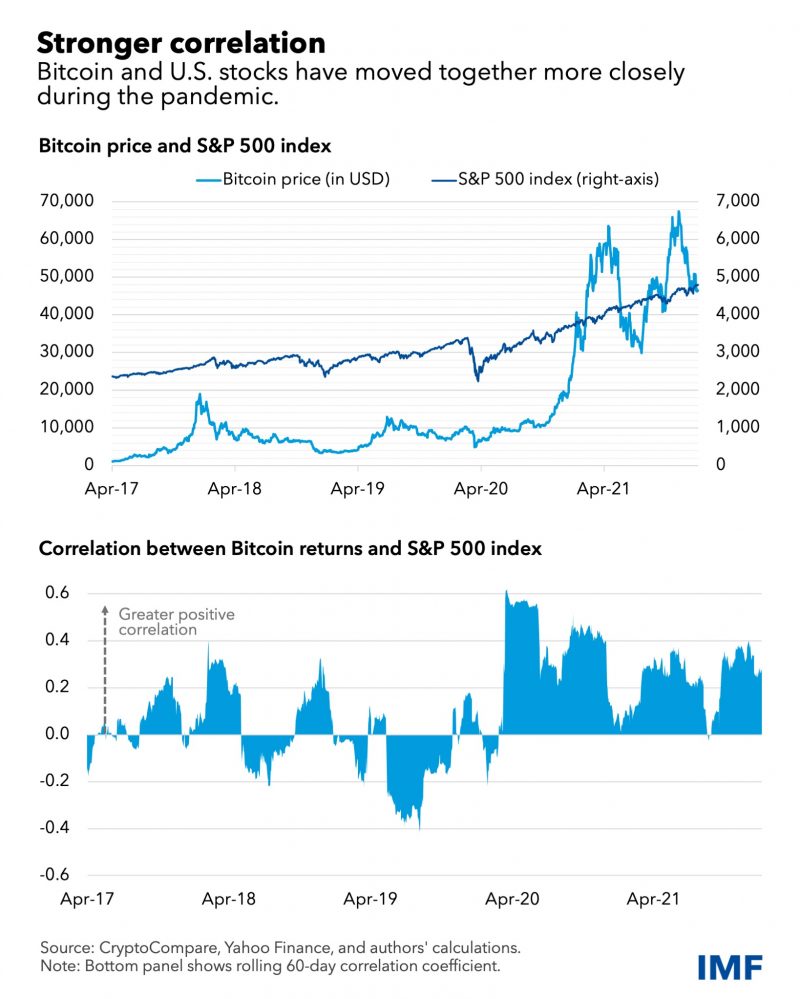

Looking at Bitcoin as an example, the IMF said the flagship crypto asset did not move in any particular direction with the S&P 500 from 2017 to 2019, with a correlation coefficient of daily moves of just 0.01. This correlation coefficient, however, increase to 0.36 for 2020-2021 as movements in the crypto and financial markets were more in tune with each other.

“Crypto assets are no longer on the fringe of the financial system,” the IMF report said.

“There’s a growing interconnectedness between virtual assets and financial markets.”

What does this mean for crypto?

As with all things crypto-related, the result of this interconnectedness is not quite black and white.

The IMF said when they moved independently of financial markets, crypto assets were viewed as a way to diversify an investment portfolio and act as a hedge against swings in other class assets.

This created something of a paradox for the crypto world: the volatile nature of cryptocurrencies made them a riskier investment than other assets, but their independence from financial markets meant they were still viewed as a way to diversify risk.

However, as the correlation between crypto and stock movements grows, crypto loses its perceived risk diversification benefits.

One might consider, then, that this correlation may limit the volatility of the crypto market. However, the IMF said the inverse is true: rather than stabilising crypto, the correlation increases the volatility of the whole market.

“Increased crypto-stocks correlation raises the possibility of spillovers of investor sentiment between those asset classes,” the IMF report said.

“Indeed, our analysis, which examines the spillovers of prices and volatility between crypto and global equity markets, suggests that spillovers from Bitcoin returns and volatility to stock markets, and vice versa, have risen significantly in 2020–21 compared with 2017–19.”

Essentially, the growing interconnectedness of crypto and equity markets permits the “transmission of shocks that can destabilise financial markets”, the IMF said.

The IMF’s conclusion, then, was that there needs to be a global regulatory framework in place to guide national regulation and supervision of the crypto market and “mitigate the financial stability risks” that stem from the crypto ecosystem.

Bitcoin last traded for $59,173 per coin. Ethereum is currently worth $4489 per coin.