- Kalina Power (KPO) successfully taps investors for $10 million through an oversubscribed share placement

- The company plans to issue 370.4 million new shares to institutional and sophisticated investors at 2.7 cents each — an 18 per cent discount to its last closing share price

- Kalina says it will use the funding boost to advance its work in Alberta, Canada

- Specifically, the company is looking to lock in full notice to proceed (FTNP) for its Kalina Energy Centre in Saddie Hills, among other plans

- Shares in Kalina Power closed 12.12 per cent lower at 2.9 cents each

Cleantech company Kalina Power (KPO) has successfully tapped investors for $10 million through an oversubscribed share placement.

The company said in a statement to the ASX this morning it was set to issue 370.4 million new shares to institutional and sophisticated investors at 2.7 cents each — an 18 per cent discount to Kalina’s last closing share price of 3.3 cents.

Kalina said it would use the funding boost to advance its work in Alberta, Canada. Specifically, the company is looking to lock in full notice to proceed (FTNP) for its Kalina Energy Centre in Saddie Hills.

On top of this, Kalina said it was also looking to bid its tech on various “industrial Waste Heat to Power opportunities”.

Kalina said it would be able to place 266.2 million shares — altogether worth just under $7.2 million — without the need for shareholder approval.

The company will seek shareholder approval for the remaining shares to be issued under the placement at an upcoming annual general meeting (AGM).

Managing Director Ross MacLachlan thanked shareholders for their support in the placement.

“On behalf of the board, I am pleased to welcome the participation of several new institutions joining our register and the large number of sophisticated investors who have joined many of our current shareholders in supporting this placement,” Mr MacLachlan said.

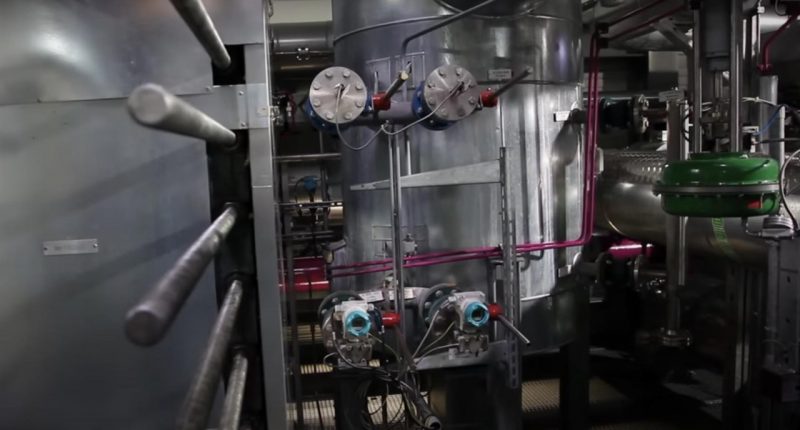

Kalina’s technology is designed to turn heat from industrial processes — such as petrochemical, steel and cement making — into electricity to supplement the power requirements of the manufacturing facilities from which these products are made.

This lowers energy costs for the producers and allows for the generation of renewable energy from geothermal and solar thermal sources.

Shares in Kalina Power closed 12.12 per cent lower at 2.9 cents each.