ASX today – Australian shares will open (a little) lower this morning, with futures now suggesting we’re heading for a 5-10pt drop, and that may very well turn even flatter as we get closer to the 10am bell today, too.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

That tech bloodbath is still going in the U.S., which may be why we’re not advancing; it’s most certainily why our XTX index is so battered.

Beyond our tech bundle there’s not much that can actually get lashed by the tech demolition this week, but wider sentiment on the Wall Street dive has still led traders to stay away from the ‘buy’ button. The Nasdaq composite is down another -1.5% today, while the S&P 500 lost -0.5% to U.S. close.

There’s two central bank policy meetings through the next 24 hours, too: England’s comes at 11pm this evening, then Europe’s is just under an hour after. Neither are expected to follow the RBA’s lead; both will be ‘holds.’

Now, let’s take a look at some Aussie company news.

ASX stocks to watch

First up, Rio Tinto (ASX:RIO) and Glencore will likely have to write up a deal extension this week, after the mining giants failed to come close to terms on their mooted mega-deal. The $300 billion agreement, should it get over the line in the meeting rooms, originally had a 4am Friday (AEDT) deadline.

Elsewhere, Neuren Pharma (ASX:NEU) – the ‘main character’ on the HotCopper forums this week so far – has landed a U.S. win, with lawmakers in the States reauthorising a key incentive program the company had been using.

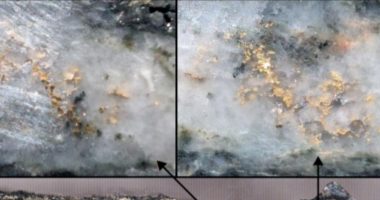

Back to mining, Right Resources (ASX:RRE) will be a watch today, after the smallcap explorer demonstrated its Pilot Project hosts “a potential large-scale gold mineralisation system” with multiple stockwork zones.

And, American Tungsten and Antimony (ASX:AT4) has produced its very first antimony ingots from materials at Antimony Canyon in Utah.

Beach Energy (ASX:BPT) has its quarterly results today, too.

Buck and ore

Now – in forex, the Aussie dollar is just under US 70c.

Looking at commodities, all in the greenback,

Iron Ore is back up slightly, selling at $102.15 a tonne in Singapore today,

Brent Crude is up +1.7%, to $68.51/Bbl,

Gold is selling at $5,038/ounce,

US natgas futures bounced +5%, to $3.47 per gigajoule.

That’s HotCopper’s Market Open, I’m Isaac McIntyre – happy trading.

Join the discussion. See what’s trending right now on Australia’s largest stock forum and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.