What’s ahead for traditional media and its advertising revenue pool in the ever-growing red ocean of alternatives?

Global media network, Omnicom Media Group, has warned that more than $300 million will vanish from the linear TV ad market this year.

Traditional media content is distributed through established channels, including television, online, print (including newspapers) and radio.

Prominent players include the ASX-listed Nine Entertainment Group (NEC), Seven West Media (SWM) and News Corporation (NWS), and there are numerous others domestically and globally.

Omnicom predicted “the biggest audience decline in the history of TV,” marking a historic low point for broadcast television.

The shift is part of a larger trend – the rise of streaming services. TV had already been grappling with competition from platforms including YouTube and Foxtel when Netflix became an international phenomenon.

Subscription Video-on-Demand services (SVOD), including Netflix and Binge, along with social media sites like Facebook, TikTok and Instagram have become the go-to channels for tailored content consumption.

According to GlobalData research, the Australian SVOD market increased by nearly 50 per cent in 2021, with total earnings of about $2.4 billion.

While linear TV faces substantial challenges, networks remain relevant by offering catch-up TV, sports, reality shows, and online movies through their Video-on-Demand (BVOD) services.

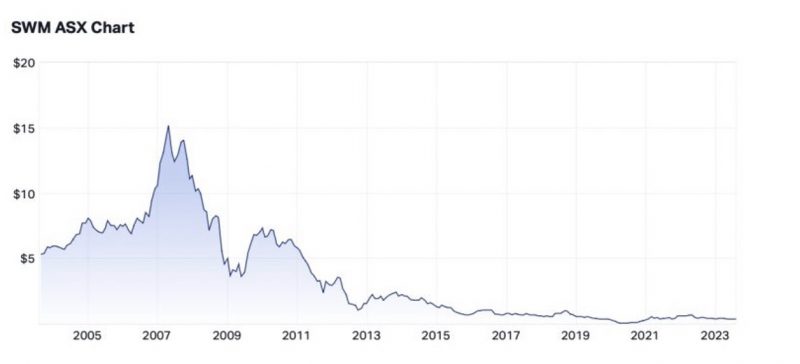

Companies like Seven West Media have seen declining share prices, despite initially venturing into the SVOD market with Presto.

A visual representation of Seven West Media’s ASX share price shows a consistent fall since 2005, despite offering its catch-up online streaming service, 7plus.

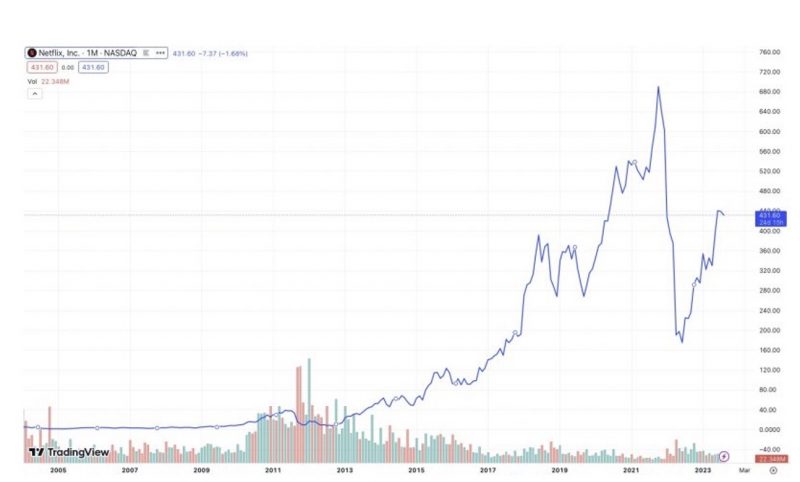

In contrast, Netflix has seen significant growth on the NASDAQ since 2003, reflecting the global shift toward on-demand content.

This transformation in media consumption prompts the question: What media entity presents a good investment opportunity?

With the proliferation of niche streaming services, the advent of artificial intelligence, the emergence of the metaverse, and the growth of virtual reality, the way we consume information is poised for a significant shift in our high-tech world.

What does the media of the future look like?

In an interview with The Market Herald, Dubai-based international media and tech consultant Mazen Hayek said investing in traditional media required careful analysis.

He said much of the transformation in media consumption stemmed from shorter attention spans, compelling media entities to adapt to evolving information consumption habits.

Mr Hayek pointed out the average attention span was 8 to 12 seconds.

“A casual search suggests that an average urban dweller is likely to be exposed to around 10,000 marketing messages every day, this, obviously, excludes all other pieces of information ranging from news, updates and personal information and messages – all of which compete heavily for an individual’s attention span,” he said.

“The bottom line is that while our attention spans have been under violent assault for quite some time, the acceleration and increase in such an assault seems to be growing exponentially.

“These range from short-form/videos and stories – like those on TikTok, Instagram and Snapchat, to greater personalisation and customisation using algorithms and data analytics, tailoring content to individual preferences, all while keeping users engaged.”

Regarding future trends, Hayek maintained an open mind about the roles artificial intelligence (AI), Web 3 and virtual reality (VR) might play in content creation.

“AI might play a more significant role in content creation, from automated reporting to deep analysis,” he said.

“This could raise concerns about job displacement, authenticity, originality, accuracy and credibility.

“With virtual reality (VR) and augmented reality (AR) technologies becoming more mainstream, media consumption could move beyond the screen to immersive experiences.”

Mr Hayek emphasised that while diverse perspectives would be abundant in the future, a challenge would be maintaining content quality and authenticity while addressing issues like fake news, misinformation, and disinformation.

What type of media content draws the most profit from investing?

While traditional media faces challenges from digital streaming services and social media platforms, some traditional entities have successfully adapted.

“Investing in traditional media requires a careful analysis of how well a company is positioned to navigate such transformational, or rather, existential changes,” Mr Hayek added.

He said tech and media companies had diverse revenue streams (commercial advertising, subscriptions, content distribution/aggregation and syndication).

But what happens when only one of these assets is delivering a good profit?

An example of this is News Corp’s Kayo Sport, which is part of Foxtel – the company hosts a variety of Foxtel programs able to be streamed through an online subscription.

This alternative form of media is gaining and securing a large audience attention span, but nonetheless, does not ultimately mean a sound investment.

A listed media entity needs all of its assets to perform well.

“I would look at their wealth of library content and IP (intellectual property) because this is extremely important and valuable…,” Mr Hayek said.

“I would look at their commitment to sustainability, to noble causes, to the environment and to what matters to audiences, and, I wouldn’t forget the most important challenge, I would look to see how these companies are coping with an increasing government intervention and regulatory framework when it comes to compliance with GDPR (general data protection regulation), with content moderation, with ad targeting, geolocation and even profiling of consumers based on their browsing history.”

Most importantly, he said media companies needed to have a strategy that’s future-proof.