Metro Mining (ASX:MMI) has updated the market on its offtake position for the next two years, with 2025 and 2026 bauxite deliveries contracted.

The company will ship off just shy of 7M tonnes in 2025 and 6.1M tonnes in 2026 on a wet metric basis.

The offtake deal also reflects a contract extension with buyer Xinfa Aluminium Group – among China’s largest aluminium companies boasting a long-term relationship with Metro.

Two new buyers have also entered the fray. China Aluminium International Trading Group – the trading division of China’s state-owned Aluminium Corporation of China – is now a Metro customer; so too is Shandong Lubei Enterprise Group, a China-based chemical manufacturer.

Exact values Metro highlighted as confidential on Friday but noted that the lion’s share of the offtake will be based on “shorter term pricing quotation” for the next two years.

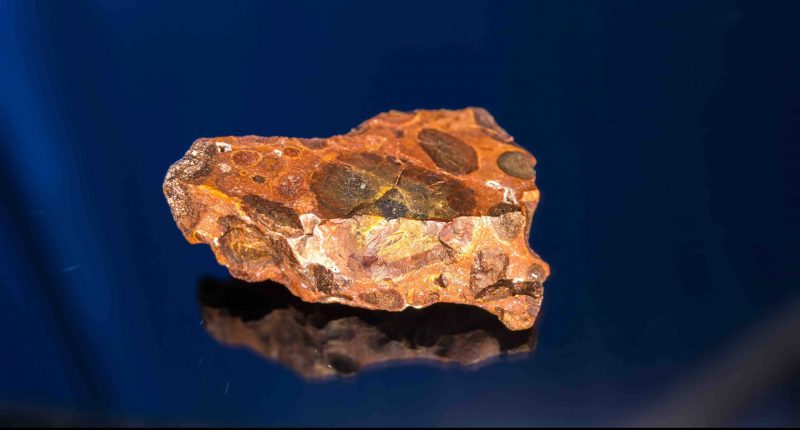

Some 85% of the agreed delivery of ore is already locked into freight and shipping arrangements. The company also added on Friday its bauxite ultimately goes to make aluminium for use in transportation and mobile phone manufacture.

“This high-quality portfolio of customers is a testament to Metro bauxite’s competitiveness and its technical service, commercial flexibility and efficient and large-scale logistics to establish a robust and low risk market positioning,” Metro chief Simon Wensley said.

The move comes as China’s economy appears to be slowly re-awakening in the face of much publicised and consecutive stimulus pushes from the Xi Jinping government.

MMI last traded at 5cps.

Join the discussion: See what HotCopper users are saying about Metro Mining and be part of the conversations that move the markets.