In the face of soaring electricity prices, energy insecurity, and the urgent need to address climate change, Australia stands at a crossroads regarding its national energy policy.

Among the mix of discussions dominating energy commentary and policy discussions from all sectors of the community lies the controversial yet potentially promising solution of nuclear power.

However, despite Australia being the world’s third-largest producer of uranium, a primary source of nuclear fuel, widespread bans on nuclear power plants have been in place for almost two decades.

Furthermore, the current Federal Government’s appetite for revisiting its stance on nuclear still remains largely suppressed.

The Liberal National Party, currently in opposition to the Australian Labor Party, has recently shown some openness to nuclear energy over coal.

This comes as more than 50 countries around the world have turned to nuclear power, and it’s expected to grow by an average of nearly four per cent over 2023-2025, double that of years gone by.

Many of these countries plan to enhance nuclear energy production into 2030 and through 2050 to meet global emissions targets.

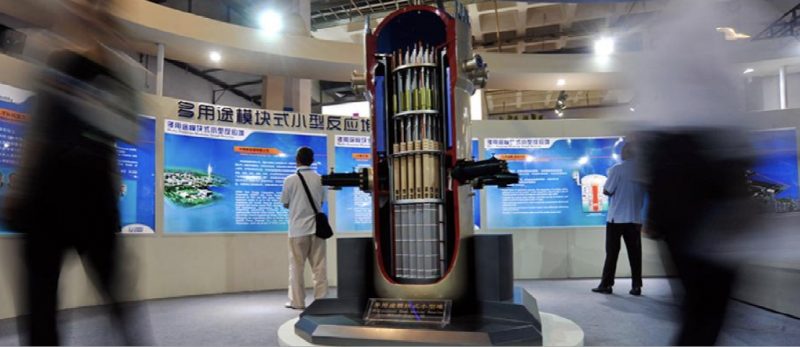

Small Modular Reactors (SMRs) are gaining popularity as a form of nuclear energy technology.

However, the mainstream rollout of SMRs is not scheduled until the 2030s in most countries, and there remains the challenge that small reactors have limited capacity to generate megawatts for electricity grids.

Despite the hype around SMRs, their widespread adoption is still uncertain. These reactors may occupy a smaller surface area, reduce costs, and enhance safety by producing less radioactive waste.

So, what are the stances of Australia’s two leading political parties on nuclear energy?

The Australian Liberal Party

Recent discussions from the Australian Government’s opposition, the Liberal National Party (LNP), led by Peter Dutton, have called for the lifting of the nuclear ban, criticising solar and wind energy.

Mr Dutton, addressing the Institute of Public Affairs on July 7, referred to the rollout of solar and wind as “fanciful” and suggested that nuclear energy could help reduce Australia’s soaring electricity prices.

“The only feasible and proven technology which confirms up renewables and helps us achieve the goals of clean cost-effective and consistent power is next-generation nuclear technologies which are safe and emit zero emissions,” he said.

“A single SMR can power some 300,000 homes, a micro-reactor could power a regional hospital, a factory, a mining site, or a military base.”

The Australian Labor Party

In contrast, the Australian Labor Party’s Energy Minister Chris Bowen gave a speech to the Clean Energy Council on July 18, outlining five “crippling facts” against using nuclear energy to power Australian homes.

Minister Bowen argued that nuclear energy is intensely expensive, slow to build, and unproven, given that SMRs are still in an experimental stage. He also pointed out that nuclear energy is inflexible and harmful to the environment.

“On cost, we have the evidence of the CSIRO and AEMO, who I take seriously, but the Opposition does not,” he said.

“The latest Gencost Report, out today in fact, confirms that the more we learn about small modular reactors, the more expensive they get … they are tracking to be up to five times more expensive than firmed wind and solar in 2030.”

He also highlighted that nuclear costs increased by 36 per cent between 2009 and 2021, while solar costs fell by 90 per cent, and wind costs decreased by 72 per cent.

“To listen to Peter Dutton, you’d think there are SMRs everywhere around the world, in fact, there are two: one on a barge in Russia and one demonstration plant in China.”

Industry views

The Minerals Council of Australia (MCA) reported earnings of $564 million from uranium exports during the 2021-22 financial year, suggesting room for further growth.

One of the major ASX-listed players in the uranium exploration sector is Deep Yellow (DYL).

Deep Yellow is the only company in Australia with two early-stage advanced uranium projects in tier-one mining jurisdictions.

CEO and Managing Director John Borshoff spoke to The Market Herald, expressing optimism regarding the uranium industry and the potential for nuclear energy adoption in Australia.

“It’ll take about as much as what it took people to understand that a nuclear submarine beats a diesel [submarine], so it is a first example of fossil giving away to nuclear,” he said.

“We’ve got one of the most amazing energy crises in some countries, largely driven by experiments of renewables … and although it will be an important component of the new energy world, it will only be a fraction of it, because you just need baseload and nuclear fits that incredibly well.”

Mr Borshoff is also the founder of Paladin Energy, an ASX-200 independent tier-one producer and explorer.

He said that Australia needs to aspire toward a process such as Canada’s, one that uses hydro to complement its nuclear power source.

“Only 20 per cent of the global energy equation is electricity bound, the rest is transport … which will need more electricity, and of course, industrial heat, which is nearly half of the equation, of which the renewables can’t contribute one iota toward,” he added.

Furthermore, cost projections from the CSIRO were rejected by Mr Borshoff who argued they failed to represent the true nature of constructing nuclear power.

“When you look at the total cost, nuclear performs extremely well … we’re really sort of in the dark ages in terms of our universities and everything in terms of new technologies,” he said.

“It’s just a hard business providing onshore electricity in a viable, continuous way, and people just don’t understand that everybody thinks renewables are the end of it.”

The deployment of large, acre-hungry solar and wind systems is a phenomenon that Mr Borschoof does not believe will take flight in the long term.

Global footprints

Countries like Sweden, Finland, Canada, and the UK have shifted their focus to enhance energy security through nuclear power.

For example, Sweden generates 98 per cent of its electricity from hydropower, nuclear, and wind sources, while the UK is investing heavily in its nuclear industry.

The British Government has begun filtering more than £20 billion ($38 billion) of taxpayers’ money into accelerating the country’s nuclear industry, with an official goal to get 24 gigawatts of nuclear energy powered by 2050.

However, nuclear energy adoption also brings concerns, such as nuclear waste storage. Finland is currently trialling the world’s first permanent storage site for ‘spent’ nuclear fuel, which will remain underground for 100,000 years.

Moreover, approvals for Japan to release one million tonnes of radioactive wastewater from its Fukushima nuclear plant into the ocean have raised concerns, leading some countries to ban seafood imports from Japan due to contamination fears.

According to The World Nuclear Association’s own projections, it would take nearly 10 years to build one nuclear reactor. But despite the risks, ignoring nuclear altogether could risk future energy security at a disproportionate scale.

But despite some scepticism toward estimates from the CSIRO, Australia’s Climate Change Council also disputes that both cost and time constraints far outweigh the advantages of nuclear.

Nonetheless, Deep Yellow’s Mr Borshoff has flagged that with the uptake of the nuclear energy processes, a higher demand for uranium will inevitably surface.

“Uranium and nuclear is still probably 12 months away from really charging up … you’ve got all the ingredients of a massive, massive return to nuclear,” he said.

“You’ll see that as uranium prices go up, which they inevitably will, that’ll encourage a huge increase in exploration companies looking for those deposits that will be needed in 2035, 2040s.”

More global authorities are starting to bet on coupling renewables with nuclear energy to meet the approaching 2050 emissions targets, and with that will come a need to accelerate the nuclear workforce.

“The mines that will have to come in, the issue with the supply side, which I won’t go into, but that’s going to exacerbate price, and on the background of a higher price, this will recharge and it will beat the lithium play,” Mr Borshoff said.