- Oliver’s Real Foods’ (OLI) deal with EG Group is in hot water after Oliver’s exceeded its net debt limit by $110,000

- In March, EG Group made a scheme of arrangement offer for 10 cents per share – representing a value of $25 million

- Part of the deal meant Oliver’s could not exceed net debt of $800,000 but it has faithfully announced doing just that

- Oliver’s’ temporary shut down of its stores and reduction in cash flow led to the increase

- The food retailer has requested a waiver to the arrangement conditions but it yet to receive a response

- Company shares are down a slight 1.89 per cent and are trading for 5.2 cents each

Oliver’s Real Foods’ (OLI) scheme of arrangement with EG Group is in hot water after Oliver’s announced it has exceeded its net debt limit by $110,000.

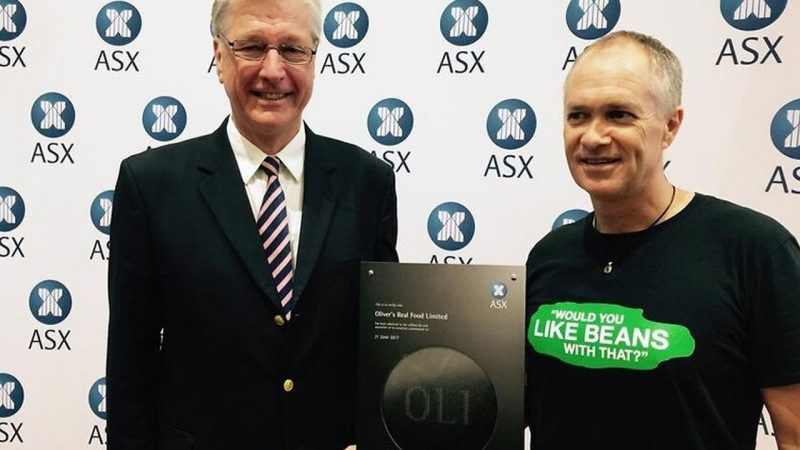

In early March, the healthy food retailer received a proposal from EG Group to purchase the company.

EG Group is a British retailer who operates petrol stations and fast food outlets in Europe, the United States and Australia.

Just hours after the purchase offer was announced, Oliver’s entered a scheme implementation agreement with EG and Oliver’s urged shareholders to agree as it would be favourable to the company.

EG made a non-binding, conditional offer of 10 cents per share for Oliver’s that, at the time, valued the company at $25 million on a share price of 0.065 cents.

“EG Group’s proposal represents a significant premium to Oliver’s recent trading levels and represents an attractive value outcome for shareholders,” Chairman Nicholas Dower said at the time.

“This acquisition presents a great opportunity for us to enter the Australian restaurant market and the potential to enhance our convenience offer across our

500+ store network,” he added.

Part of the deal stated that Oliver’s nor its subsidiaries could exceed the net debt limit of $800,000 but the company has faithfully announced its net debt has reached $910,000. It has requested a waiver of the Net Debt Condition.

Unless this waiver is granted, or conditions of the deed change, the Scheme will not proceed.

The increase is due to the reduction in cash inflows as a result of COVID-19 and the temporary suspension of operations announced on March 23.

To avoid the increase climbing any further, OLI plans to commence a staged re-opening of its stores as soon as stay-at-home orders have been eased enough to allow non-essential travel.

If eligible, the food retailer will will utilise the Federal Government’s Jobkeeper scheme to keep staff engaged.

To keep up with upfront payments for its staff to be eligible for the Jobkeeper scheme, Oliver’s has secured approval for a temporary overdraft facility of up to $700,000.

In addition, it will try and establish a business stimulus loan of $250,000 to assist with working capital requirements over the next two to three months.

Oliver’s has EG Group a request to approve this but has been given no reply as of yet.

Company shares are down a slight 1.89 per cent and are trading for 5.2 cents each at 1:06 pm AEST.