- Payright (PYR) has recorded a 134 per cent year-on-year increase in gross merchandise value (GMV) to $26.1 million for the June 2021 quarter

- In the same time frame, Payright has seen a 41 per cent rise in total merchant stores to 34,000 as well as a 58 per cent increase in total customers to 53,400

- Founded in 2016 and listed on the ASX in December 2020, Payright provides merchants with a buy now, pay later option for their customers

- The company attributes the growth to its ongoing national marketing campaign, and focus on delivering upgrades and innovative new features

- Payright ended the day 4.9 per cent in the green to close at 53.5 cents

Payright (PYR) has achieved another record quarter of gross merchandise value (GMV) for the June 2021 quarter.

Compared to the prior corresponding period (being the June 2020 quarter), the buy now, pay later company recorded a 134 per cent increase in GMV to $26.1 million.

For the month of June alone, the company achieved a record monthly level of GMV at $9.2 million.

Over the course of the 2021 financial year, the finance stock has seen consistent growth. For the December quarter, Payright noted $20.6 million in GMV— a 28 per cent increase against the September quarter. Then in the March 2021 quarter, GMV went up once more to $22.2 million.

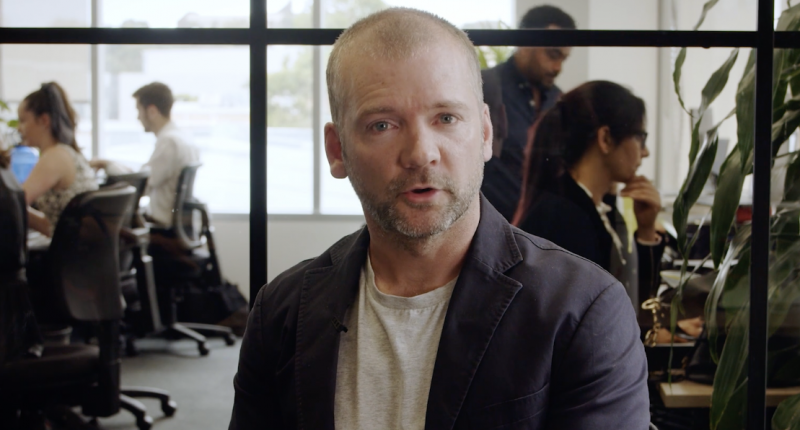

Co-CEO Piers Redward said he was pleased with the company’s performance throughout FY21.

“In what has been a record quarter for the business, we are pleased to have surpassed guidance in all key metrics, reiterating our ability to deliver on our growth strategy.”

Founded in 2016 but listed on the ASX in December 2020, Payright is an Australian company that provides merchants with a buy now, pay later option to offer their customers.

Co-CEO Myles Redward noted that in addition to the GMV growth there had been an increase in customers and stores on the platform.

“In the quarter, we added 308 new stores to the platform and welcomed a record 6,000 new customers – further demonstrating the need for our technology to keep up with demand and support a frictionless customer onboarding process,” he said.

As of June 30 2021, Payright had around 53,400 total customers which is a 58 per cent increase on the prior corresponding period.

Similarly, total merchant stores grew by 41 per cent since the June 2020 quarter to 34,000 stores.

The company attributes the growth to its ongoing national marketing campaign to build its presence as well as its ongoing focus on delivering upgrades and innovative new features.

Payright ended the day 4.9 per cent in the green to close at 53.5 cents.