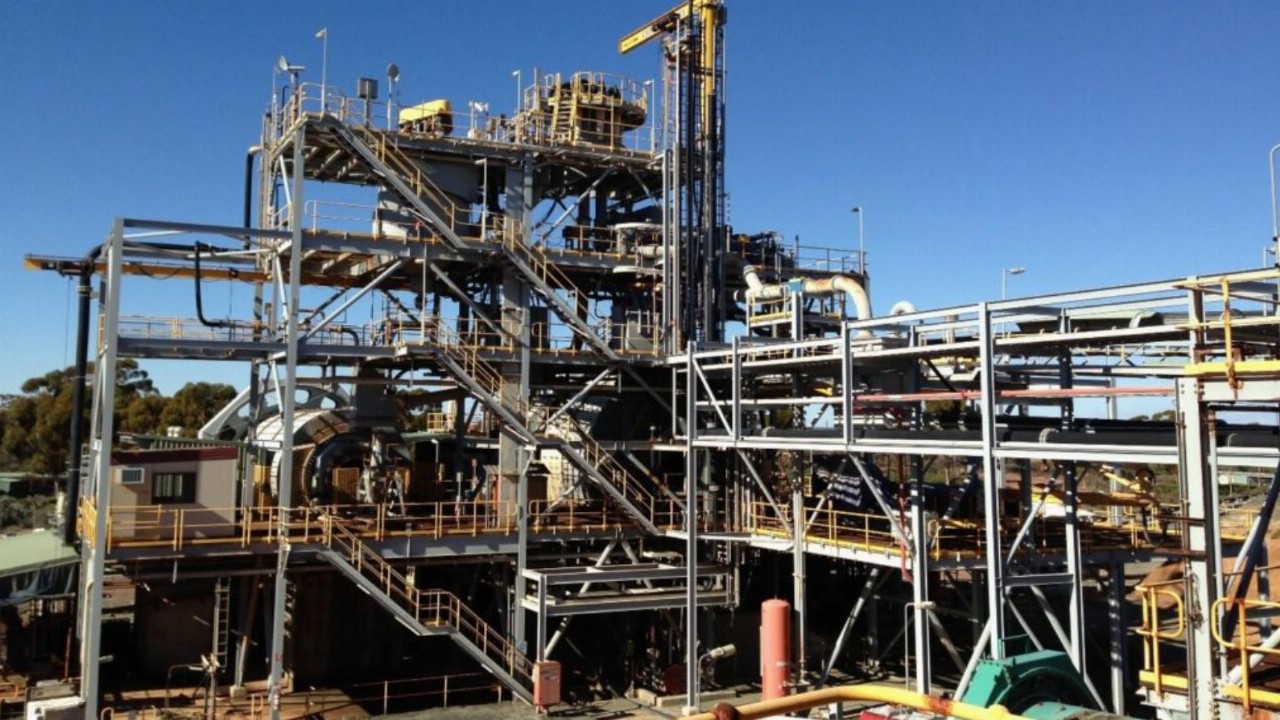

- Poseidon Nickel (POS) delays its planned restart of the Black Swan project in Western Australia

- The company’s C-Suite has been reshuffled with the CEO swapping out for the General Manager

- Poseidon will not restart Black Swan until the share market trading environment and nickel prices improve

- Poseidon shares last traded at 1.9 cents

Poseidon Nickel (POS) has captured the market’s attention with its announcement that the company has reshuffled its management structure ahead of the once-again delayed restart of the Black Swan operations in Western Australia.

The company’s CEO, Peter Harold, is transitioning to Non-Executive Chair; Craig Jones, General Manager, now assumes the role of CEO – and two board members, Derek La Ferla and Dean Hildebrand, will retire.

Craig Jones previously held positions at Bellevue Gold (BGL) as COO and held senior roles at Northern Star Resources (NST).

Peter Harold, on the other hand, has been with Poseidon throughout the challenging past few years and played a key role in delivering a feasibility study in 2022.

As for Black Swan, the company is still on hold.

“The company made the prudent decision to defer the Black Swan restart until … the nickel price environment and equity markets improve,” Poseidon wrote on Friday.

Nevertheless, the central focus of the company’s new three-pronged strategy is: “Pathway to Production – restart Black Swan.”

“While we have made significant progress on project financing, concentrate quality and offtake, approvals and planning in relation to the Black Swan restart as previously advised we are not in a position to make the final investment decision for a number of reasons,” Poseidon CEO Peter Harold said.

“Since the decision was made, in mid-July 2023, to defer the restart, the board and executive team has been looking at ways to reduce costs in the business both at the corporate and asset levels. To that end some major personnel changes will be made.”

The company stated on Friday that it has found a way to save $3 million per year while the site remains mothballed; exploration activities will be focused on the Lake Johnston and Western Ultramafic Unit targets.

POS shares last traded at 1.9 cents.