- Prospect Resources (PSC) completes the sale of its stake in the Arcadia Lithium Project in Zimbabwe for a total of US$377.8 million (A$507 million)

- The 87 per cent interest was taken up by a subsidiary of Shanghai-listed Zhejiang Huayou Cobalt

- After payments for Zimbabwean capital gains tax and to Sinomine for the termination of an offtake deal, Prospect pocketed at total of US$342.9 million (A$461 million)

- A large portion of the proceeds will be returned to shareholders, with the balance to be used to advance other projects in Zimbabwe and the broader sub-Saharan region

- Shares in Prospect Resources finished trading yesterday at $0.92 each

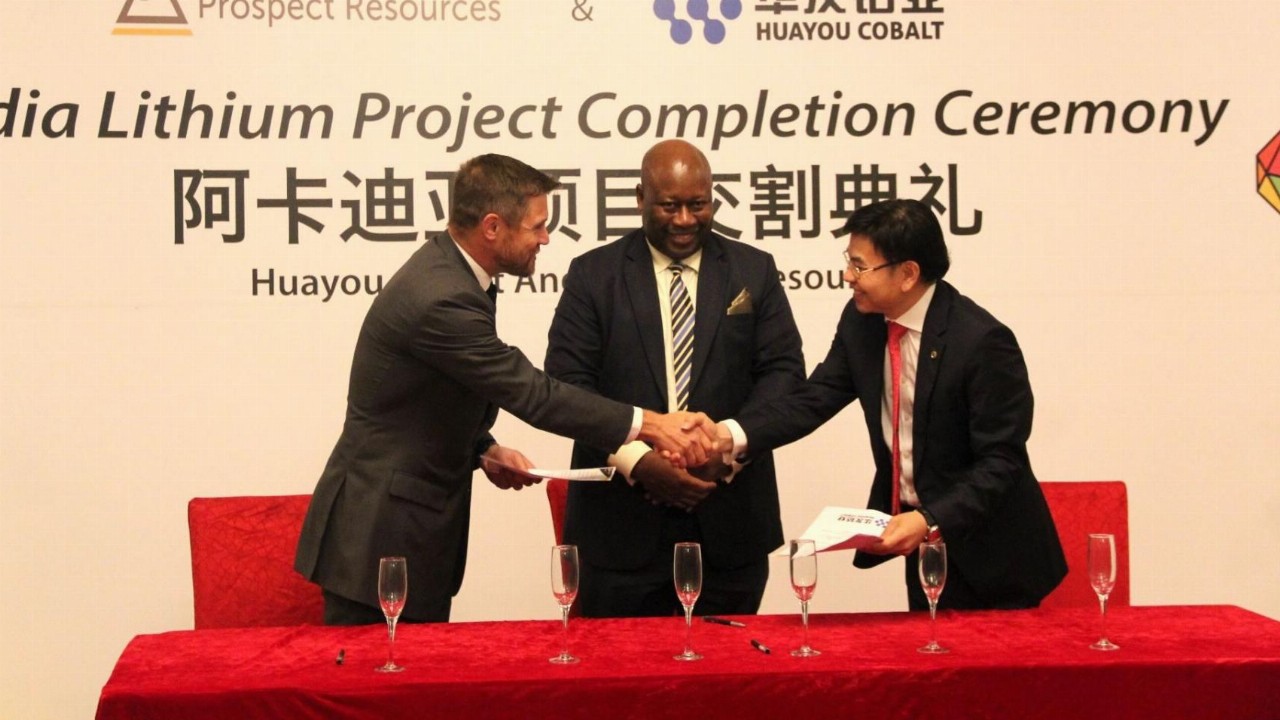

Prospect Resources (PSC) has completed the sale of its stake in the Arcadia Lithium Project in Zimbabwe for a total of US$377.8 million (A$507 million).

The 87 per cent interest was taken up by a subsidiary of Shanghai-listed Zhejiang Huayou Cobalt — a company Prospect described as a “new energy lithium-ion battery material producer,” but which has been operating since 2002 and has previously been accused of exploiting child labour in the Democratic Republic of the Congo.

Following payments of US$26.8 million (A$36 million) in Zimbabwean capital gains tax and US$8 million (A$10.75 million) to Sinomine in relation to the termination of an offtake deal, Prospect pocketed a total of US$342.9 million (A$461 million) from the sale.

“Huayou’s pedigree as a leading electric vehicle battery precursor producer opens up opportunities in Zimbabwe and supports our strategy both in Zimbabwe and the broader sub-Saharan region,” Prospect Managing Director and CEO Sam Hosack said.

“The transaction, being the culmination of years of effort progressing and developing the Arcadia Project to this point is a testament to the skills and expertise of the Prospect team, who are now firmly focussed on the path ahead, to build the next iteration of Prospect, a developer of lithium and battery and electrification metals projects.”

With the transaction now complete, Prospect said it would distribute between $440 million and $450 million — $0.94 to $0.96 per share — to shareholders. This is expected to include a capital reduction component of up to $0.20 per share, which will require shareholder approval, as well as an unfranked dividend component.

As such, the company is applying for an ATO ruling, which will set out the tax treatment of the distribution — expected to occur not long after the end of June — for the main classes of its shareholders.

Prospect will retain a balance of between $30 million and $40 million to advance battery and other electrification metal projects in Zimbabwe, with a secondary focus on the broader sub-Saharan region.

“I would like to take this opportunity to express a sincere thanks to the Government of Zimbabwe,” Mr Hosack said.

“Without their strong support and vision we simply would not have been able to complete this transaction, confirming indeed, that Zimbabwe is open for business and is a premier jurisdiction for the burgeoning lithium industry.”

Shares in Prospect Resources finished trading yesterday at $0.92 each.