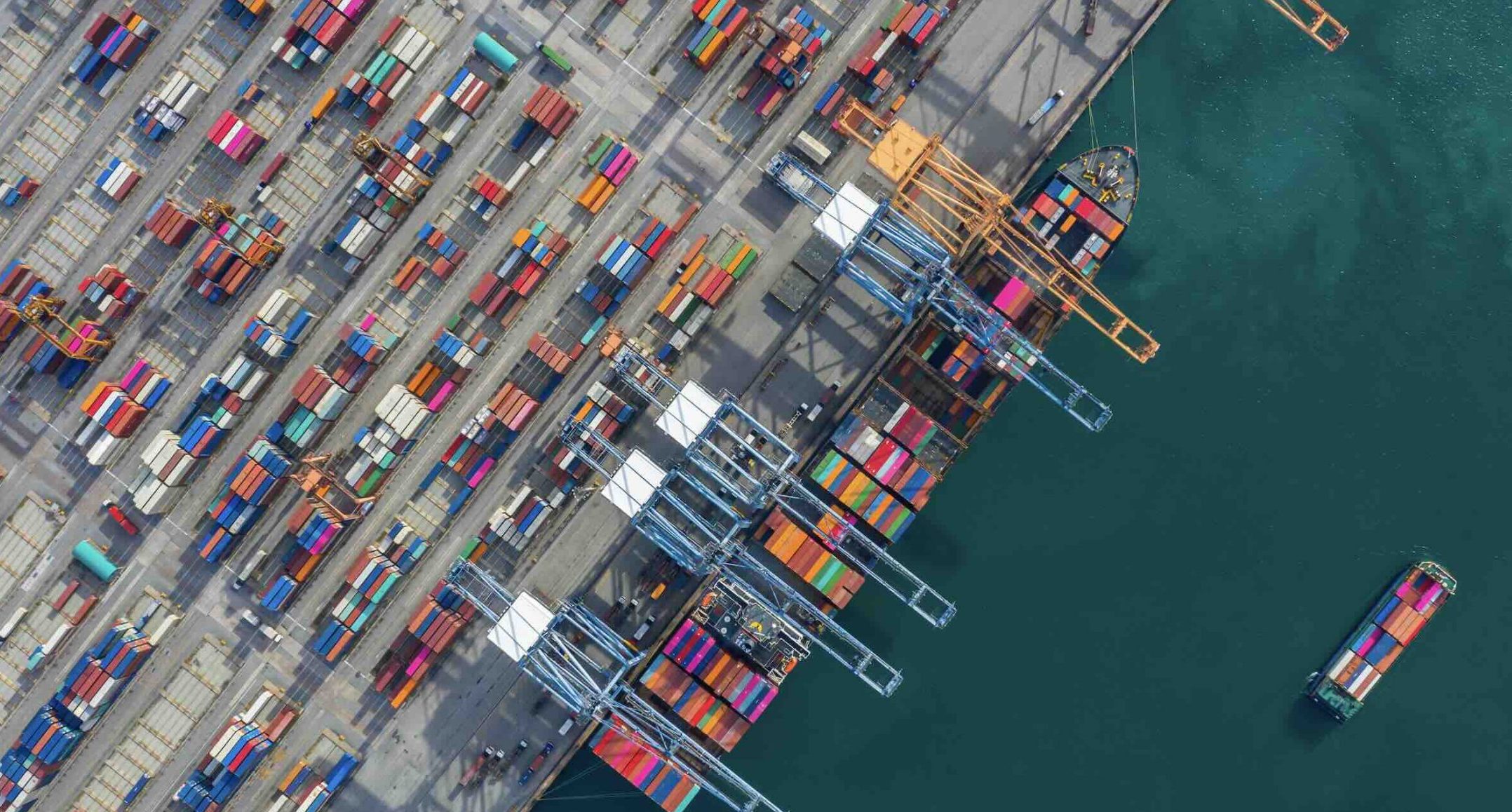

Provaris (ASX:PV1) has announced its execution of a deal with Global Energy Storage (GES) to build a hydrogen import facility at the Port of Rotterdam.

Provaris has been working for a number of years on the early stage design and manufacture of oceanic hydrogen transport vessels.

The deal with GES is a logical extension of its plans with the company to design a gaseous hydrogen import facility at Rotterdam.

GES is already developing a terminal focused on refrigerated ammonia and compressed hydrogen.

Both products, under GES’s intended vision for the terminal, can then be redelivered into barges – or rail and truck options – to be transported downriver.

The terminal will also connect to a hydrogen grid called “HyNetwork” operated by a company called Gasunie.

However, all in all, Provaris will only be developing a pre-feasibility study (PFS) with GES to assess the viability of whether Provaris’s H2 vessels can be slotted into GES’s overarching terminal design.

The company will also help GES market the facility “where Provaris will be responsible for the transportation of the hydrogen into the H2Neo carriers.”

The PFS is to take into account jetty facilities, connection to HyNetwork, and emissions considerations for the EU landscape.

A prototype tank is being built in Norway “to support a final construction approval from Class targeted for mid-2024.”

PV1 last traded at 38cps.