- QEM (QEM) was up as much as 126 per cent today after revealing a green hydrogen strategy for its Julia Creek Project in Queensland

- Upcoming studies will investigate the regulatory and financial requirements of producing green hydrogen onsite using a solar-powered electrolyser

- An electrolyser uses electricity to break water into hydrogen and oxygen through a process called electrolysis

- Hydrogen production is considered green if renewable energy, such as solar or wind power, is used to generate electricity for the electrolysis process

- To help with the operating and capital costs, QEM has appointed E2C Advisory who have extensive experience in using electrolysers

- QEM is still up a healthy 120 per cent with shares trading at 18 cents

QEM (QEM) was up as much as 126 per cent today after revealing a green hydrogen strategy for its Julia Creek Project in Queensland.

The 250-square-kilometre project lies in North Western Queensland and has a JORC 2012 resource of 2760 million tonnes of vanadium with an average grade of 0.30 per cent vanadium oxide.

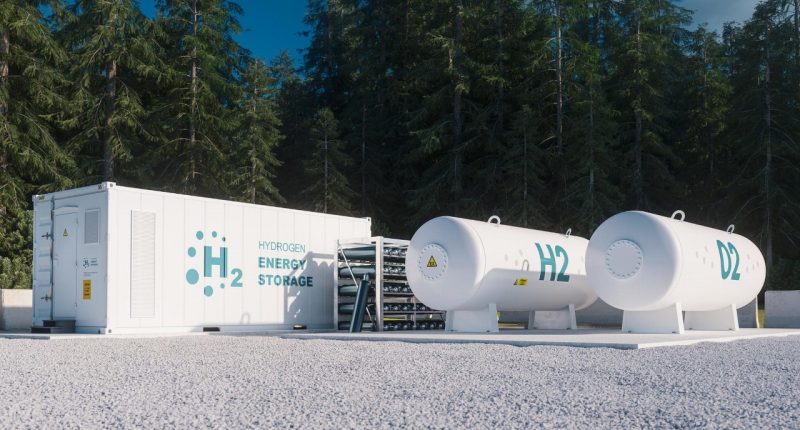

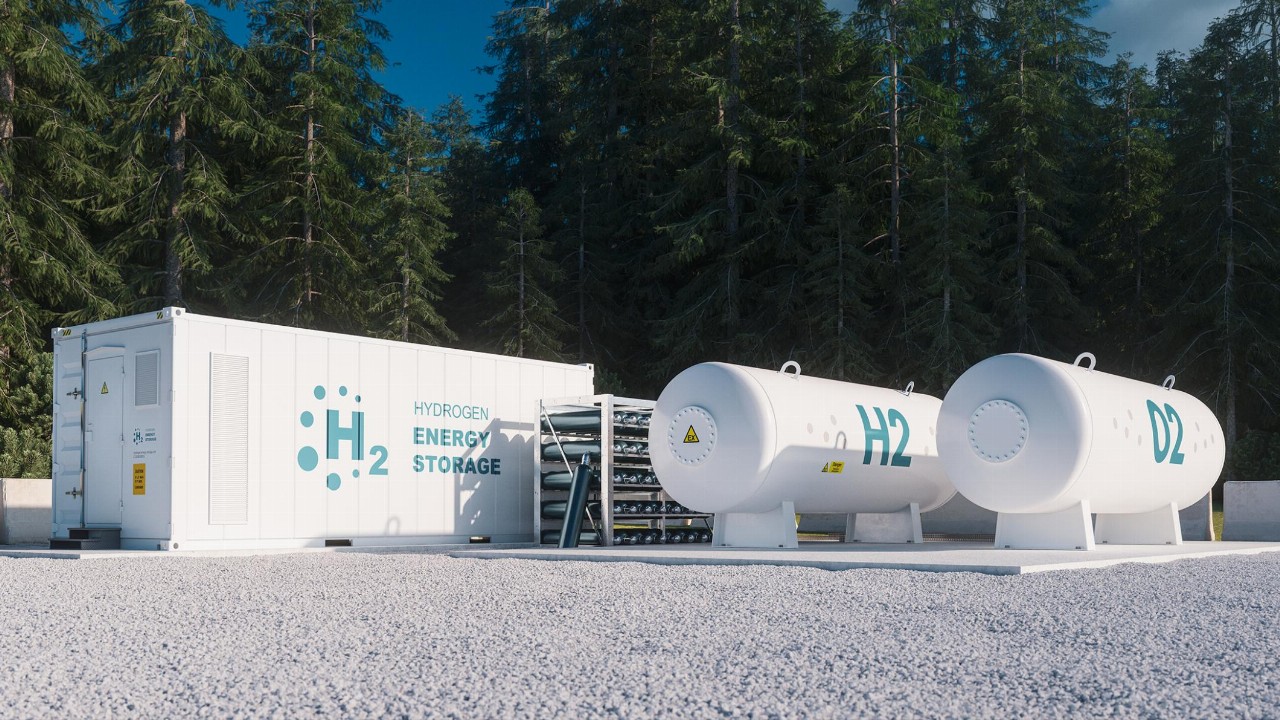

Upcoming studies will investigate the regulatory and financial requirements of producing green hydrogen onsite using a solar-powered electrolyser.

An electrolyser uses electricity to break water into hydrogen and oxygen through a process called electrolysis.

Hydrogen production is considered green if renewable energy, such as solar or wind power, is used to generate electricity for the electrolysis process.

To help with the operating and capital costs, QEM has appointed E2C Advisory, which has extensive experience in using electrolysers.

Additionally, the company will begin discussions with the Queensland government regarding the approval process to access water resources.

“The commissioning of these studies will lay the groundwork to advance our green hydrogen strategy at Julia Creek amid increasingly buoyant market conditions and the project’s optimal location and resource profile to produce hydrogen onsite,” Managing Director Gavin Loyden commented.

“Crucially, the hydrogen strategy aligns with the broader strategic direction of Julia Creek as QEM looks to target both the liquid fuels and renewable energy sectors,” he added.

QEM is still up a healthy 120 per cent with shares trading at 18 cents at 12:37 pm AEDT.