Ahead of tomorrow’s Reserve Bank of Australia (RBA) interest rate decision, we’ve explored the market landscape to gauge the prevailing expectations.

Recently, Australian inflation came in at 6 per cent, with trimmed mean inflation almost on par at 5.9 per cent.

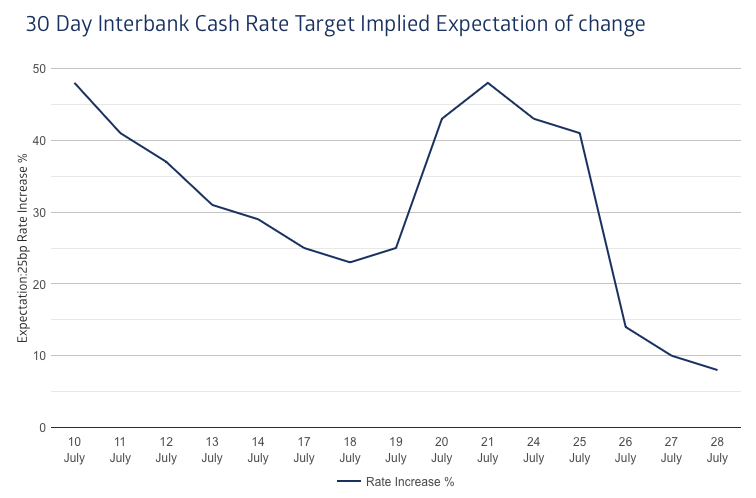

According to the ASX’s RBA Rate Indicator as of Monday, July 31, traders are currently only betting on an 8 per cent chance of an RBA rate hike.

Ten days ago, that figure sat at 48 per cent, after the unemployment data came out.

Inflation remains persistent in the services sector, particularly affecting rent, wages, and electricity prices.

Rental inflation, in particular, is expected to remain elevated for a prolonged period, primarily due to supply constraints rather than macroeconomic factors.

Citigroup: Hike

Citi analysts acknowledged the persistence of services inflation, keeping the RBA’s inclination to hike “in play.”

Despite the inflation reading of 6 per cent beating the RBA’s expectations of 6.3 per cent, Citi remains concerned about services.

Citi maintains its view that the RBA will implement two 25bps rate hikes in August and September.

UBS: Hike

UBS analysts described the 6 per cent inflation rate as “very high,” but they also noted it is now a closer call due to weaker retail spending data.

Similar to Citigroup, UBS foresees a 25bps rate hike in August, supported by a tight labour market and lower-than-expected unemployment rates.

However, UBS predicts that the RBA will begin cutting interest rates at some point in 2024.

Morgan Stanley: Pause

Despite recognising the sticky services inflation, Morgan Stanley analysts anticipate the RBA to pause in August.

“We think [the latest inflation data] will likely be able to keep the RBA’s inflation forecasts relatively unchanged … as such, we do think that this print is likely to give them enough scope to continue their pause,” Morgan Stanley analysts wrote.

The bank believes that services inflation is only marginally offset by easing goods prices and that cheaper goods won’t significantly reduce core inflation.

“Rents remain an important driver of this services strength, and increased to the highest annual rate since 2009,” analysts wrote.

Tomorrow’s RBA interest rate decision holds particular significance as it marks one of the last rate decisions before new RBA governor, Michele Bullock, steps up to the plate.